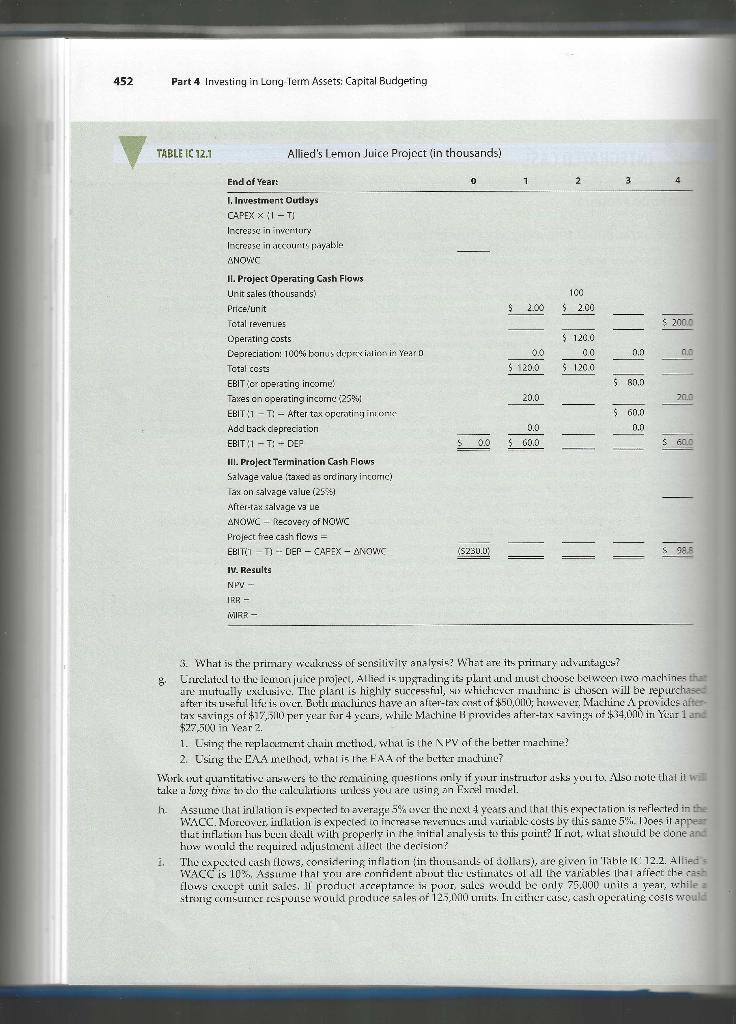

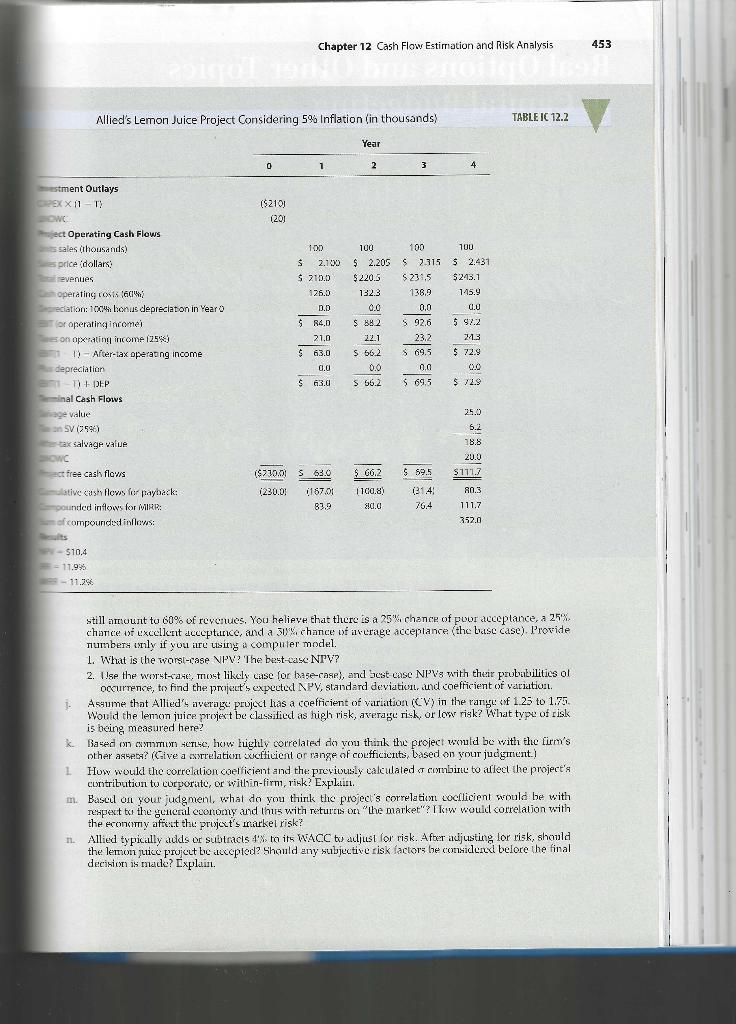

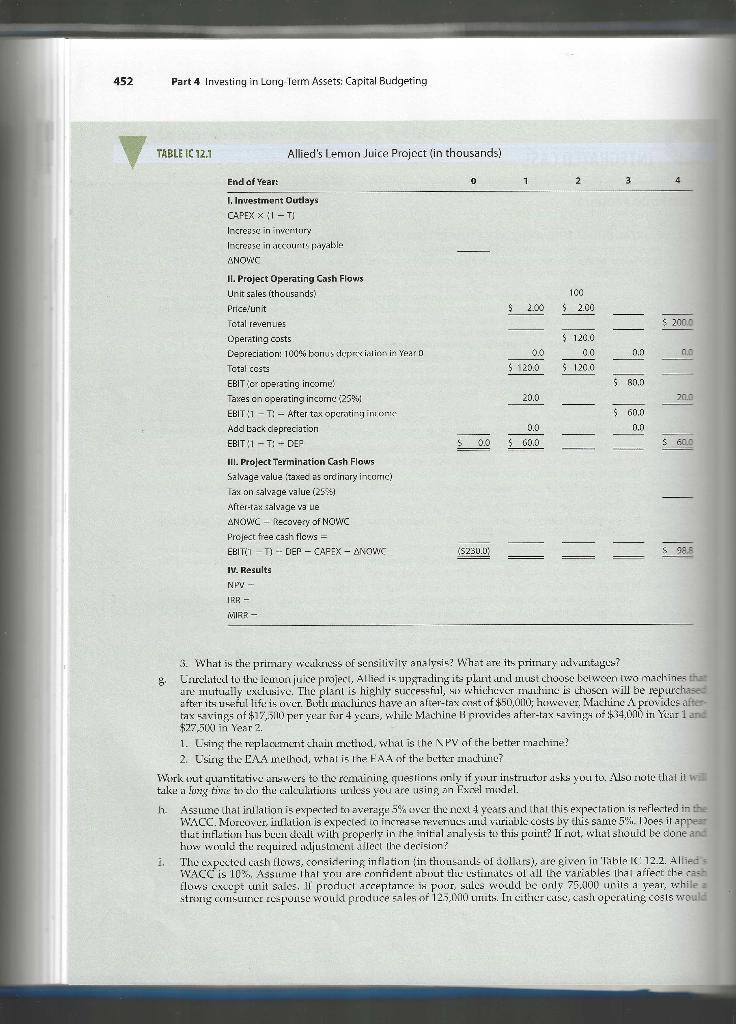

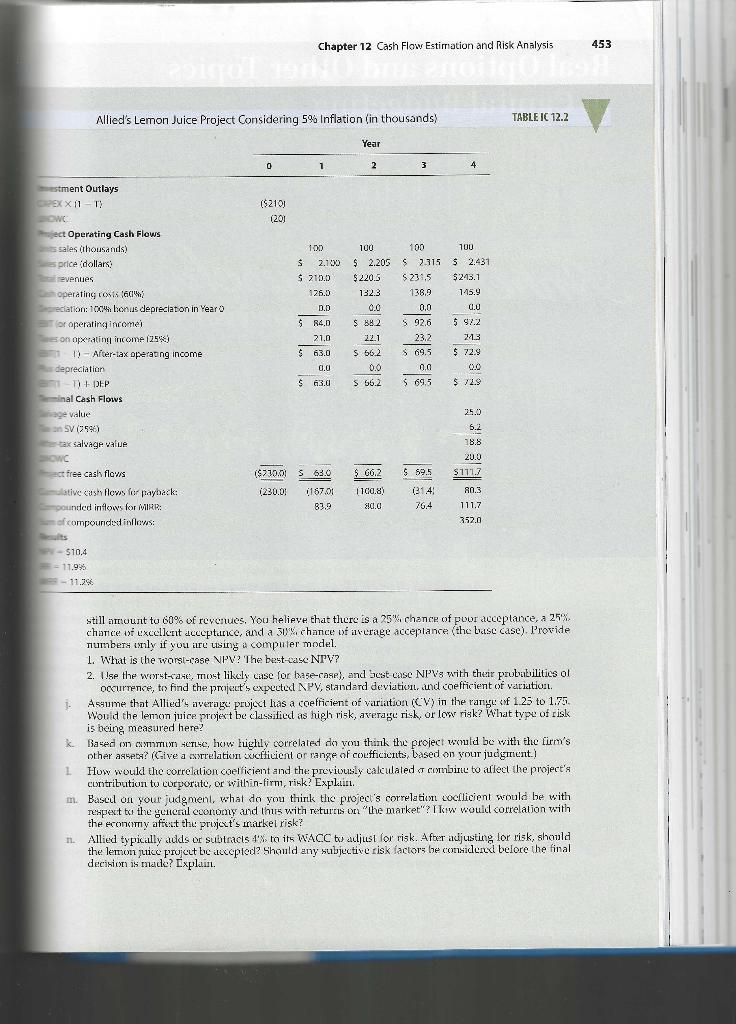

22 CAPITAL BUDGETIMG AND CASH FLOW ESTIMATION Allicd Fwxd Produts is considcring expand ing inton the Iruit juice trusiness writh a mew fres lomon juice product. Assume that you were roxently hired is issistant to the directur of capital budgeting, and you must evaluate the new projecl. The leinun juice would be poduced in an umised building adjacent to sillied s Fort Nyers pliut: Allied owns the huilking, which is fully depociated. Ihe purchase price of the required equipment is $281,100, induding shipping and installation cost, and the cyuipment is clisible for 100% bonus deprexiation al the time of purchase. In addition, invertories would rise by $25,000, while accountr payable would mereas: by 45,090 . All of these costs woudd be incurred at t=11. Ihe project is expected to operate lor 4 years, at which time it bill be terminates. I The cach inflows ane assumed to begin 1 year after the project is undertaken, or at t=1, and to continue out to 1.4 . A1 the end of the project's life (t =41, the equipment is expected to have a salvage value of S25,1010, Unit sales are expecled tu total 160,000 unils per year, and the uxperted sales prise is $2.00 per unit. Cash operatinu cosis lor the project are expecied to tastai Gow of denlar sales. Allied s lax rate is 25%, and it, WACC is 10. Tentatively, the lemm itice projec is assumed to he of cqual risk to Allied's other assets. You have been asked to evaluite the project and to make a rexrmmendition as to whether it should be accepled or rejecled. Ta guide you in your analysis, your hoss gave you the following set of takks/questiuns: a. Alliod has a standand torm that is used in the capitil budgetine procens. (See Table K 12.1 . Part of the table has been completed, but you must replacc the blanks with the missing numbers. Complele the table using the following steps: 1. Fill in the blirki under Yeir 0 for the initial investment vutlays: CAPIX (1 T) and ANOWC. 2. Complete the labke for unit sulesi, sales price, total revenues, and operatincs cosls. 3. Complete the lable down to after-tax operating income and then down to the project's uperaling cash Hluw:, HiRIT (1 - T) - DET. 4. Fill in the blanks under Year 4 lor the terminal cash flows and complete the projert free cash flow line. 1)iscuss the recovery of nei upurating, working capial. Whit would luve happened if the machinecy had heen sold for less thim iti book value? b. 1. Allicd uses debt in its capitul structure, so some of the money used to finance the project will be deht. Given this lact, should the propected citsh flows be sevired to show projecled interesi charges? Explain. 