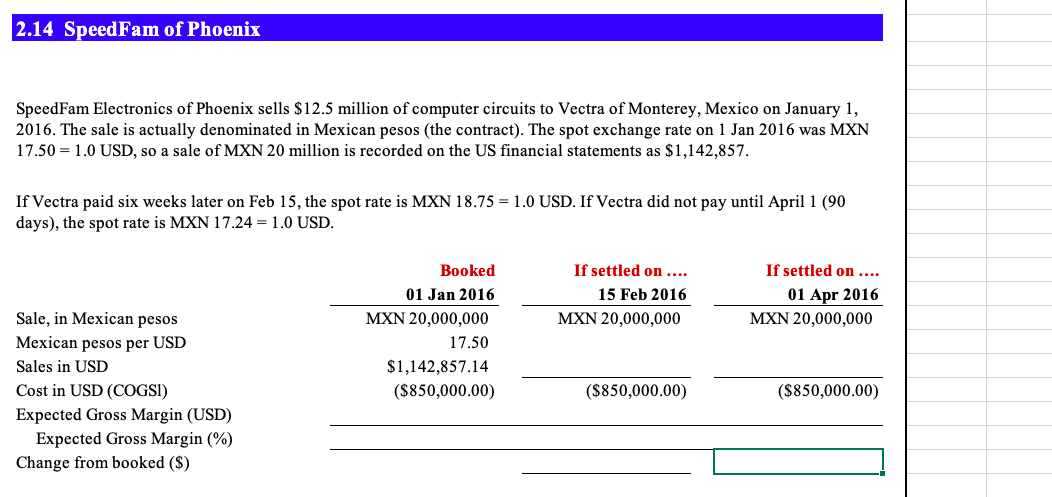

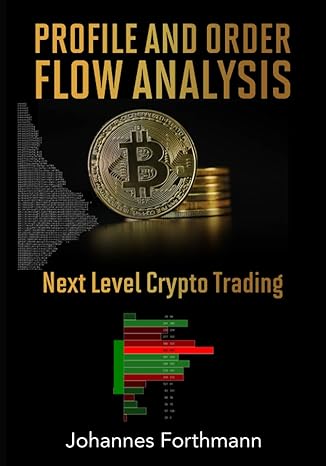

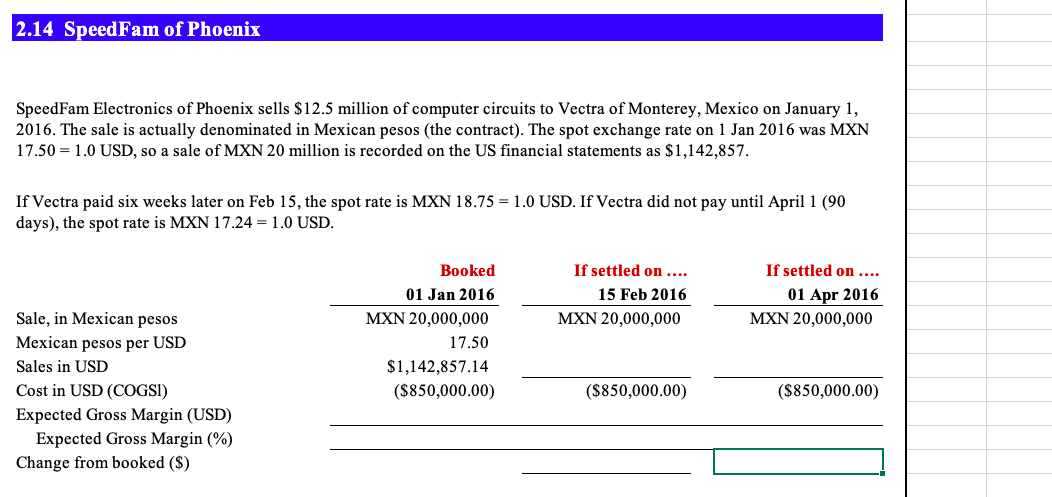

2.14 SpeedFam of Phoenix SpeedFam Electronics of Phoenix sells $12.5 million of computer circuits to Vectra of Monterey, Mexico on January 1, 2016. The sale is actually denominated in Mexican pesos (the contract). The spot exchange rate on 1 Jan 2016 was MXN 17.50 = 1.0 USD, so a sale of MXN 20 million is recorded on the US financial statements as $1,142,857. If Vectra paid six weeks later on Feb 15, the spot rate is MXN 18.75 = 1.0 USD. If Vectra did not pay until April 1 (90 days), the spot rate is MXN 17.24 = 1.0 USD. If settled on .... 15 Feb 2016 MXN 20,000,000 If settled on .... 01 Apr 2016 MXN 20,000,000 Sale, in Mexican pesos Mexican pesos per USD Sales in USD Cost in USD (COGSI) Expected Gross Margin (USD) Expected Gross Margin (%) Change from booked ($) Booked 01 Jan 2016 MXN 20,000,000 17.50 $1,142,857.14 ($850,000.00) ($850,000.00) ($850,000.00) a. Complete the spreadsheet. b. How would the gross margin change over the three different setttlement dates? c. If the total sale was settled on 01 April 2016, what would be the foreign exchange gain (loss) recorded on the sale? 2.14 SpeedFam of Phoenix SpeedFam Electronics of Phoenix sells $12.5 million of computer circuits to Vectra of Monterey, Mexico on January 1, 2016. The sale is actually denominated in Mexican pesos (the contract). The spot exchange rate on 1 Jan 2016 was MXN 17.50 = 1.0 USD, so a sale of MXN 20 million is recorded on the US financial statements as $1,142,857. If Vectra paid six weeks later on Feb 15, the spot rate is MXN 18.75 = 1.0 USD. If Vectra did not pay until April 1 (90 days), the spot rate is MXN 17.24 = 1.0 USD. If settled on .... 15 Feb 2016 MXN 20,000,000 If settled on .... 01 Apr 2016 MXN 20,000,000 Sale, in Mexican pesos Mexican pesos per USD Sales in USD Cost in USD (COGSI) Expected Gross Margin (USD) Expected Gross Margin (%) Change from booked ($) Booked 01 Jan 2016 MXN 20,000,000 17.50 $1,142,857.14 ($850,000.00) ($850,000.00) ($850,000.00) a. Complete the spreadsheet. b. How would the gross margin change over the three different setttlement dates? c. If the total sale was settled on 01 April 2016, what would be the foreign exchange gain (loss) recorded on the sale