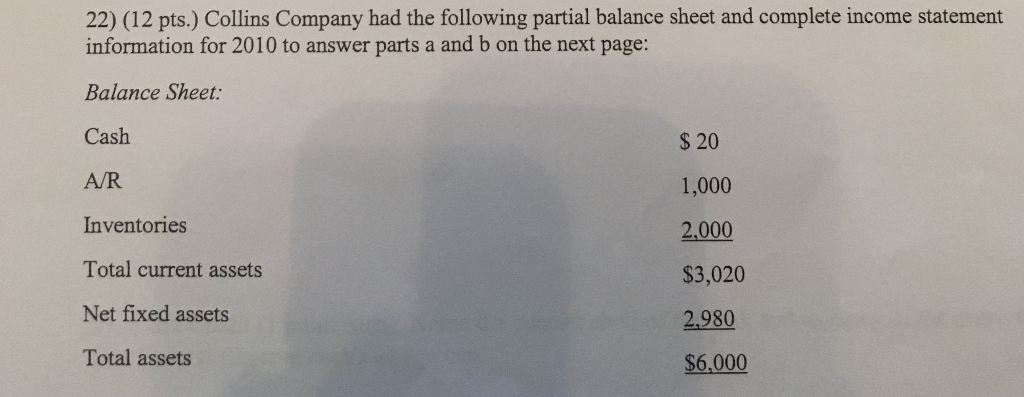

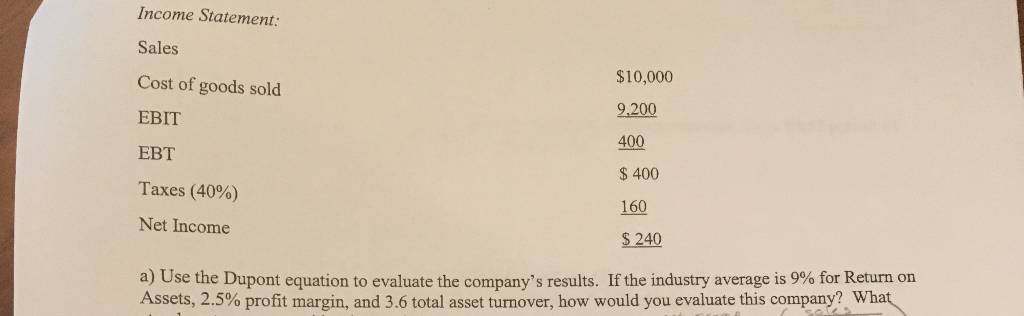

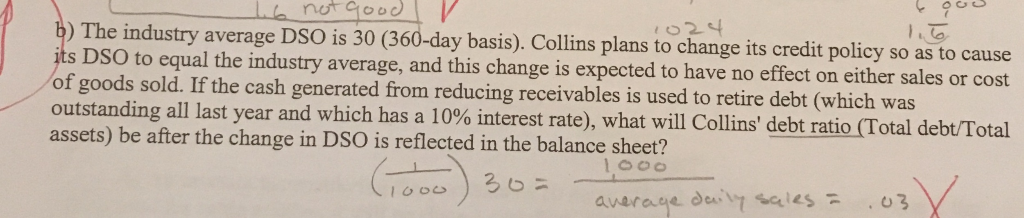

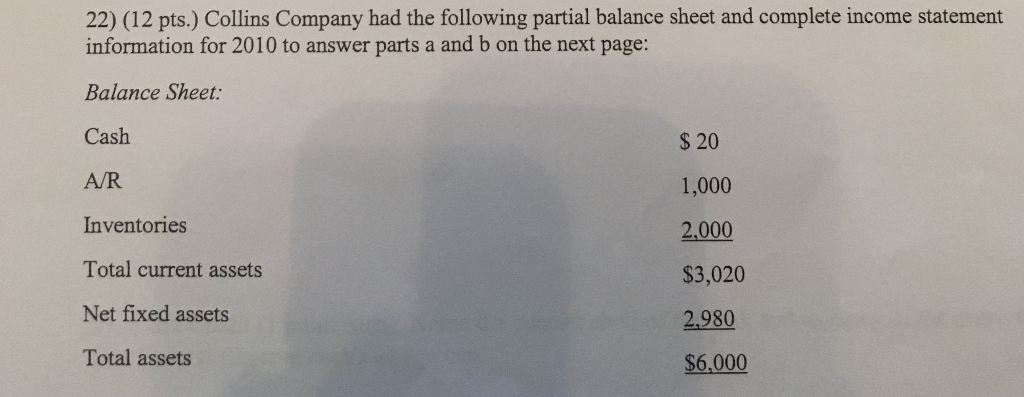

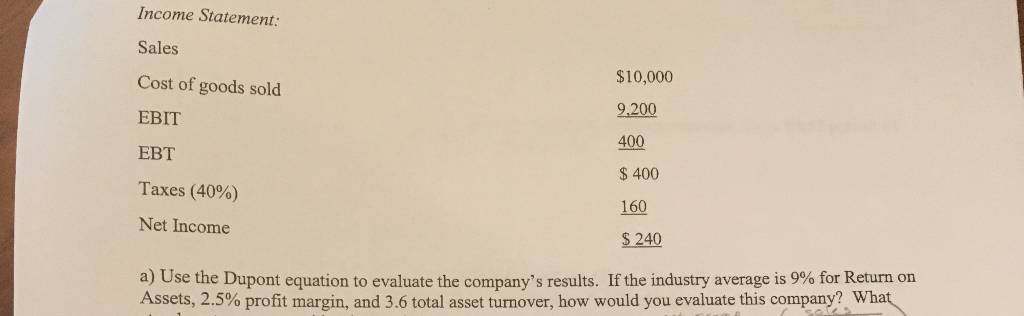

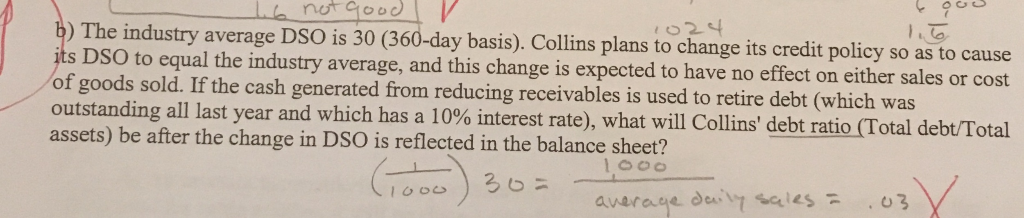

22) (12 pts.) Collins Company had the following partial balance sheet and complete income statement information for 2010 to answer parts a and b on the next page: Balance Sheet: Cash A/R Inventories Total current assets Net fixed assets Total assets $ 20 1,000 2.000 $3,020 2.980 $6.000 Income Statement: Sales Cost of goods sold EBIT EBT Taxes (40%) Net Income $10,000 9,200 400 $ 400 160 $ 240 a) Use the Dupont equation to evaluate the company's results. If the industry average is 9% for Return on Assets, 2.5% profit margin, and 3.6 total asset turnover, how would you evaluate this company? What )The industry average DSO is 30 (360-day basis). Collins plans to change its credit policy so as to cause s DSO to equal the industry average, and this change is expected to have no effect on either sales on of goods sold. If the cash generated from reducing receivables is used to retire debt (which was outstanding all last year and which has a 10% interest rate), what will Collins debtrt ) Total debt Total assets) be after the change in DSO is reflected in the balance sheet? 22) (12 pts.) Collins Company had the following partial balance sheet and complete income statement information for 2010 to answer parts a and b on the next page: Balance Sheet: Cash A/R Inventories Total current assets Net fixed assets Total assets $ 20 1,000 2.000 $3,020 2.980 $6.000 Income Statement: Sales Cost of goods sold EBIT EBT Taxes (40%) Net Income $10,000 9,200 400 $ 400 160 $ 240 a) Use the Dupont equation to evaluate the company's results. If the industry average is 9% for Return on Assets, 2.5% profit margin, and 3.6 total asset turnover, how would you evaluate this company? What )The industry average DSO is 30 (360-day basis). Collins plans to change its credit policy so as to cause s DSO to equal the industry average, and this change is expected to have no effect on either sales on of goods sold. If the cash generated from reducing receivables is used to retire debt (which was outstanding all last year and which has a 10% interest rate), what will Collins debtrt ) Total debt Total assets) be after the change in DSO is reflected in the balance sheet