2. Suppone you learned that Allied had spent 550,000 to renotale the building last year, expernsing, thece cosis. Should this cuxit be rellected in the analysis? Hxplain. 3. Suppose you luiuned that Allied mild leisie its building to another purty and carn $25,000FCT yeate. Should that fact he rellected in the andalysis? 11 so, how? 4. Assume that the lemon juice project would lake profitable sules away lrom Allied's fresh orange juice business. Should that lact be reflected in your analy sis? If so, how? c. Disrerard all the assumptions made in part b and issume there is no alternative vse for the building over the next 4 years. Now calculate the projects. NTV, INR, MIRR, and paybeck. Do these indicators sursgest thut the projest should tic dexepted? Explain. d. II this project had heen a replacement rather than iun expansion project, how would the aralysis have cheanged? Thurk about the changes that woruld hatwe ta oreur in the cash flow table. t.. 1. Whit three levels, or types, of proiect risk are nomolly cunsidered? 2. Which type is must relerant? 3. Which ly pe is easicst ta measure? 4. Are the dirue types of risk generilly highly corruleted? 1. 1. What is sensitivity analysis? 2. How would you perfocm a sensitivily amblysis on the urit sales, salvage value, and WiACC lor the: poojcit? Assume that each of these variables deriales from its base casc, or expectou, walue by p lus or munus IV\%, 20, and 30. Explain how you would calculate the NPV, IIK, MERR, and paybick for cieh case, bue don'l do the analysis unlens your instructor asks you ter. Part 4 Irvesting in Long lerm Assets: Capital Budgeting TABLE IC 12.1 Allied's Lemon Juice Project (in thousands) 3. What is the primary weaknuss of sensilivily analysis? What are it primary idvantagas? g. Cruclitted to the lemon juice project, Allied is upgrading its plunt and must chouse belwoen (wo machines that ure mutudlly exalusive. The plant is highly successful, wi) whichever mathine is thosen will be repurchased after its useful life is over. Butl maiclines have an afier-tax onkt of 450,000 ; however. Machine A provides after: tax savings of $77, silo per year fir 4 yeirs, while Machine b provides after-tax saving; of th 34,000 in Your 1 and $27500 in Yesr 2. 1. Lsing the replacement chain mcthod, what is the NPV of the better machime? 