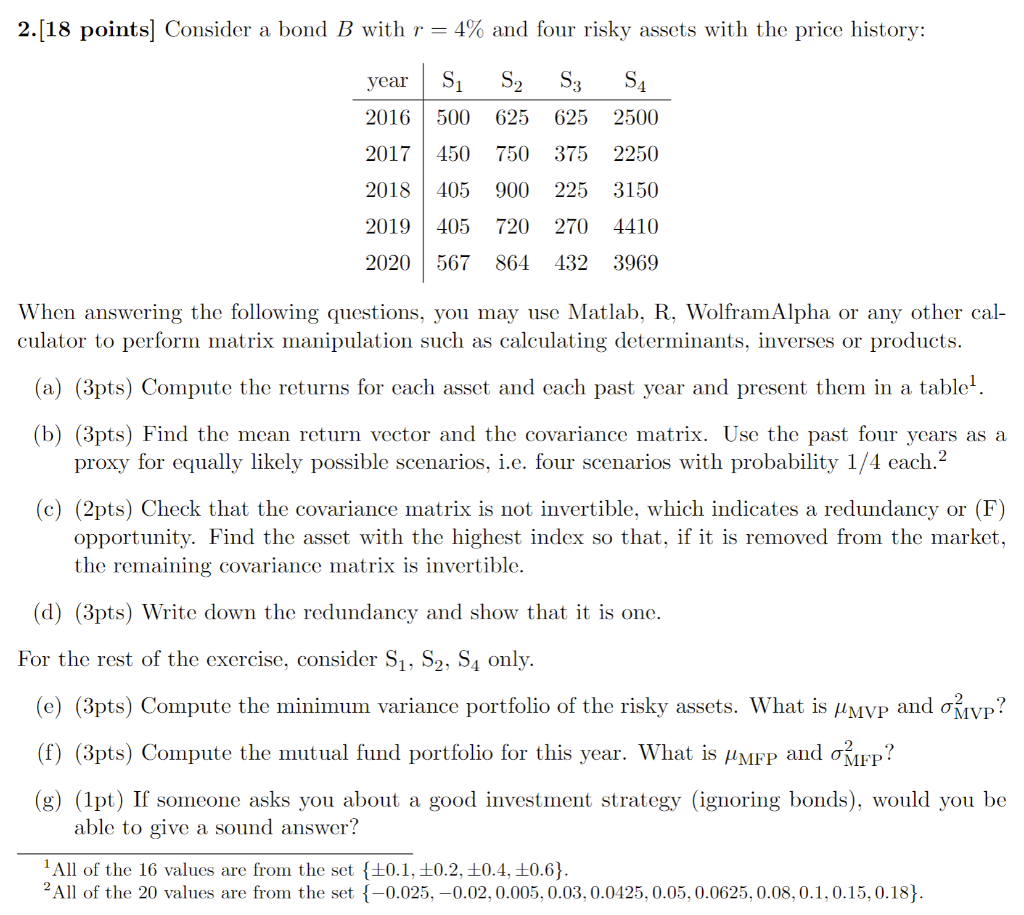

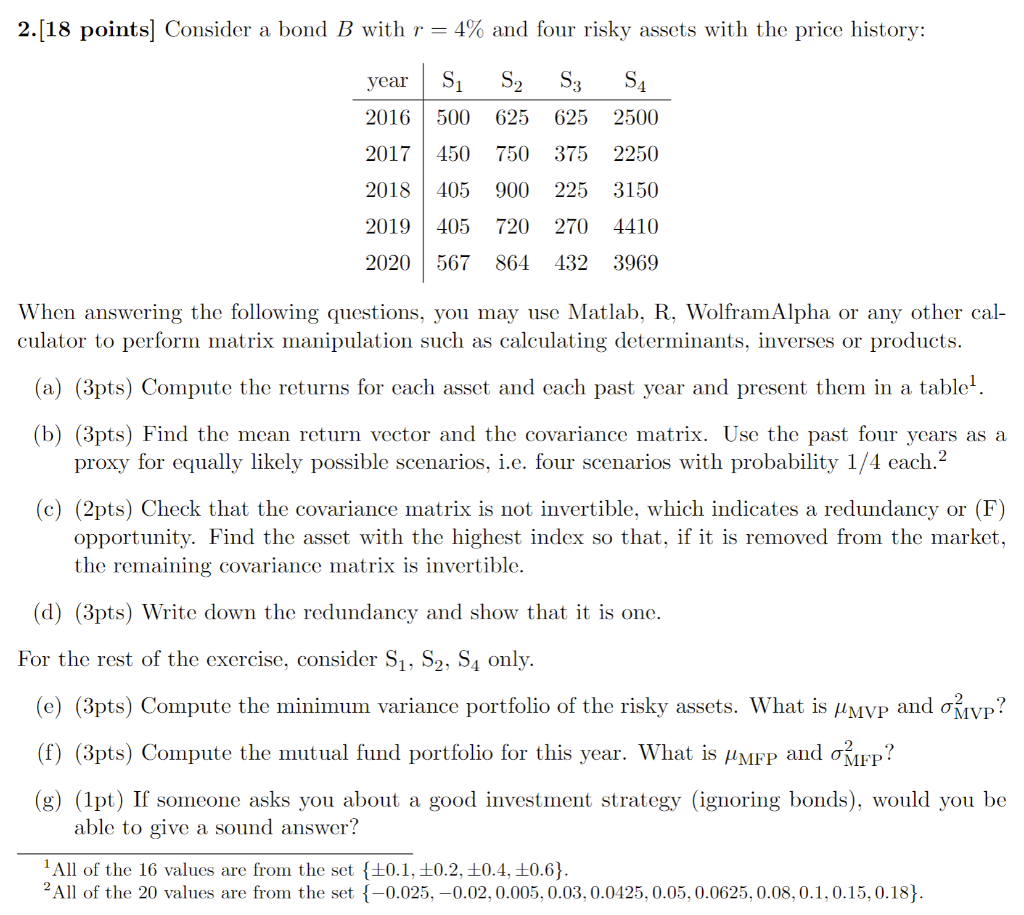

2.(18 points. Consider a bond B with r = 4% and four risky assets with the price history: year Si S2 S3 S4 2016 500 625 625 2500 2017 450 750 375 2250 2018 405 900 225 3150 2019 405 720 270 4410 2020 567 864 432 3969 When answering the following questions, you may use Matlab, R, Wolfram Alpha or any other cal- culator to perform matrix manipulation such as calculating determinants, inverses or products. (a) (3pts) Compute the returns for each asset and each past year and present them in a tablet. (b) (3pts) Find the mean return vector and the covariance matrix. Use the past four years as a proxy for equally likely possible scenarios, i.e. four scenarios with probability 1/4 each.2 (c) (2pts) Check that the covariance matrix is not invertible, which indicates a redundancy or (F) opportunity. Find the asset with the highest index so that, if it is removed from the market, the remaining covariance matrix is invertible. (d) (3pts) Write down the redundancy and show that it is one. For the rest of the exercise, consider S1, S2, S4 only. (e) (3pts) Compute the minimum variance portfolio of the risky assets. What is j'mvp and ovp? (f) (3pts) Compute the mutual fund portfolio for this year. What is MMFP and OMFP? (g) (1pt) If someone asks you about a good investment strategy (ignoring bonds), would you be able to give a sound answer? All of the 16 values are from the set {+0.1, +0.2, +0.4, +0.6}. 2 All of the 20 values are from the set {-0.025, -0.02, 0.005,0.03, 0.0425, 0.05, 0.0625, 0.08, 0.1, 0.15, 0.18}. 