Answered step by step

Verified Expert Solution

Question

1 Approved Answer

22. Ms. Barth is a professional tax return preparer. Three years ago, she prepared Form 1120 for Denver Inc. Her fee for the preparation

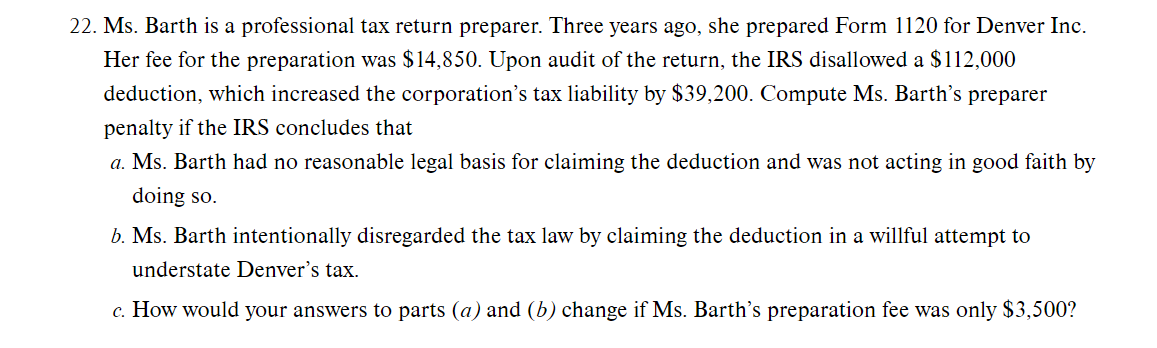

22. Ms. Barth is a professional tax return preparer. Three years ago, she prepared Form 1120 for Denver Inc. Her fee for the preparation was $14,850. Upon audit of the return, the IRS disallowed a $112,000 deduction, which increased the corporation's tax liability by $39,200. Compute Ms. Barth's preparer penalty if the IRS concludes that a. Ms. Barth had no reasonable legal basis for claiming the deduction and was not acting in good faith by doing so. b. Ms. Barth intentionally disregarded the tax law by claiming the deduction in a willful attempt to understate Denver's tax. c. How would your answers to parts (a) and (b) change if Ms. Barth's preparation fee was only $3,500?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started