2. Using the EAA methot, what is l he FAA of the better machine? Whrk tuat quantitative anwwers to the romaining guestions only if your instructor asks you to. Also note that it wat take a Iong tive to do the calculitions unless you are using, an Fxnel model. h. Assume that indation is expected to average 5% sser the next 4 years and that this expectation is reflerted in the WACC. Morcuver, inflation is expected io increa re revenues imu viuriuble costs by this same 5 in I Ioes if appear that infletion has beeu dexlt wilh properly in the inital analysis to this point? If not, what should be done and how would thu required idljustment alled the decision? i. The expected cash tlows, considering inflation (in thwusands of dollars), are given in Table IC: 12.2. Alied s WACC is 10%. Assume that rou are contident abuut the cstimates of till the valiables that affect the cast flowi cxeept unit sales, If producl acceptance is poor sules would be only 75,200 unils a year; while a string combuner tesponse woud produce sales of 125,090 umits. In cither case, cash operating costs would Chapter 12 Cash Flow Estimation and Risk Analysis Allied's Lemon Juice Project Considering 5% Inflation (in thousands) TABLE IC 12.2 still amount to 60% of rexcnues. You helieve that there is a 25%, chance of pour acceptance, a 25% chance of uxcellent acceptance, and a Jys, chance of akerage acceptance (the base case). Proride numbers anly if you are using a compuler model. 1. What is the worst-iase NPV? The best-cas NPV? 2. IIse the worst-cane, most likely case for tazse-rasel, and best case NPVs with their prubibilitics of occurrence, to find the project's expected NPV, stand ard deviation, and coefficient of variation. 1. Assume that Allieds averagc project has a coefficient of variation ( V ) in the range of 1.25 to 1.75 , Woud the lemon juice projet be clessified as high risk, average risk, or low risk? What type of risk is being measured here? k. Based on communn serne, how highly correlated do you thuirk the project would be with the firm's other assets? (Cive a txrrelation cucfticient or range of coefficients, based on your judgment.) 1. Huw mould the correlation coelficient and the presiuusly calculaled a combinu to aflect the project's cuntribution to corporite, or within-firm, risk? Explein. m. Bascul on your judgmenl, what do you thirk the projecl's correlation wocflicient would be with respert to the genemil economy and this with returts on "the market"? I Kiw would correlation with the eronomy affect thu' priyjot's markel risk? n. Allied typically adds or subtracls 4 m to its WACC tu adjust for risk. After adjusting lor risk, should the lemon juice project be aecepted? Shauld any subjective risk lactors he combidered belore the final decision is made? Ixplain. 