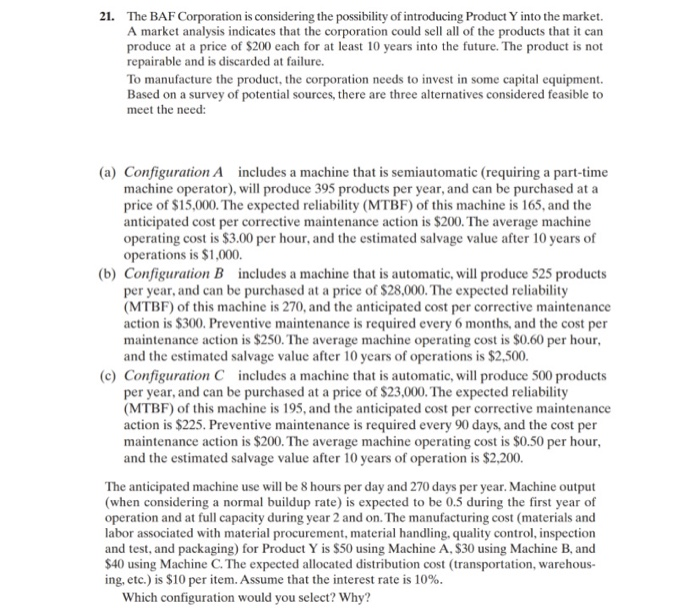

21. The BAF Corporation is considering the possibility of introducing Product Y into the market. A market analysis indicates that the corporation could sell all of the products that it can produce at a price of $200 each for at least 10 years into the future. The product is not repairable and is discarded at failure. To manufacture the product, the corporation needs to invest in some capital equipment. Based on a survey of potential sources, there are three alternatives considered feasible to meet the need: (a) Configuration A includes a machine that is semiautomatic (requiring a part-time machine operator), will produce 395 products per year, and can be purchased at a price of $15,000. The expected reliability (MTBF) of this machine is 165, and the anticipated cost per corrective maintenance action is $200. The average machine operating cost is $3.00 per hour, and the estimated salvage value after 10 years of operations is $1,000. (b) Configuration B includes a machine that is automatic, will produce 525 products per year, and can be purchased at a price of $28,000. The expected reliability (MTBF) of this machine is 270, and the anticipated cost per corrective maintenance action is $300. Preventive maintenance is required every 6 months, and the cost per maintenance action is $250. The average machine operating cost is $0.60 per hour, and the estimated salvage value after 10 years of operations is $2,500. (c) Configuration includes a machine that is automatic, will produce 500 products per year, and can be purchased at a price of $23,000. The expected reliability (MTBF) of this machine is 195, and the anticipated cost per corrective maintenance action is $225. Preventive maintenance is required every 90 days, and the cost per maintenance action is $200. The average machine operating cost is $0.50 per hour, and the estimated salvage value after 10 years of operation is $2,200. The anticipated machine use will be 8 hours per day and 270 days per year. Machine output (when considering a normal buildup rate) is expected to be 0.5 during the first year of operation and at full capacity during year 2 and on. The manufacturing cost materials and labor associated with material procurement, material handling, quality control, inspection and test, and packaging) for Product Y is $50 using Machine A, $30 using Machine B, and $40 using Machine C. The expected allocated distribution cost transportation, warehous- ing, etc.) is $10 per item. Assume that the interest rate is 10%. Which configuration would you select? Why