Answered step by step

Verified Expert Solution

Question

1 Approved Answer

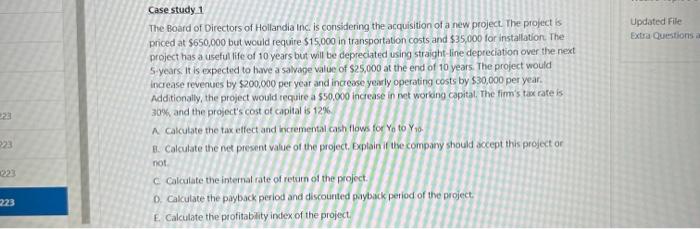

223 223 223 223 Case study 1 The Board of Directors of Hollandia Inc. is considering the acquisition of a new project. The project

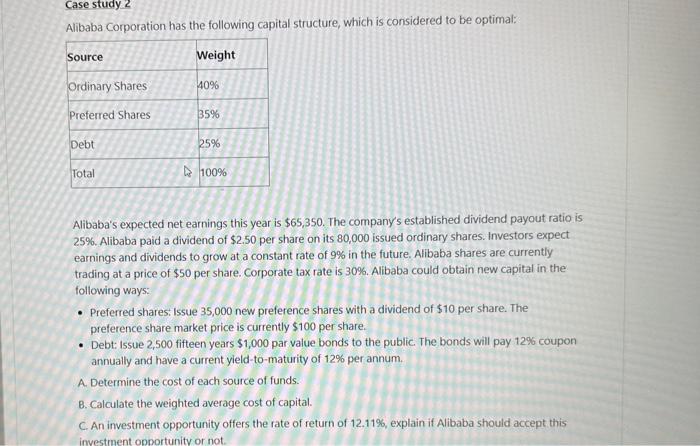

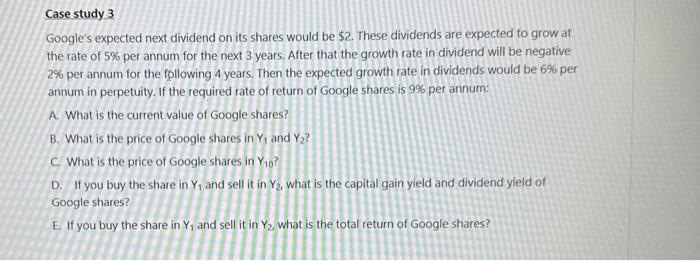

223 223 223 223 Case study 1 The Board of Directors of Hollandia Inc. is considering the acquisition of a new project. The project is priced at $650,000 but would require $15,000 in transportation costs and $35,000 for installation. The project has a useful life of 10 years but will be depreciated using straight-line depreciation over the next 5-years. It is expected to have a salvage value of $25,000 at the end of 10 years. The project would increase revenues by $200,000 per year and increase yearly operating costs by $30,000 per year. Additionally, the project would require a $50,000 increase in net working capital. The firm's tax rate is 30%, and the project's cost of capital is 12% A Calculate the tax effect and incremental cash flows for Yo to Yo- B. Calculate the net present value of the project. Explain it the company should accept this project or not. C Calculate the internal rate of return of the project. D. Calculate the payback period and discounted payback period of the project. E. Calculate the profitability index of the project Updated File Extra Questions a Case study 2 Alibaba Corporation has the following capital structure, which is considered to be optimal: Source Weight Ordinary Shares Preferred Shares Debt Total 40% 35% 25% 100% Alibaba's expected net earnings this year is $65,350. The company's established dividend payout ratio is 25%. Alibaba paid a dividend of $2.50 per share on its 80,000 issued ordinary shares. Investors expect earnings and dividends to grow at a constant rate of 9% in the future. Alibaba shares are currently trading at a price of $50 per share. Corporate tax rate is 30%. Alibaba could obtain new capital in the following ways: Preferred shares: Issue 35,000 new preference shares with a dividend of $10 per share. The preference share market price is currently $100 per share. Debt: Issue 2,500 fifteen years $1,000 par value bonds to the public. The bonds will pay 12% coupon annually and have a current yield-to-maturity of 12% per annum. A. Determine the cost of each source of funds. B. Calculate the weighted average cost of capital. C. An investment opportunity offers the rate of return of 12.11%, explain if Alibaba should accept this investment opportunity or not. Case study 3 Google's expected next dividend on its shares would be $2. These dividends are expected to grow at the rate of 5% per annum for the next 3 years. After that the growth rate in dividend will be negative 2% per annum for the following 4 years. Then the expected growth rate in dividends would be 6% per annum in perpetuity. If the required rate of return of Google shares is 9% per annum: A. What is the current value of Google shares? B. What is the price of Google shares in Y and Y? C. What is the price of Google shares in Y10? D. If you buy the share in Y and sell it in Y, what is the capital gain yield and dividend yield of Google shares? E. If you buy the share in Y and sell it in Y, what is the total return of Google shares?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

It appears youve provided images with three separate case studies involving financial analysis for different companies As the information is quite extensive and covers multiple questions in each case ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started