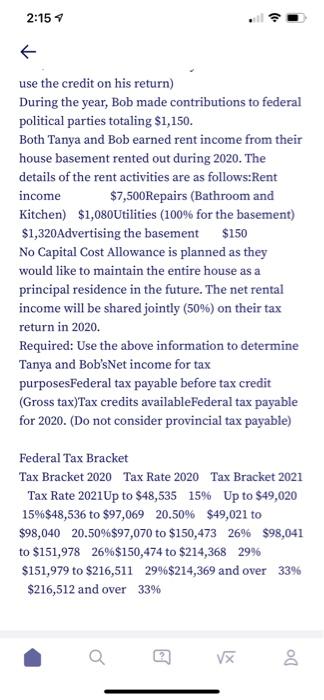

2:12 Tanya is 45 years of age and her 2020 income is made up of employment income of $93,500 and she contributed $9,800 to her Registered Retirement Savings Plan. (Assuming she has the RRSP contribution room from working in 2019). She was awarded a year-end bonus of $10,000, all of which was payable in February 2021. [The bonus was received on February 10, 2021 - consider if the bonus should be included in employment income in 2020 or 2021 (cash or accrual basis)).For 2020, her employer withheld maximum CPP ($2,898) and EI ($856) contributions. Tanya lived with her family in Lethbridge, Alberta. Other information pertaining to 2020 is as follows:Tanya's spouse is 47 years old and his employment income for the year totaled $45,500. Bob and Tanya have a daughter, Tammy, who is 3years old in 2020. Tammy was taken care of while Bob and Tanya worked during 2020 by Bob's mother who is currently unemployed and retired. The family's medical expenses for the year, all of which were paid by Bob, totaled $3,355. Of this amount, $300 was reimbursed by Tanya's employer. During the year, Tanya made cash donations to registered Canadian charities in the amount of $3,500 and Bob made $200. (Consider whether Bob will have higher donation credit if he transferred the $200 donation credit to Tanya or if he should use the credit on his return) VX Do 2:15 use the credit on his return) During the year, Bob made contributions to federal political parties totaling $1,150. Both Tanya and Bob earned rent income from their house basement rented out during 2020. The details of the rent activities are as follows:Rent income $7,500 Repairs (Bathroom and Kitchen) $1,080Utilities (100% for the basement) $1,320Advertising the basement $150 No Capital Cost Allowance is planned as they would like to maintain the entire house as a principal residence in the future. The net rental income will be shared jointly (50%) on their tax return in 2020. Required: Use the above information to determine Tanya and Bob'sNet income for tax purposesFederal tax payable before tax credit (Gross tax)Tax credits available Federal tax payable for 2020. (Do not consider provincial tax payable) Federal Tax Bracket Tax Bracket 2020 Tax Rate 2020 Tax Bracket 2021 Tax Rate 2021Up to $48,535 15% Up to $49,020 15%$48,536 to $97,069 20.50% $49,021 to $98,040 20.50%$97,070 to $150,473 26% $98,041 to $151,978 26%$150,474 to $214,368 29% $151,979 to $216,511 29%$214,369 and over 3396 $216,512 and over 33% Q Do 2:12 Tanya is 45 years of age and her 2020 income is made up of employment income of $93,500 and she contributed $9,800 to her Registered Retirement Savings Plan. (Assuming she has the RRSP contribution room from working in 2019). She was awarded a year-end bonus of $10,000, all of which was payable in February 2021. [The bonus was received on February 10, 2021 - consider if the bonus should be included in employment income in 2020 or 2021 (cash or accrual basis)).For 2020, her employer withheld maximum CPP ($2,898) and EI ($856) contributions. Tanya lived with her family in Lethbridge, Alberta. Other information pertaining to 2020 is as follows:Tanya's spouse is 47 years old and his employment income for the year totaled $45,500. Bob and Tanya have a daughter, Tammy, who is 3years old in 2020. Tammy was taken care of while Bob and Tanya worked during 2020 by Bob's mother who is currently unemployed and retired. The family's medical expenses for the year, all of which were paid by Bob, totaled $3,355. Of this amount, $300 was reimbursed by Tanya's employer. During the year, Tanya made cash donations to registered Canadian charities in the amount of $3,500 and Bob made $200. (Consider whether Bob will have higher donation credit if he transferred the $200 donation credit to Tanya or if he should use the credit on his return) VX Do 2:15 use the credit on his return) During the year, Bob made contributions to federal political parties totaling $1,150. Both Tanya and Bob earned rent income from their house basement rented out during 2020. The details of the rent activities are as follows:Rent income $7,500 Repairs (Bathroom and Kitchen) $1,080Utilities (100% for the basement) $1,320Advertising the basement $150 No Capital Cost Allowance is planned as they would like to maintain the entire house as a principal residence in the future. The net rental income will be shared jointly (50%) on their tax return in 2020. Required: Use the above information to determine Tanya and Bob'sNet income for tax purposesFederal tax payable before tax credit (Gross tax)Tax credits available Federal tax payable for 2020. (Do not consider provincial tax payable) Federal Tax Bracket Tax Bracket 2020 Tax Rate 2020 Tax Bracket 2021 Tax Rate 2021Up to $48,535 15% Up to $49,020 15%$48,536 to $97,069 20.50% $49,021 to $98,040 20.50%$97,070 to $150,473 26% $98,041 to $151,978 26%$150,474 to $214,368 29% $151,979 to $216,511 29%$214,369 and over 3396 $216,512 and over 33% Q Do