Answered step by step

Verified Expert Solution

Question

1 Approved Answer

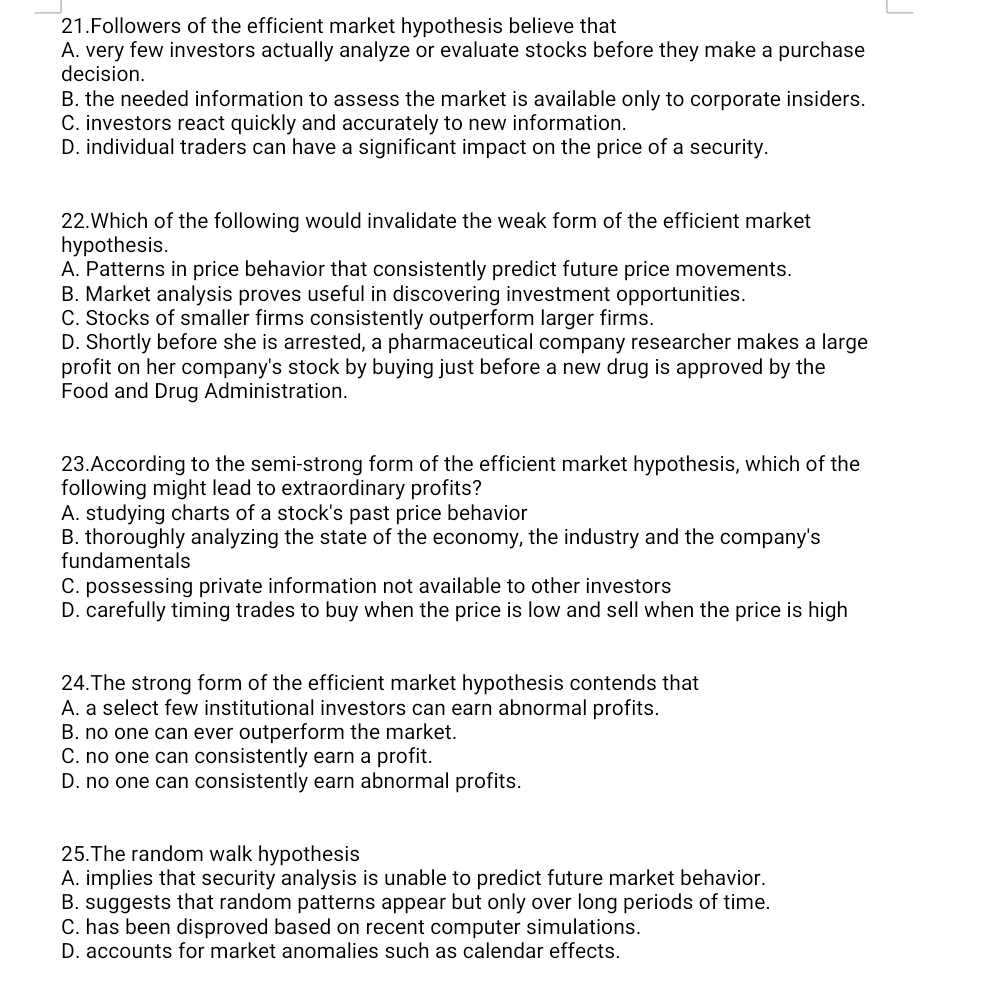

21.Followers of the efficient market hypothesis believe that A. very few investors actually analyze or evaluate stocks before they make a purchase decision. B. the

21.Followers of the efficient market hypothesis believe that A. very few investors actually analyze or evaluate stocks before they make a purchase decision. B. the needed information to assess the market is available only to corporate insiders. C. investors react quickly and accurately to new information. D. individual traders can have a significant impact on the price of a security. 22. Which of the following would invalidate the weak form of the efficient market hypothesis. A. Patterns in price behavior that consistently predict future price movements. B. Market analysis proves useful in discovering investment opportunities. C. Stocks of smaller firms consistently outperform larger firms. D. Shortly before she is arrested, a pharmaceutical company researcher makes a large profit on her company's stock by buying just before a new drug is approved by the Food and Drug Administration. 23.According to the semi-strong form of the efficient market hypothesis, which of the following might lead to extraordinary profits? A. studying charts of a stock's past price behavior B. thoroughly analyzing the state of the economy, the industry and the company's fundamentals C. possessing private information not available to other investors D. carefully timing trades to buy when the price is low and sell when the price is high 24.The strong form of the efficient market hypothesis contends that A. a select few institutional investors can earn abnormal profits. B. no one can ever outperform the market. C. no one can consistently earn a profit. D. no one can consistently earn abnormal profits. 25. The random walk hypothesis A. implies that security analysis is unable to predict future market behavior. B. suggests that random patterns appear but only over long periods of time. C. has been disproved based on recent computer simulations. D. accounts for market anomalies such as calendar effects

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started