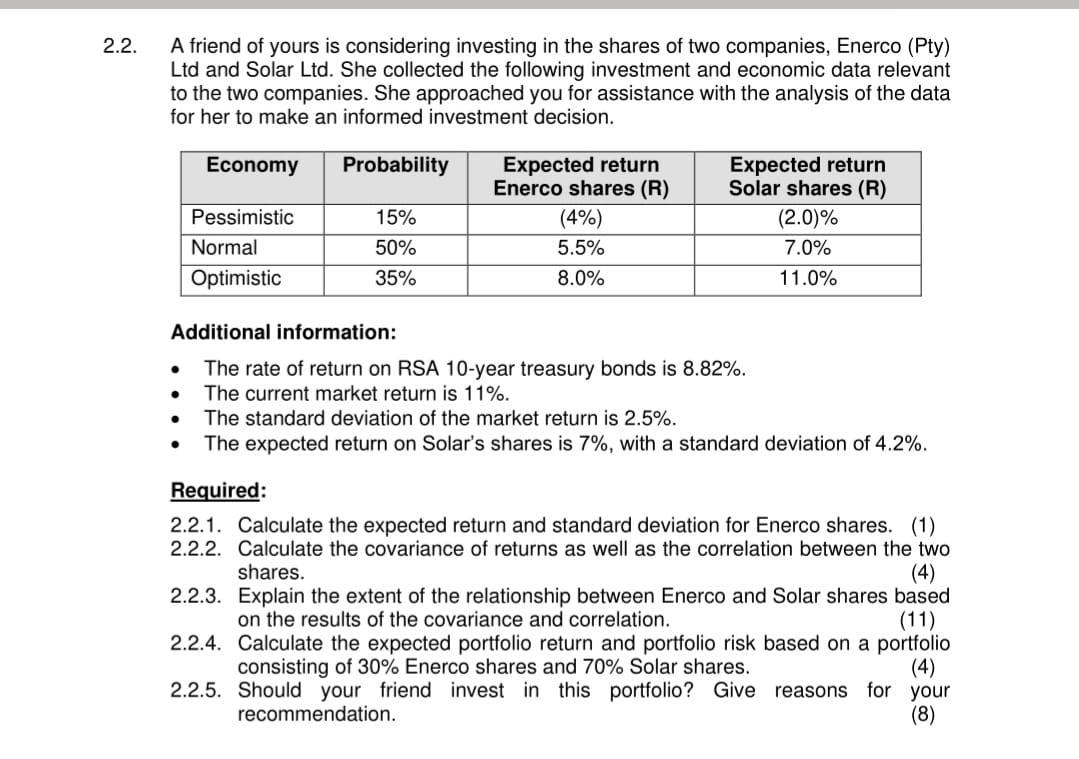

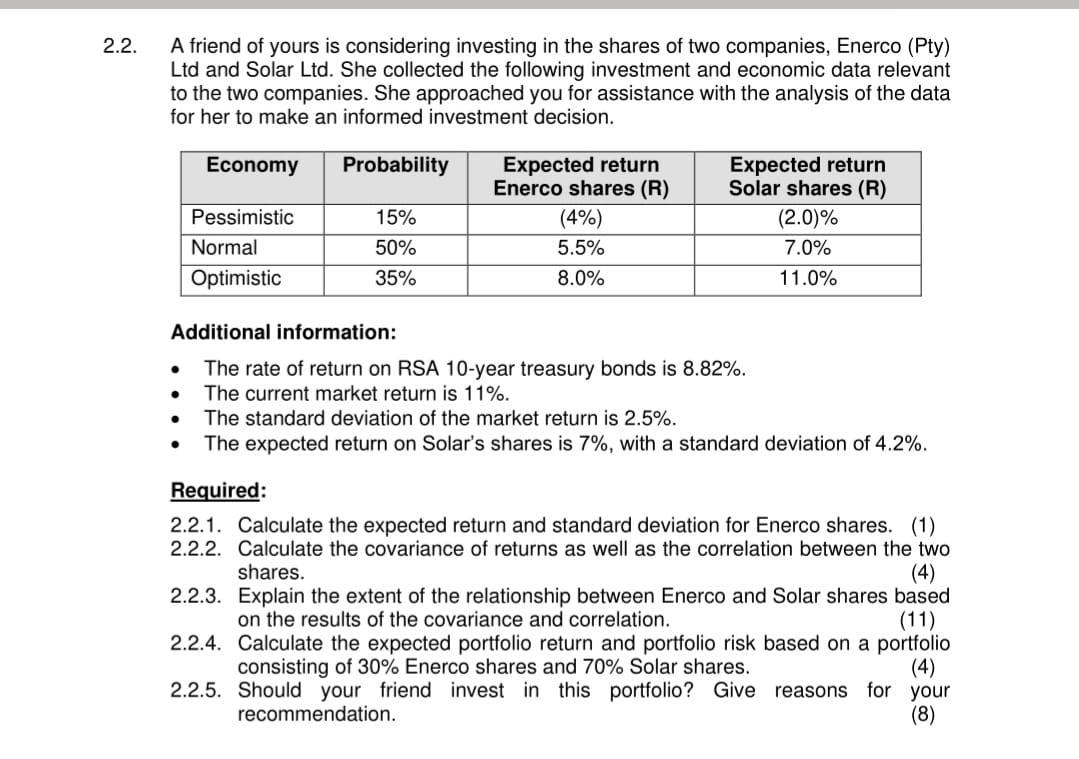

2.2. A friend of yours is considering investing in the shares of two companies, Enerco (Pty) Ltd and Solar Ltd. She collected the following investment and economic data relevant to the two companies. She approached you for assistance with the analysis of the data for her to make an informed investment decision. Economy Probability Pessimistic Normal Optimistic 15% 50% 35% Expected return Enerco shares (R) (4%) 5.5% 8.0% Expected return Solar shares (R) (2.0)% 7.0% 11.0% Additional information: . The rate of return on RSA 10-year treasury bonds is 8.82%. The current market return is 11%. The standard deviation of the market return is 2.5%. The expected return on Solar's shares is 7%, with a standard deviation of 4.2%. . . Required: 2.2.1. Calculate the expected return and standard deviation for Enerco shares. (1) 2.2.2. Calculate the covariance of returns as well as the correlation between the two shares. 2.2.3. Explain the extent of the relationship between Enerco and Solar shares based on the results of the covariance and correlation. (11) 2.2.4. Calculate the expected portfolio return and portfolio risk based on a portfolio consisting of 30% Enerco shares and 70% Solar shares. (4) 2.2.5. Should your friend invest in this portfolio? Give reasons recommendation. (8) for your 2.2. A friend of yours is considering investing in the shares of two companies, Enerco (Pty) Ltd and Solar Ltd. She collected the following investment and economic data relevant to the two companies. She approached you for assistance with the analysis of the data for her to make an informed investment decision. Economy Probability Pessimistic Normal Optimistic 15% 50% 35% Expected return Enerco shares (R) (4%) 5.5% 8.0% Expected return Solar shares (R) (2.0)% 7.0% 11.0% Additional information: . The rate of return on RSA 10-year treasury bonds is 8.82%. The current market return is 11%. The standard deviation of the market return is 2.5%. The expected return on Solar's shares is 7%, with a standard deviation of 4.2%. . . Required: 2.2.1. Calculate the expected return and standard deviation for Enerco shares. (1) 2.2.2. Calculate the covariance of returns as well as the correlation between the two shares. 2.2.3. Explain the extent of the relationship between Enerco and Solar shares based on the results of the covariance and correlation. (11) 2.2.4. Calculate the expected portfolio return and portfolio risk based on a portfolio consisting of 30% Enerco shares and 70% Solar shares. (4) 2.2.5. Should your friend invest in this portfolio? Give reasons recommendation. (8) for your