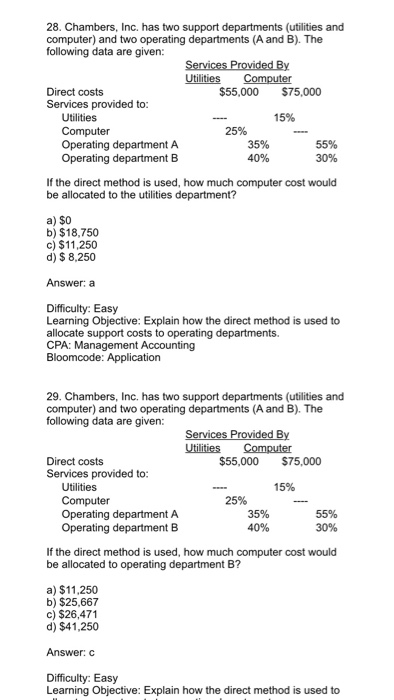

22. Cervantes Industries provides an in-house cafeteria for production and administrative employees. This service costs $25,000 per month, plus $3 per meal served. The company has 800 production employees and 400 administrative employees. During the past month 5,500 meals were served to production employees and 2,000 to administrative. The amount of cost allocated to the administrative department using actual meals served as the basis is: a) $16,675 b) $12,667 c) $14,325 d) $18,500 Answer: b Difficulty: Easy Learning Objective: Explain the difference between single- and dual-rate allocations. CPA: Management Accounting 23. Cervantes Industries provides an in-house cafeteria for production and administrative employees. This service costs $25,000 per month, plus $3 per meal served. The company has 800 production employees and 400 administrative employees. During the past month 5,500 meals were served to production employees and 2,000 to administrative. The amount allocated to the operating department using a dual-rate basis with the fixed cost allocation based on number of employees is a) $33,167 b) $31,683 c) $24,833 d) $41,500 Answer: a Difficulty: Easy Learning Objective: Explain the difference between single- and dual-rate allocations. CPA: Management Accounting 24. The personnel department provides service to operating departments A and B. Personnel's budget is based on 250 employees (100 in department A and 150 in department B). The budget calls for $40,000 in fixed costs, plus $140 per employee. During a recent month the personnel department 24. The personnel department provides service to operating departments A and B. Personnel's budget is based on 250 employees (100 in department A and 150 in department B). The budget calls for $40,000 in fixed costs, plus $140 per employee. During a recent month the personnel department incurred $41,000 in fixed costs and $42,200 in variable costs. The two operating departments, A and B, had 120 and 140 employees, respectively How much would be charged to department A if actual costs were allocated based on number of employees? a) $36,000 b) $38,400 c) $30,000 d) $34,615 Answer: b Difficulty: Easy Learning Objective: Explain the difference between single- and dual-rate allocations. CPA: Management Accounting 25. The personnel department provides service to operating departments A and B. Personnel's budget is based on 250 employees (100 in department A and 150 in department B). The budget calls for $40,000 in fixed costs, plus $140 per employee. During a recent month the personnel department incurred $41,000 in fixed costs and $42,200 in variable costs. The two operating departments, A and B, had 120 and 140 employees, respectively How much would be charged to department B if budgeted costs were allocated based on number of employees? a) $45,000 b) $44,800 c) $43,600 d) $40,385 Answer: a Difficulty: Easy Learning Objective: Explain the difference between single- and dual-rate allocations. CPA: Management Accounting 26. The personnel department provides service to operating departments A and B. Personnel's budget is based on 250 28. Chambers, Inc. has two support departments (utilities and computer) and two operating departments (A and B). The following data are given: Utilities Computer $55,000 $75,000 Direct costs Services provided to: Utilities 15% Computer 25% 35% 40% 55% 30% Operating department B If the direct method is used, how much computer cost would be allocated to the utilities department? a) $0 b) $18,750 c) $11,250 d) $ 8,250 Answer: a Difficulty: Easy Learning Objective: Explain how the direct method is used to allocate support costs to operating departments. CPA: Management Accounting 29. Chambers, Inc. has two support departments (utilities and computer) and two operating departments (A and B). The following data are given: Utilities Computer Direct costs Services provided to: $55,000 $75,000 Utilities Computer Operating department A 15% 25% 35% 40% 55% 30% If the direct method is used, how much computer cost would be allocated to operating department B? a) $11,250 b) $25,667 c) $26,471 d) $41,250 Answer: C Difficulty: Easy Learning Objective: Explain how the direct method is used to