Answered step by step

Verified Expert Solution

Question

1 Approved Answer

23. Before performing any calculations, Hwan asks you to correct the errors in the worksheet. a. b. c. To the right of the Annual

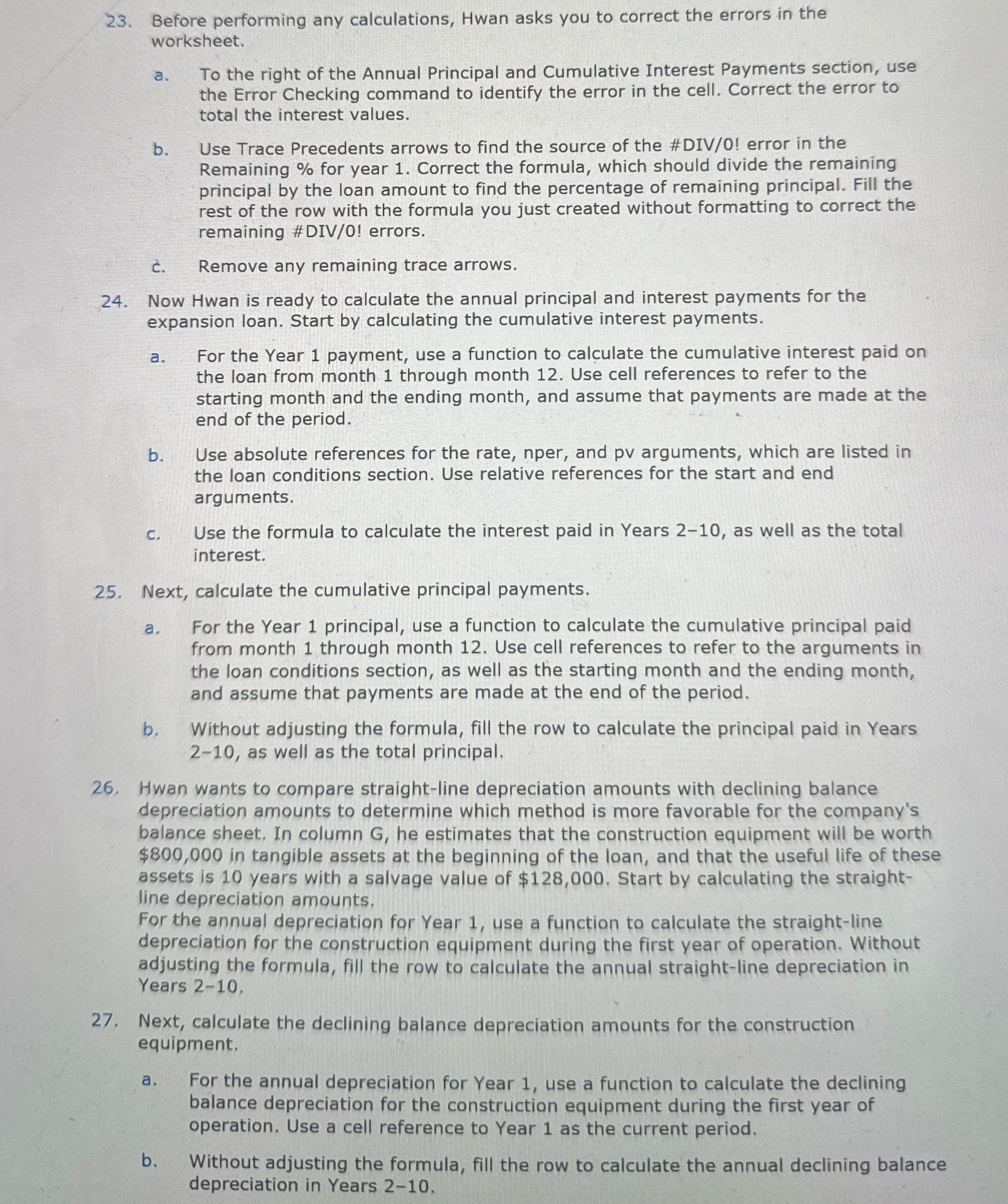

23. Before performing any calculations, Hwan asks you to correct the errors in the worksheet. a. b. c. To the right of the Annual Principal and Cumulative Interest Payments section, use the Error Checking command to identify the error in the cell. Correct the error to total the interest values. Use Trace Precedents arrows to find the source of the #DIV/0! error in the Remaining % for year 1. Correct the formula, which should divide the remaining principal by the loan amount to find the percentage of remaining principal. Fill the rest of the row with the formula you just created without formatting to correct the remaining #DIV/0! errors. Remove any remaining trace arrows. 24. Now Hwan is ready to calculate the annual principal and interest payments for the expansion loan. Start by calculating the cumulative interest payments. a. b. C. For the Year 1 payment, use a function to calculate the cumulative interest paid on the loan from month 1 through month 12. Use cell references to refer to the starting month and the ending month, and assume that payments are made at the end of the period. Use absolute references for the rate, nper, and pv arguments, which are listed in the loan conditions section. Use relative references for the start and end arguments. Use the formula to calculate the interest paid in Years 2-10, as well as the total interest. 25. Next, calculate the cumulative principal payments. a. For the Year 1 principal, use a function to calculate the cumulative principal paid from month 1 through month 12. Use cell references to refer to the arguments in the loan conditions section, as well as the starting month and the ending month, and assume that payments are made at the end of the period. b. Without adjusting the formula, fill the row to calculate the principal paid in Years 2-10, as well as the total principal. 26. Hwan wants to compare straight-line depreciation amounts with declining balance depreciation amounts to determine which method is more favorable for the company's balance sheet. In column G, he estimates that the construction equipment will be worth $800,000 in tangible assets at the beginning of the loan, and that the useful life of these assets is 10 years with a salvage value of $128,000. Start by calculating the straight- line depreciation amounts. For the annual depreciation for Year 1, use a function to calculate the straight-line depreciation for the construction equipment during the first year of operation. Without adjusting the formula, fill the row to calculate the annual straight-line depreciation in Years 2-10. 27. Next, calculate the declining balance depreciation amounts for the construction equipment. a. b. For the annual depreciation for Year 1, use a function to calculate the declining balance depreciation for the construction equipment during the first year of operation. Use a cell reference to Year 1 as the current period. Without adjusting the formula, fill the row to calculate the annual declining balance depreciation in Years 2-10.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started