Answered step by step

Verified Expert Solution

Question

1 Approved Answer

22 21 20 Allowance for Doubtful Account has a credit balance of $500 at the end of the year before adjustment), and bad debt expense

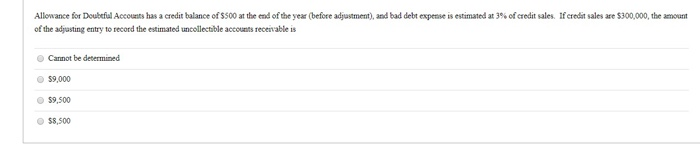

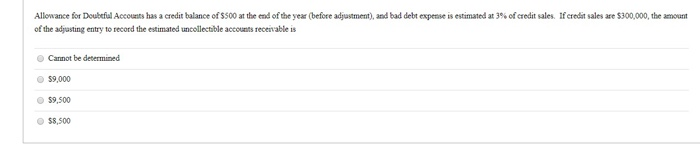

22

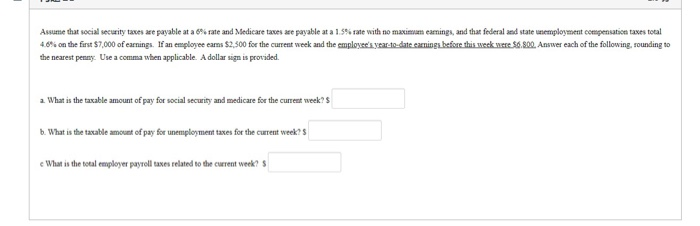

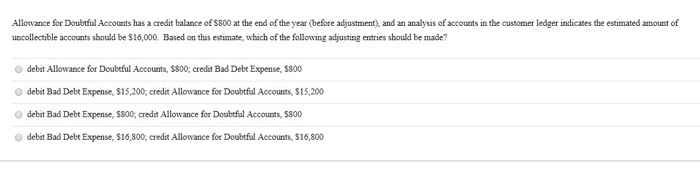

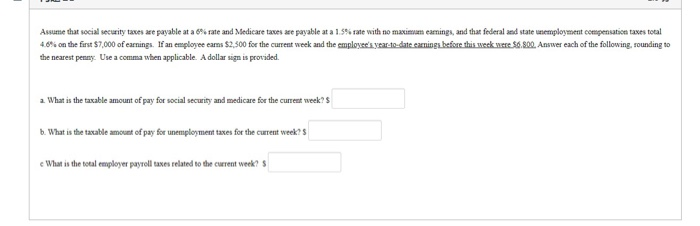

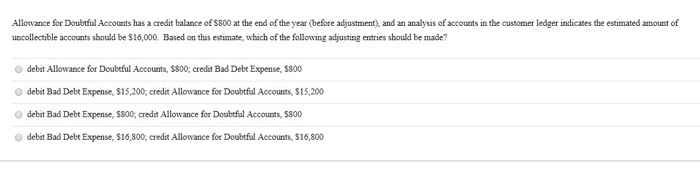

Allowance for Doubtful Account has a credit balance of $500 at the end of the year before adjustment), and bad debt expense is estimated at 3% of credit sales. If credit sales are $300,000, the amount of the adjusting entry to record the estimated uncollectable accounts receivable is Cannot be determined $9.000 $9,500 $8.500 Assume that social security taxes are payable at a 6% rate and Medicare taces are payable at a 1.5% rate with no maximam eamings, and that federal and state employment compensation taxes total 4.0% on the first $7,000 of earnings. If an employee earns $2.500 for the current week and the employee's year-to-date earnings before this week were $6.800. Answer each of the following, sounding to the nearest penny. Use a comma when applicable. A dollar sign is provided a. What is the taxable amount of pay for social security and medicare for the current week? b. What is the taxable amount of pay for unemployment taxes for the current week? What is the total employer payroll taxes related to the current week? Allowance for Doubtful Accounts has a credit balance of $800 at the end of the year (before adjustment)and an analysis of accounts in the customer ledger indicates the estimated amount of uncollectible accounts should be $16,000. Based on this estimate, which of the following adjusting entries should be made? debit Allowance for Doubtful Accounts, $800credit Bad Debt Expense, 5800 debit Bad Debt Expense, $15,200, credit Allowance for Doubtful Accounts, $15,200 debit Bad Debt Expense, $800, credit Allowance for Doubtful Accounts, $800 debit Bad Debt Expense, $16,800, credit Allowance for Doubtful Accounts, $16,800

21

20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started