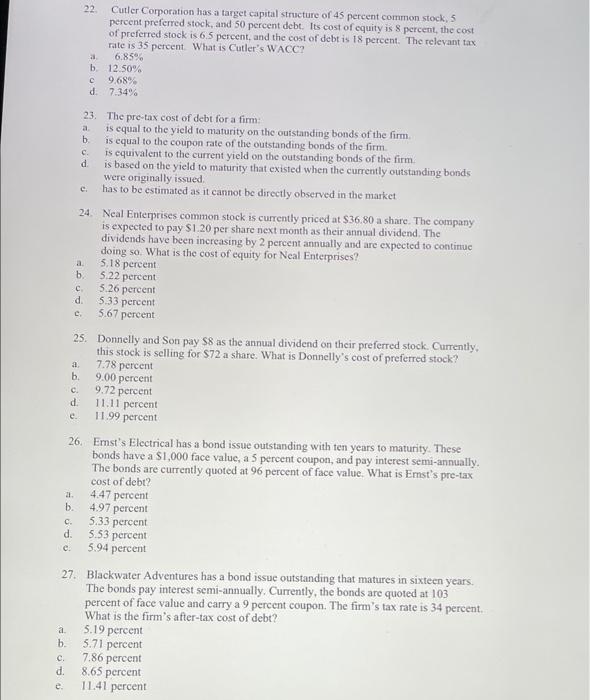

22 Cutler Corporation has a target capital structure of 45 percent common stock, 5 percent preferred stock, and 50 percent debt. Its cost of equity is 8 percent, the cost of preferred stock is 6.5 percent, and the cost of debt is 18 percent. The relevant tax rate is 35 percent. What is Cutler's WACC? 6.85% b 12.50% 9.689 d. 7.34% c d 23. The pre-tax cost of debt for a firm: a is equal to the yield to maturity on the outstanding bonds of the firm b is equal to the coupon rate of the outstanding bonds of the firm. c. is equivalent to the current yield on the outstanding bonds of the firm. d is based on the yield to maturity that existed when the currently outstanding bonds were originally issued has to be estimated as it cannot be directly observed in the market 24. Neal Enterprises common stock is currently priced at $36.80 a share. The company is expected to pay $1.20 per share next month as their annual dividend. The dividends have been increasing by 2 percent annually and are expected to continue doing so. What is the cost of equity for Neal Enterprises? 5.18 percent b 5.22 percent 5.26 percent 5:33 percent 5.67 percent 25. Donnelly and Son pay S8 as the annual dividend on their preferred stock. Currently, this stock is selling for $72 a share. What is Donnelly's cost of preferred stock? 7.78 percent b 9.00 percent c. 9.72 percent d. 11.11 percent 11.99 percent 26. Erst's Electrical has a bond issue outstanding with ten years to maturity. These bonds have a $1,000 face value, a 5 percent coupon, and pay interest semi-annually. The bonds are currently quoted at 96 percent of face value. What is Emst's pre-tax cost of debt? 4.47 percent b. 4.97 percent 5.33 percent d. 5.53 percent 5.94 percent 27. Blackwater Adventures has a bond issue outstanding that matures in sixteen years. The bonds pay interest semi-annually. Currently, the bonds are quoted at 103 percent of face value and carry a 9 percent coupon. The firm's tax rate is 34 percent. What is the firm's after-tax cost of debt? a 5.19 percent b. 5.71 percent c. 7.86 percent d. 8.65 percent 11.41 percent e. c. e e