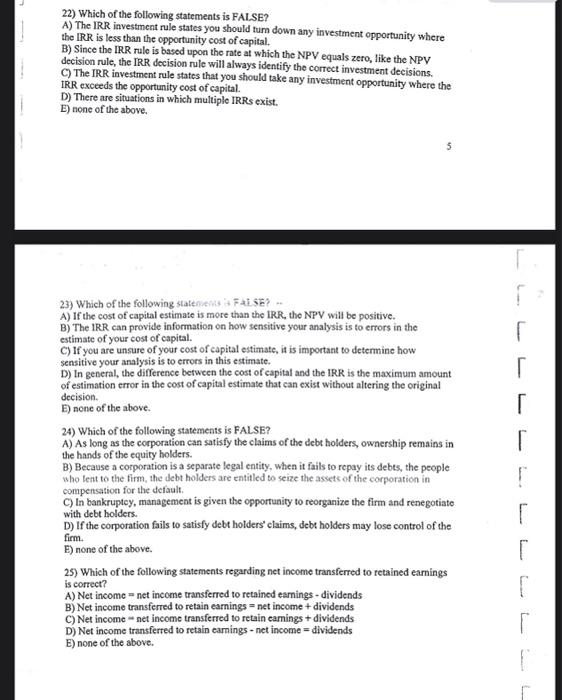

22) Which of the following statements is FAISE? A) The IRR investment rule states you should tum down any investment opportunity where the IRR is less than the opportunity cost of capital. B) Since the IRR rule is based upon the rate at which the NPV equals zero, like the NPV decision rule, the IRR decision rule will always identify the correct investment decisions. C) The IRR investment rule states that you should take any investment opportunity where the IRR exceeds the opportunity cost of capital. D) There are situations in which multiple IRRs exist. E) none of the above. 5 23) Which of the following statenens it Fat Ske? .. A) If the cost of capital estimate is more than the IRR, the NPV will be positive. B) The IRR can provide information on how sensitive your analysis is to errors in the estimate of your cost of capital. C) If you are unsure of your cost of capital estimate, it is important to determine how sensitive your analysis is to errors in this estimate. D) In general, the difference between the cost of capital and the IRR is the maximum amount of estimation error in the cost of capital estimate that can exist without altering the original decision. E) none of the above. 24) Which of the following statements is FALSE? A) As long as the corporation can satisfy the claims of the debt holders, ownership remains in the hands of the equity holders. B) Because a corporation is a separate legal entity, when it fails to repay its debts, the people who lent to the firm, the debt holders are entitled to seize the assets of the corporation in compensation for the default. C) In bankruptcy, management is given the opportunity to reorganize the firm and renegotiate with debt holders. D) If the corporation fails to satisfy debt holders' claims, debt holders may lose control of the firm. E) none of the above. 25) Which of the following statements regarding net income transferred to retained eamings is correct? A) Net income = net income transferred to retained eamings - dividends B) Net income transferred to retain earnings = net income + dividends C) Net income - net income transferred to retain eamings + dividends D) Net income transferred to retain earnings - net income = dividends E) none of the above