Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2.1.5 (30) FINANCE QUESTION 2 2.1 Use the information provided below to calculate the following ratios and interpret them over the two-year period (2017-2018) taking

2.1.5

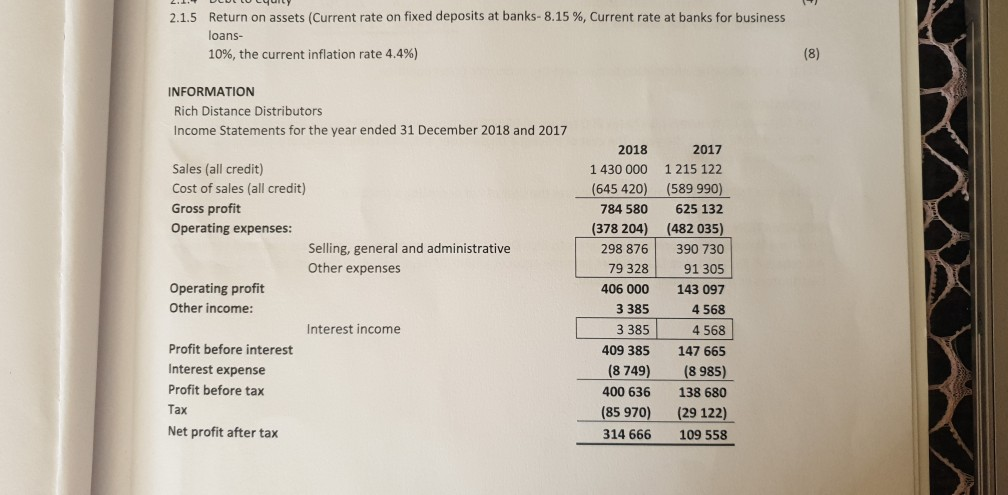

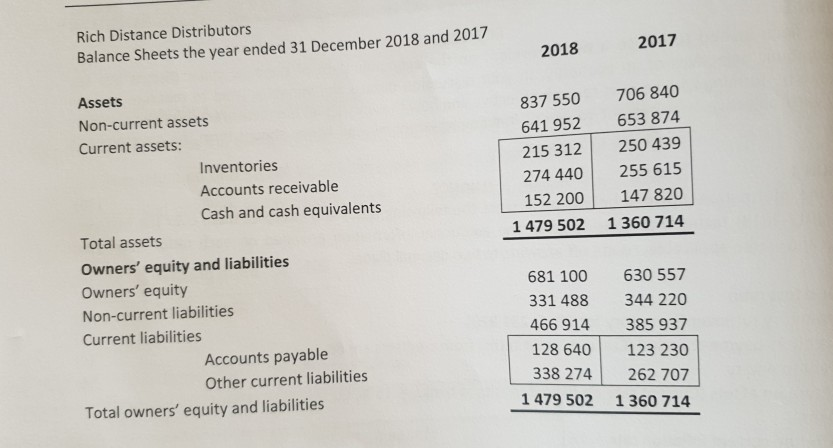

(30) FINANCE QUESTION 2 2.1 Use the information provided below to calculate the following ratios and interpret them over the two-year period (2017-2018) taking into consideration the additional information provided on each ratio. Show your workings and where applicable, round off answers to two decimal places. Return on assets (Current rate on fixed deposits at banks- 8.15 %, Current rate at banks for business 2.1.5 loans- 10%, the current inflation rate 4.4 % ) (8) INFORMATION Rich Distance Distributors Income Statements for the year ended 31 December 2018 and 2017 2018 2017 Sales (all credit) 1 430 000 1 215 122 (645 420 Cost of sales (all credit) (589 990) Gross profit 784 580 625 132 (378 204) Operating expenses: (482 035) Selling, general and administrative 298 876 390 730 Other expenses 79 328 91 305 Operating profit 406 000 143 097 Other income: 3 385 4568 Interest income 3 385 4 568 Profit before interest 409 385 147 665 Interest expense (8 985) (8 749) Profit before tax 400 636 138 680 Tax (85 970) (29 122) Net profit after tax 314 666 109 558 Rich Distance Distributors Balance Sheets the year ended 31 December 2018 and 2017 2017 2018 Assets 706 840 837 550 Non-current assets 653 874 641 952 Current assets: 250 439 215 312 Inventories 255 615 274 440 Accounts receivable 147 820 152 200 Cash and cash equivalents 1 479 502 1 360 714 Total assets Owners' equity and liabilities Owners' equity 630 557 681 100 Non-current liabilities 331 488 344 220 Current liabilities 466 914 385 937 Accounts payable 128 640 123 230 Other current liabilities 338 274 262 707 Total owners' equity and liabilities 1 479 502 1 360 714 (30) FINANCE QUESTION 2 2.1 Use the information provided below to calculate the following ratios and interpret them over the two-year period (2017-2018) taking into consideration the additional information provided on each ratio. Show your workings and where applicable, round off answers to two decimal places. Return on assets (Current rate on fixed deposits at banks- 8.15 %, Current rate at banks for business 2.1.5 loans- 10%, the current inflation rate 4.4 % ) (8) INFORMATION Rich Distance Distributors Income Statements for the year ended 31 December 2018 and 2017 2018 2017 Sales (all credit) 1 430 000 1 215 122 (645 420 Cost of sales (all credit) (589 990) Gross profit 784 580 625 132 (378 204) Operating expenses: (482 035) Selling, general and administrative 298 876 390 730 Other expenses 79 328 91 305 Operating profit 406 000 143 097 Other income: 3 385 4568 Interest income 3 385 4 568 Profit before interest 409 385 147 665 Interest expense (8 985) (8 749) Profit before tax 400 636 138 680 Tax (85 970) (29 122) Net profit after tax 314 666 109 558 Rich Distance Distributors Balance Sheets the year ended 31 December 2018 and 2017 2017 2018 Assets 706 840 837 550 Non-current assets 653 874 641 952 Current assets: 250 439 215 312 Inventories 255 615 274 440 Accounts receivable 147 820 152 200 Cash and cash equivalents 1 479 502 1 360 714 Total assets Owners' equity and liabilities Owners' equity 630 557 681 100 Non-current liabilities 331 488 344 220 Current liabilities 466 914 385 937 Accounts payable 128 640 123 230 Other current liabilities 338 274 262 707 Total owners' equity and liabilities 1 479 502 1 360 714Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started