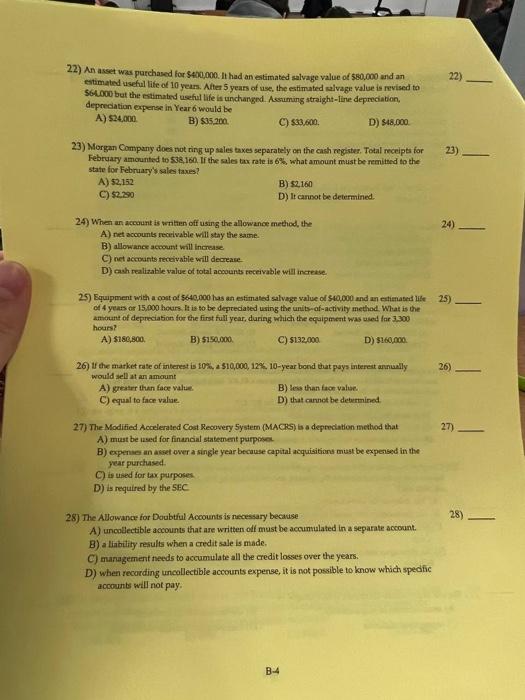

22) 22) An asset was purchased for $400,000. It had an estimated salvage value of $80,000 and an estimated useful life of 10 years. After 5 years of use, the estimated salvage value is revised to 564.000 but the estimated useful life is unchanged. Assuming straight-line depreciation, depreciation expense in Year 6 would be A) $24,000 B) 35.000 C) $83.600 D) $18,000 23) 23) Morgan Company does not ring up sales taxes separately on the cash register. Total receipts for February amounted to 538,160. If the sales tax rate is 6%, what amount must be remitted to the state for February's sales taxes! A) 52,152 B) $2,160 C) $2.280 D) It cannot be determined. 24) 24) When an account is written off using the allowance method, the A) net accounts receivable will stay the same. B) allowance account will increase C) net accounts receivable will decrease D) cash realisable value of total accounts receivable will increase 25) Equipment with a cost of 5640,000 has an estimated salvage value of $40.000 and an estimated lite 25) of 4 years or 15,000 hours. It is to be depreciated using the unit-of-activity method. What is the amount of depreciation for the first full year during which the equipment was used for 3300 hours? A) $180,800 B) $150.000 C) $132.000 D) $160,000 26) 26) the market rate of interest is 10%, $10,000, 12%. 10-year bond that pays interest annually would sell at an amount A) greater than face value B) less than toon value C) equal to face value D) that cannot be determined 27) 27) The Modified Accelerated Cost Recovery System (MACRS) is a depreciation method that A) must be used for financial statement purpose B) expenses an asset over a single year because capital acquisition must be expensed in the year purchased C) is used for tax purposes D) is required by the SEC 28) 28) The Allowance for Doubtful Accounts is necessary because A) uncollectible accounts that are written of must be accumulated in a separate account. B) a liability results when a credit sale is made C) management needs to accumulate all the credit losses over the years. D) when recording uncollectible accounts expense, it is not possible to know which specific accounts will not pay. B4