Question

22. A company is considering investing in new machinery as part of a project to increase production output. There are two investment alternatives available; Machine

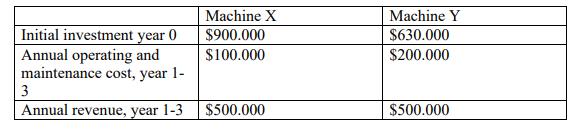

22. A company is considering investing in new machinery as part of a project to increase production output. There are two investment alternatives available; Machine X and Machine Y. Both machines have a lifetime of 3 years and will increase production output corresponding to revenue of $500.000 per year. Machine X is more expensive, with an initial investment of $900.000, but its operating and maintenance costs are lower with an annual cost of $100.000. Machine Y means an initial investment of $630.000, with annual operating and maintenance costs of $200.000. The information is summarized in the table below. Both machines have zero salvage value. The company uses a discount rate of 10 %.

a) Calculate payback time for Machine X and Machine Y?

b) Calculate Net present value (NPV) for Machine X and Machine Y?

c) Based on your calculations would you advise the company to go ahead with the project and if so, which machine should they choose?

Machine X Machine Y Initial investment year 0 Annual operating and maintenance cost, year 1- $900.000 $100.000 $630.000 $200.000 Annual revenue, year 1-3 $500.000 $500.000

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Machine X Machine Y Initial investment year 0 900000 630000 Annual revenue year 13 500000 500000 Ann...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

6045b2ea66036_7486916.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started