Answered step by step

Verified Expert Solution

Question

1 Approved Answer

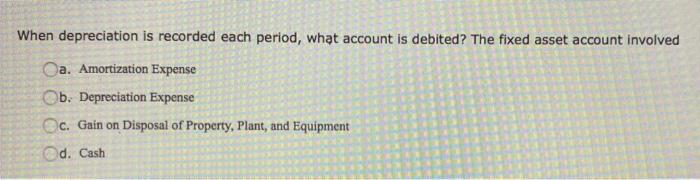

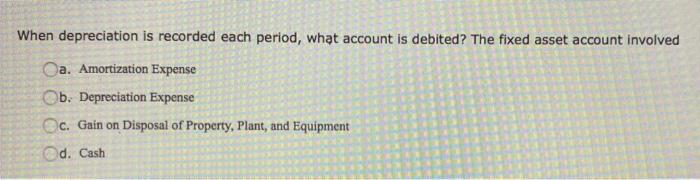

21-15 When depreciation is recorded each period, what account is debited? The fixed asset account involved a. Amortization Expense b. Depreciation Expense c. Gain on

21-15

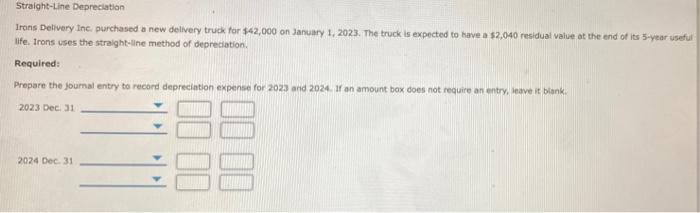

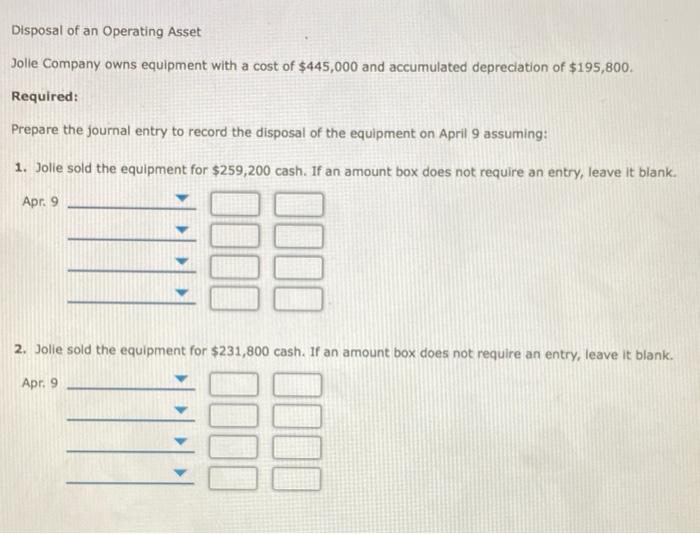

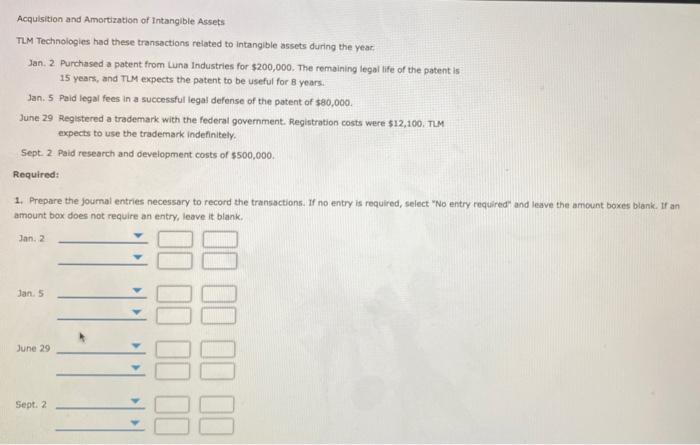

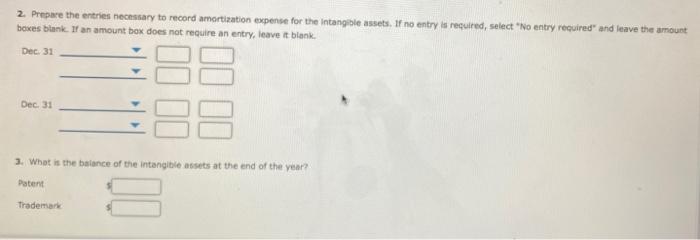

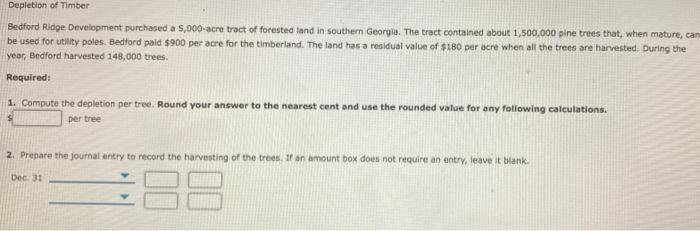

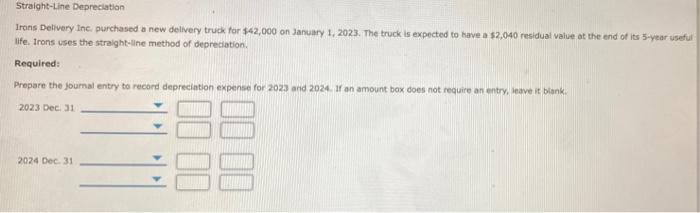

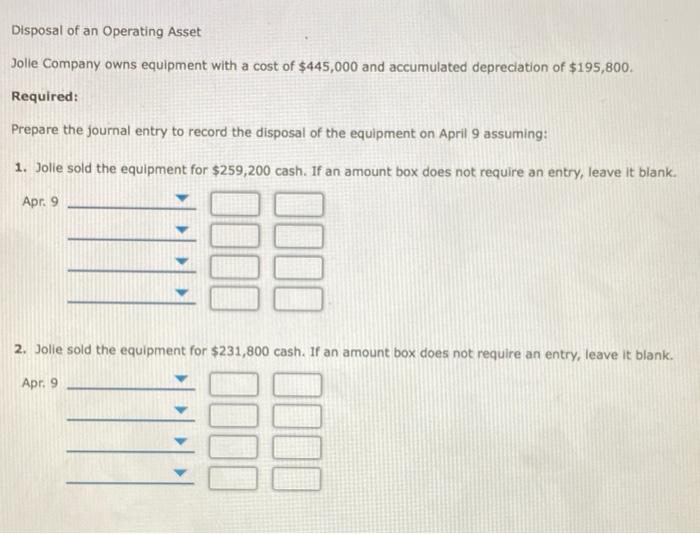

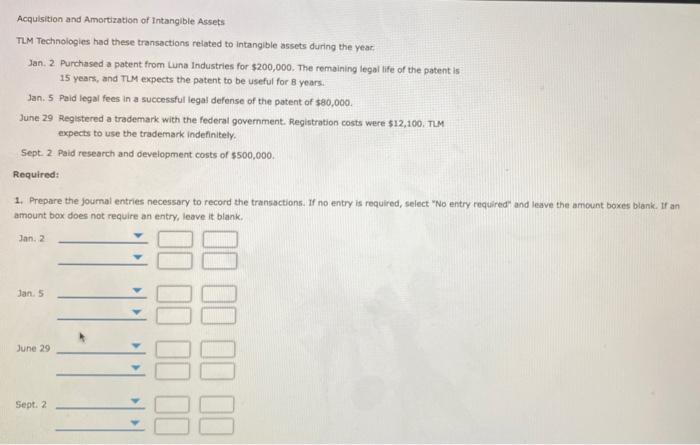

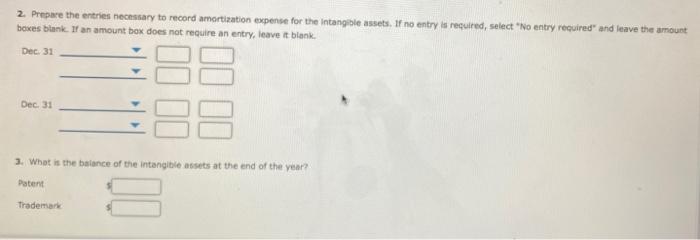

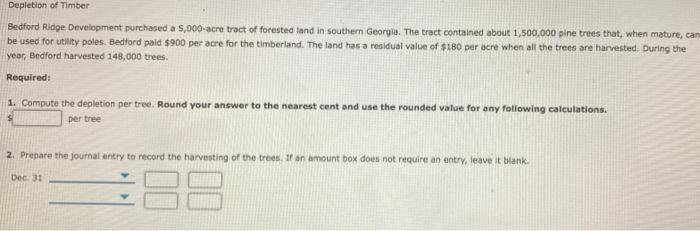

When depreciation is recorded each period, what account is debited? The fixed asset account involved a. Amortization Expense b. Depreciation Expense c. Gain on Disposal of Property, Plant, and Equipment d. Cash Straight-Line Depreciation Irons Delivery Inc. purchased a new delivery truck for $42,000 on January 1, 2023. The truck is expected to have a $2,040 residual value at the end of its 5-year useful life. Irons uses the straight-line method of depreciation. Required: Prepare the journal entry to record depreciation expense for 2023 and 2024. 17 an amount box does not require an entry, have it blank 2023 Dec 31 2024 Dec. 31 11 Disposal of an Operating Asset Jolle Company owns equipment with a cost of $445,000 and accumulated depreciation of $195,800. Required: Prepare the journal entry to record the disposal of the equipment on April 9 assuming: 1. Jolle sold the equipment for $259,200 cash. If an amount box does not require an entry, leave it blank. Apr. 9 2. Jolie sold the equipment for $231,800 cash. If an amount box does not require an entry, leave it blank. Apr. 9 Acquisition and Amortization of Intangible Assets TLM Technologies had these transactions related to intangible assets during the year. Jan. 2 Purchased a patent from Luna Industries for $200,000. The remaining legal life of the patent is 15 years, and TLM expects the patent to be useful for 8 years. Jan. 5 Paid legal fees in a successful legal defense of the patent of $80,000. June 29 Registered