Answered step by step

Verified Expert Solution

Question

1 Approved Answer

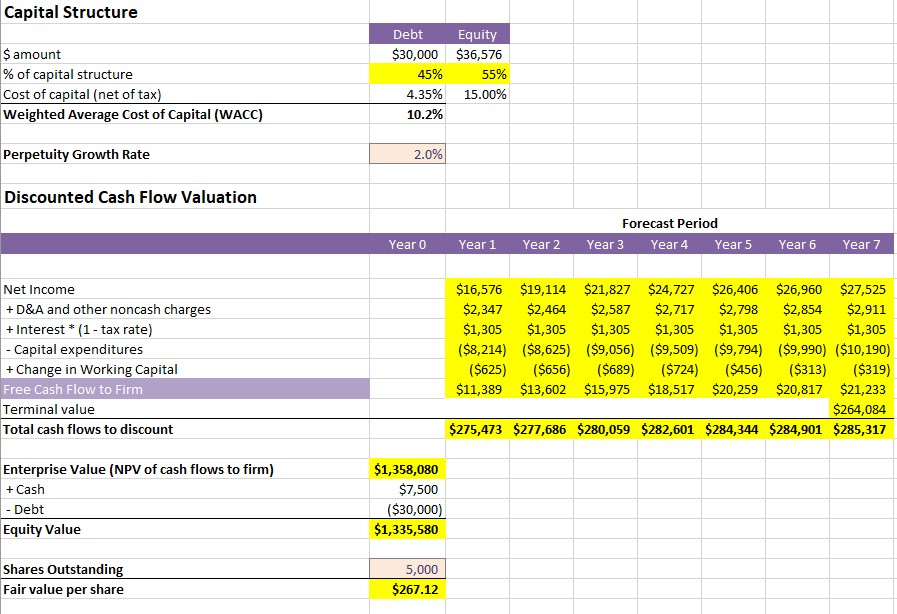

23. If your goal is to reach $40 for the fair value per share, what cost of equity should be? Something with a percentage? Capital

23. If your goal is to reach $40 for the fair value per share, what cost of equity should be? Something with a percentage?

Capital Structure DebtEquity 30,000 $36,576 $ amount % of capital structure Cost of capital (net of tax Weighted Average Costof Capital (WACC) 45% 4.35% 10.2% 55% 15.00% Perpetuity Growth Rate 2.0% Discounted Cash Flow Valuation Forecast Perio Year 0 Year 1 Year 2Year 3 Year 4Year 5 Year 6Year 7 $16,576 $19,114 $21,827 $24,727 $26,406 $26,960 $27,525 $2,347 $2,464 $2,587 $2,717 $2,798 $2,854 $2,911 $1,305 $1,305 $1,305 $1,305 $1,305 $1,305 $1,305 ($8,214) ($8,625) ($9,056) ($9,509) ($9,794) ($9,990) ($10,190) ($625) ($656) ($689) ($724) ($456) ($313) ($319) $11,389 $13,602 $15,975 $18,517 $20,259 $20,817 $21,233 $264,084 $275,473 $277,686 $280,059 $282,601 $284,344 $284,901 $285,317 Net Income D&A and other noncash charges +Interest *(1 tax rate) Capital expenditures + Change in Working Capital Free Cash Flow to Firm Terminal value Total cash flows to discount Enterprise Value (NPV of cash flows to firm) $1,358,080 $7,500 ($30,000) $1,335,580 +Cash - Debt Equity Value Shares Outstanding Fair value per share 5,000 $267.12Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started