22 CAPITAL BUDGETIMG AND CASH FLOW ESTIMATION Allicd Fwxd Produts is considcring expand ing inton the Iruit juice trusiness writh a mew fres lomon juice product. Assume that you were roxently hired is issistant to the directur of capital budgeting, and you must evaluate the new projecl. The leinun juice would be poduced in an umised building adjacent to sillied s Fort Nyers pliut: Allied owns the huilking, which is fully depociated. Ihe purchase price of the required equipment is $281,100, induding shipping and installation cost, and the cyuipment is clisible for 100% bonus deprexiation al the time of purchase. In addition, invertories would rise by $25,000, while accountr payable would mereas: by 45,090 . All of these costs woudd be incurred at t=11. Ihe project is expected to operate lor 4 years, at which time it bill be terminates. I The cach inflows ane assumed to begin 1 year after the project is undertaken, or at t=1, and to continue out to 1.4 . A1 the end of the project's life (t =41, the equipment is expected to have a salvage value of S25,1010, Unit sales are expecled tu total 160,000 unils per year, and the uxperted sales prise is $2.00 per unit. Cash operatinu cosis lor the project are expecied to tastai Gow of denlar sales. Allied s lax rate is 25%, and it, WACC is 10. Tentatively, the lemm itice projec is assumed to he of cqual risk to Allied's other assets. You have been asked to evaluite the project and to make a rexrmmendition as to whether it should be accepled or rejecled. Ta guide you in your analysis, your hoss gave you the following set of takks/questiuns: a. Alliod has a standand torm that is used in the capitil budgetine procens. (See Table K 12.1 . Part of the table has been completed, but you must replacc the blanks with the missing numbers. Complele the table using the following steps: 1. Fill in the blirki under Yeir 0 for the initial investment vutlays: CAPIX (1 T) and ANOWC. 2. Complete the labke for unit sulesi, sales price, total revenues, and operatincs cosls. 3. Complete the lable down to after-tax operating income and then down to the project's uperaling cash Hluw:, HiRIT (1 - T) - DET. 4. Fill in the blanks under Year 4 lor the terminal cash flows and complete the projert free cash flow line. 1)iscuss the recovery of nei upurating, working capial. Whit would luve happened if the machinecy had heen sold for less thim iti book value? b. 1. Allicd uses debt in its capitul structure, so some of the money used to finance the project will be deht. Given this lact, should the propected citsh flows be sevired to show projecled interesi charges? Explain. 