a trademark with the federal government. Registration costs were $12,100, TLM expects to use the trademark indefinitely Sept 2 Paid research and development costs of $500,000. Required: 1. Prepare the journal entries necessary to record the transactions. If no entry is required, select "No entry required and leave the amount boxes blank. If an amount box does not require an entry leave it blank Jan. 2 Jan 5 II II II II II II June 29 > > > Sept. 2 2. Prepare the entries necessary to record amortization expense for the intangible assets. If no entry is required, select 'No entry required" and leave the amount boxes blank. 1 an amount box does not require an entry, leave it blank Dec 31 II II Dec. 31 3. What is the balance of the intangible assets at the end of the year? Patent Trademark Depletion of Timber Bedford Ridge Development purchased a 5,000-acre tract of forested and in southern Georgia. The tract contained about 1,500,000 pine trees that, when mature, can be used for utility poles. Bedford paid $900 per acre for the timberland. The land has a residual value of $180 per acre when all the trees are harvested. During the year, Bedford harvested 148,000 trees. Required: 1. Compute the depletion per tree. Round your answer to the nearest cent and use the rounded value for any following calculations. per tree 2. Prepare the journal entry to record the harvesting of the trees. If an amount box does not require an entry, leave it blank Dec 31 88 When depreciation is recorded each period, what account is debited? The fixed asset account involved a. Amortization Expense b. Depreciation Expense c. Gain on Disposal of Property, Plant, and Equipment d. Cash Straight-Line Depreciation Irons Delivery Inc. purchased a new delivery truck for $42,000 on January 1, 2023. The truck is expected to have a $2,040 residual value at the end of its 5-year useful life. Irons uses the straight-line method of depreciation. Required: Prepare the journal entry to record depreciation expense for 2023 and 2024. 