Answered step by step

Verified Expert Solution

Question

1 Approved Answer

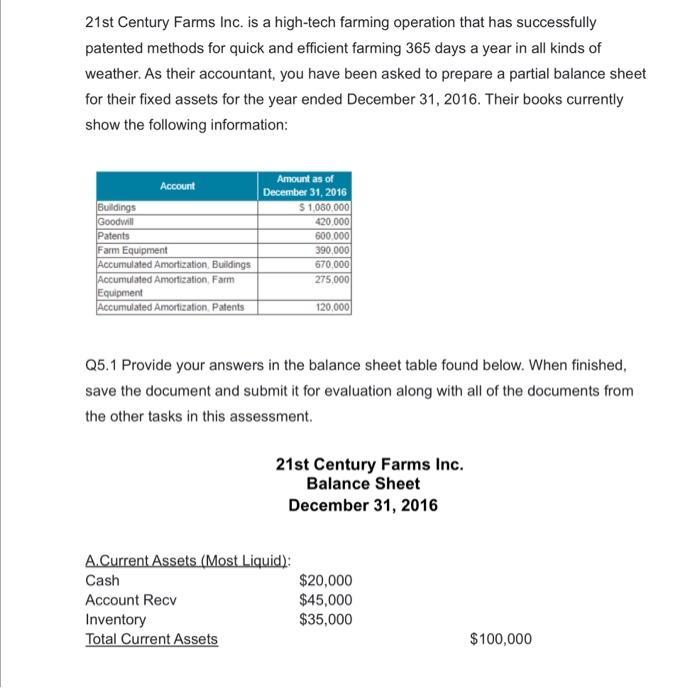

21st Century Farms Inc. is a high-tech farming operation that has successfully patented methods for quick and efficient farming 365 days a year in

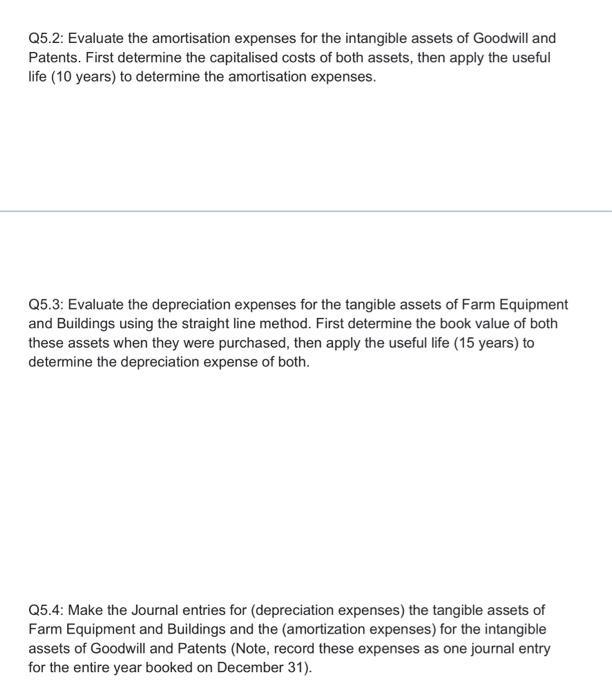

21st Century Farms Inc. is a high-tech farming operation that has successfully patented methods for quick and efficient farming 365 days a year in all kinds of weather. As their accountant, you have been asked to prepare a partial balance sheet for their fixed assets for the year ended December 31, 2016. Their books currently show the following information: Account Buildings Goodwill Patents Farm Equipment Accumulated Amortization, Buildings Accumulated Amortization, Farm Equipment Accumulated Amortization, Patents Amount as of December 31, 2016 $1,000,000 420,000 600.000 390,000 670,000 275,000 120,000 Q5.1 Provide your answers in the balance sheet table found below. When finished, save the document and submit it for evaluation along with all of the documents from the other tasks in this assessment. A. Current Assets (Most Liquid): Cash Account Recv Inventory Total Current Assets 21st Century Farms Inc. Balance Sheet December 31, 2016 $20,000 $45,000 $35,000 $100,000 Q5.2: Evaluate the amortisation expenses for the intangible assets of Goodwill and Patents. First determine the capitalised costs of both assets, then apply the useful life (10 years) to determine the amortisation expenses. Q5.3: Evaluate the depreciation expenses for the tangible assets of Farm Equipment and Buildings using the straight line method. First determine the book value of both these assets when they were purchased, then apply the useful life (15 years) to determine the depreciation expense of both. Q5.4: Make the Journal entries for (depreciation expenses) the tangible assets of Farm Equipment and Buildings and the (amortization expenses) for the intangible assets of Goodwill and Patents (Note, record these expenses as one journal entry for the entire year booked on December 31).

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

This one ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started