2. Suppone you learned that Allied had spent 550,000 to renotale the building last year, expernsing, thece cosis. Should this cuxit be rellected in the analysis? Hxplain. 3. Suppose you luiuned that Allied mild leisie its building to another purty and carn $25,000FCT yeate. Should that fact he rellected in the andalysis? 11 so, how? 4. Assume that the lemon juice project would lake profitable sules away lrom Allied's fresh orange juice business. Should that lact be reflected in your analy sis? If so, how? c. Disrerard all the assumptions made in part b and issume there is no alternative vse for the building over the next 4 years. Now calculate the projects. NTV, INR, MIRR, and paybeck. Do these indicators sursgest thut the projest should tic dexepted? Explain. d. II this project had heen a replacement rather than iun expansion project, how would the aralysis have cheanged? Thurk about the changes that woruld hatwe ta oreur in the cash flow table. t.. 1. Whit three levels, or types, of proiect risk are nomolly cunsidered? 2. Which type is must relerant? 3. Which ly pe is easicst ta measure? 4. Are the dirue types of risk generilly highly corruleted? 1. 1. What is sensitivity analysis? 2. How would you perfocm a sensitivily amblysis on the urit sales, salvage value, and WiACC lor the: poojcit? Assume that each of these variables deriales from its base casc, or expectou, walue by p lus or munus IV\%, 20, and 30. Explain how you would calculate the NPV, IIK, MERR, and paybick for cieh case, bue don'l do the analysis unlens your instructor asks you ter. Part 4 Irvesting in Long lerm Assets: Capital Budgeting TABLE IC 12.1 Allied's Lemon Juice Project (in thousands) 3. What is the primary weaknuss of sensilivily analysis? What are it primary idvantagas? g. Cruclitted to the lemon juice project, Allied is upgrading its plunt and must chouse belwoen (wo machines that ure mutudlly exalusive. The plant is highly successful, wi) whichever mathine is thosen will be repurchased after its useful life is over. Butl maiclines have an afier-tax onkt of 450,000 ; however. Machine A provides after: tax savings of $77, silo per year fir 4 yeirs, while Machine b provides after-tax saving; of th 34,000 in Your 1 and $27500 in Yesr 2. 1. Lsing the replacement chain mcthod, what is the NPV of the better machime? 