2.(18 points. Consider a bond B with r = 4% and four risky assets with the price history: year Si S2 S3 S4 2016 500 625 625 2500 2017 450 750 375 2250 2018 405 900 225 3150 2019 405 720 270 4410 2020 567 864 432 3969 When answering the following questions, you may use Matlab, R, Wolfram Alpha or any other cal- culator to perform matrix manipulation such as calculating determinants, inverses or products. (a) (3pts) Compute the returns for each asset and each past year and present them in a tablet. (b) (3pts) Find the mean return vector and the covariance matrix. Use the past four years as a proxy for equally likely possible scenarios, i.e. four scenarios with probability 1/4 each.2 (c) (2pts) Check that the covariance matrix is not invertible, which indicates a redundancy or (F) opportunity. Find the asset with the highest index so that, if it is removed from the market, the remaining covariance matrix is invertible. (d) (3pts) Write down the redundancy and show that it is one. For the rest of the exercise, consider S1, S2, S4 only. (e) (3pts) Compute the minimum variance portfolio of the risky assets. What is j'mvp and ovp? (f) (3pts) Compute the mutual fund portfolio for this year. What is MMFP and OMFP? (g) (1pt) If someone asks you about a good investment strategy (ignoring bonds), would you be able to give a sound answer? All of the 16 values are from the set {+0.1, +0.2, +0.4, +0.6}. 2 All of the 20 values are from the set {-0.025, -0.02, 0.005,0.03, 0.0425, 0.05, 0.0625, 0.08, 0.1, 0.15, 0.18}