17 an amount box does not require an entry, have it blank 2023 Dec 31 2024 Dec. 31 11 Disposal of an Operating Asset Jolle Company owns equipment with a cost of $445,000 and accumulated depreciation of $195,800. Required: Prepare the journal entry to record the disposal of the equipment on April 9 assuming: 1. Jolle sold the equipment for $259,200 cash. If an amount box does not require an entry, leave it blank. Apr. 9 2. Jolie sold the equipment for $231,800 cash. If an amount box does not require an entry, leave it blank. Apr. 9 Acquisition and Amortization of Intangible Assets TLM Technologies had these transactions related to intangible assets during the year. Jan. 2 Purchased a patent from Luna Industries for $200,000. The remaining legal life of the patent is 15 years, and TLM expects the patent to be useful for 8 years. Jan. 5 Paid legal fees in a successful legal defense of the patent of $80,000. June 29 Registered a trademark with the federal government. Registration costs were $12,100, TLM expects to use the trademark indefinitely Sept 2 Paid research and development costs of $500,000. Required: 1. Prepare the journal entries necessary to record the transactions. If no entry is required, select "No entry required and leave the amount boxes blank. If an amount box does not require an entry leave it blank Jan. 2 Jan 5 II II II II II II June 29 > > > Sept. 2 2. Prepare the entries necessary to record amortization expense for the intangible assets. If no entry is required, select 'No entry required" and leave the amount boxes blank. 1 an amount box does not require an entry, leave it blank Dec 31 II II Dec. 31 3. What is the balance of the intangible assets at the end of the year? Patent Trademark Depletion of Timber Bedford Ridge Development purchased a 5,000-acre tract of forested and in southern Georgia. The tract contained about 1,500,000 pine trees that, when mature, can be used for utility poles. Bedford paid $900 per acre for the timberland. The land has a residual value of $180 per acre when all the trees are harvested. During the year, Bedford harvested 148,000 trees. Required: 1. Compute the depletion per tree. Round your answer to the nearest cent and use the rounded value for any following calculations. per tree 2. Prepare the journal entry to record the harvesting of the trees. If an amount box does not require an entry, leave it blank Dec 31 88

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started