2. Using the EAA methot, what is l he FAA of the better machine? Whrk tuat quantitative anwwers to the romaining guestions only if your instructor asks you to. Also note that it wat take a Iong tive to do the calculitions unless you are using, an Fxnel model. h. Assume that indation is expected to average 5% sser the next 4 years and that this expectation is reflerted in the WACC. Morcuver, inflation is expected io increa re revenues imu viuriuble costs by this same 5 in I Ioes if appear that infletion has beeu dexlt wilh properly in the inital analysis to this point? If not, what should be done and how would thu required idljustment alled the decision? i. The expected cash tlows, considering inflation (in thwusands of dollars), are given in Table IC: 12.2. Alied s WACC is 10%. Assume that rou are contident abuut the cstimates of till the valiables that affect the cast flowi cxeept unit sales, If producl acceptance is poor sules would be only 75,200 unils a year; while a string combuner tesponse woud produce sales of 125,090 umits. In cither case, cash operating costs would Chapter 12 Cash Flow Estimation and Risk Analysis Allied's Lemon Juice Project Considering 5% Inflation (in thousands) TABLE IC 12.2 still amount to 60% of rexcnues. You helieve that there is a 25%, chance of pour acceptance, a 25% chance of uxcellent acceptance, and a Jys, chance of akerage acceptance (the base case). Proride numbers anly if you are using a compuler model. 1. What is the worst-iase NPV? The best-cas NPV? 2. IIse the worst-cane, most likely case for tazse-rasel, and best case NPVs with their prubibilitics of occurrence, to find the project's expected NPV, stand ard deviation, and coefficient of variation. 1. Assume that Allieds averagc project has a coefficient of variation ( V ) in the range of 1.25 to 1.75 , Woud the lemon juice projet be clessified as high risk, average risk, or low risk? What type of risk is being measured here? k. Based on communn serne, how highly correlated do you thuirk the project would be with the firm's other assets? (Cive a txrrelation cucfticient or range of coefficients, based on your judgment.) 1. Huw mould the correlation coelficient and the presiuusly calculaled a combinu to aflect the project's cuntribution to corporite, or within-firm, risk? Explein. m. Bascul on your judgmenl, what do you thirk the projecl's correlation wocflicient would be with respert to the genemil economy and this with returts on "the market"? I Kiw would correlation with the eronomy affect thu' priyjot's markel risk? n. Allied typically adds or subtracls 4 m to its WACC tu adjust for risk. After adjusting lor risk, should the lemon juice project be aecepted? Shauld any subjective risk lactors he combidered belore the final decision is made? Ixplain