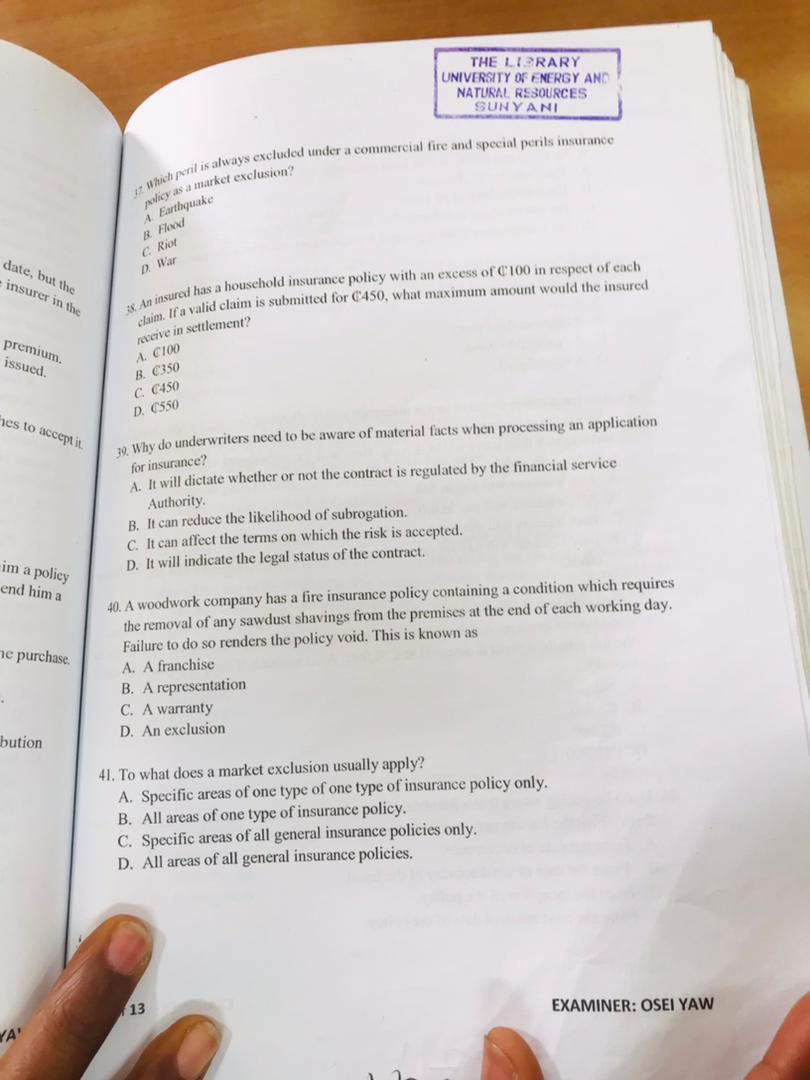

22. How is the likelihood of a loss occurring usually alfected by the existence of a ponr physical hazard? A. It always remains constant. B. It may remain constant or increase. C. It may remain constant or decrease. D. It may inerease or decrease. 23. An underwriter has identificd a good pliysical hazard in relation to an insurance application. What impact will this tend to have on the likelihood and severity of loss? A. An increase in both likelihood and severity. B. A deerease in both likelihood and severity. C. An increase in likelihood but a decrease in severity. D. A decrease in likelihood but an increase in severity. 24. A proposal form is normally used by an underwriter as a means of obtaining material facts because it A. Is a regulatory requirement. B. Is convenient and cost-effective. C. Prevents misrepresentation by the proposer. D. Provides evidence of contract. 25. What personal information about the proposer, other than name and address, is required on a commercial fire insurance proposal form? A. Age B. Marital status C. Nationality D. Occupation 26. The proposal form being completed by an applicant specifically asks for details of anyone under the age of 25 who is to be covered by the insurance policy. What type of insurance policy is this most likely to be? A. A travel insurance policy. B. A motor insurance policy. C. A personal accident insurance policy. D. A medical expenses insurance policy. A. Vary the period of cover to suit the misquoted premium B. Vary the level of cover to suit the misquoted premium C. The insurer is bound by the quotation D. Send the proposer a second quotation with the correct premium stated 28. What type of fact, if omitted by the proposer on the proposal form, might allow the insurer to make the insurance policy void? A. A fact of common knowledge B. A fact of law C. A fact which lessens the risk. D. A material fact. 29. A direct motor insurer asks a proposer questions over the telephone and a proposal form based on the proposer's replies. What is the next stage in processing the proposal? A. The insurer draws up an insurance policy. B. The insurer issued a cover note pending receipt of the premium. C. The proposer is asked to remit the premium. D. The proposal form is sent to the proposer to check. 30. The sum insured under a building's insurance policy is C70,000. A rate of C0.03% applies and a 10% discount is allowed. What is the premium excluding insurance premium tax? A. C63 B. C189 C. C210 D. C231 31. Martin buys a car and asks an intermediary to arrange insurance. From when does the insurance become effective? A. When the intermediary submits the quotation. B. From the time and the date shown on the cover note issued by the intermediary. C. When martin receives the insurance policy documents. D. When the intermediary receives the full premium. 32. An insurance policy's legal significance is on the A. Basis of contract B. Confirmation of cover. C. Contract itself. D. Evidence of contract. 33. A fire occurs at a factory one month after the insurance policy renewal date, but the renewal premium has NOT been paid. What s thee legal position of the insurer in the event of claim? A. The insurer can reject the claim in its entirety. B. The insurer must pay the claim, but with the deduction of the unpaid premium. C. The insurer must pay the claim in full, unless a cancellation has been issued. D. The insurer must delay settlement until the premium has been paid. 34. An insurance quotation is given to a customer who indicates that she wishes to accept it. At what point is the contract made? A. When the customer agrees to pay the premium. B. When the customer pays the premium. C. When the policy document is issued by the insurer. D. When the policy document is received by the customer. 35. John purchases a motor insurance policy and asks the insurer NOT to send him a policy document as he understands the extent of the cover. Why would the insurer send him a policy document anyway? A. John cannot make a claim under the policy without the policy document. B. The insurer is legally obliged to issue the policy document at the time of the purchase. C. The policy document is evidence that the insurance contract is in place. D. The policy document must be issued before the premium is legally payable. 36. When two insurance policies cover the same risk and they both contain a contribution condition, how would any claim usually be settled? A. Only one policy would contribute to the full amount. B. Both policies would contribute the full amount. C. Both polices would contribute an equal amount. D. Both policies would contribute a proportionate amount. Whid peri is always excluded under a commereial fire and special perils insurance A. Earthy as a market exclusion? B. Flood c. Riot 3. An insured has a household insurance policy with an exeess of C100 in respect of each D. War claim. If a valid claim is submitted for C450, what maximum amount would the insured receive in settlement? A. cl100 B. c350 C. C450 D. C550 39. Why do underwriters need to be aware of material facts when processing an application A. It will dictate whether or not the contract is regulated by the financial service for insurance? Authority. B. It can reduce the likelihood of subrogation. C. It can affect the terms on which the risk is accepted. D. It will indicate the legal status of the contract. 40. A woodwork company has a fire insurance policy containing a condition which requires the removal of any sawdust shavings from the premises at the end of each working day. Failure to do so renders the policy void. This is known as A. A franchise B. A representation C. A warranty D. An exclusion 41. To what does a market exclusion usually apply? A. Specific areas of one type of one type of insurance policy only. B. All areas of one type of insurance policy. C. Specific areas of all general insurance policies only. D. All areas of all general insurance policies