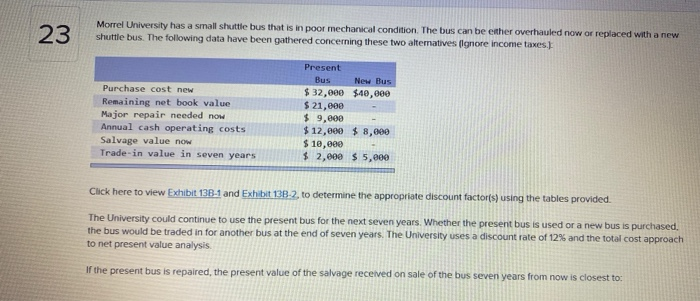

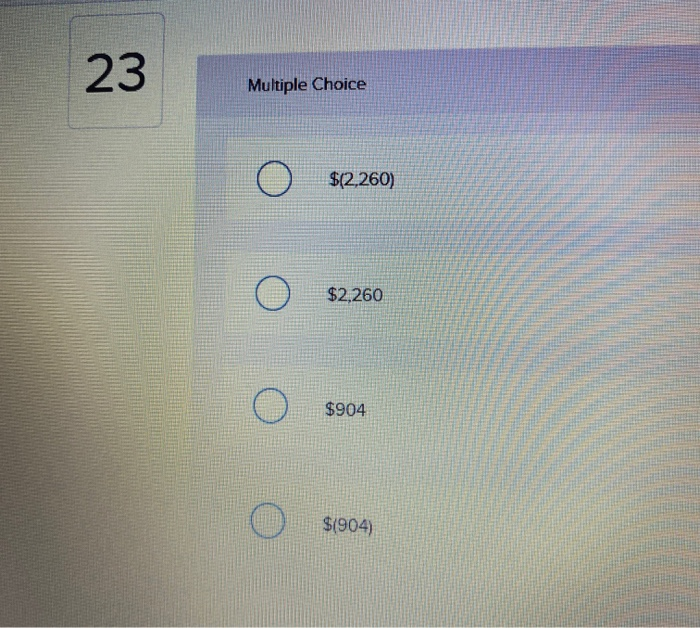

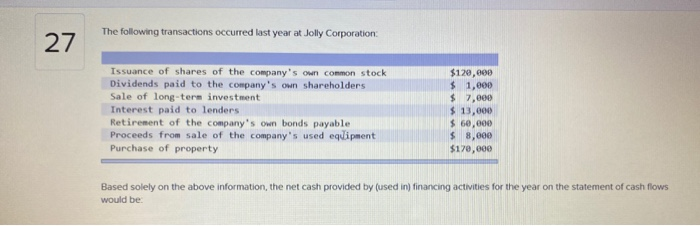

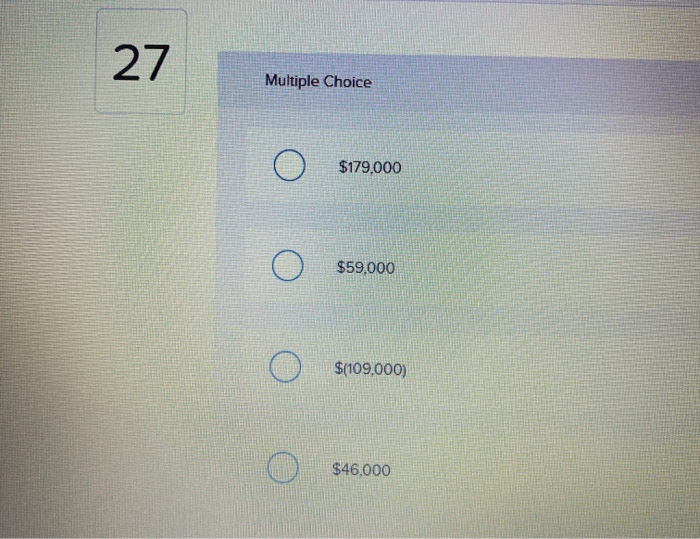

23 Morrel University has a small shuttle bus that is in poor mechanical condition. The bus can be either overhauled now or replaced with a new shuttle bus. The following data have been gathered concerning these two alternatives (Ignore income taxes. Purchase cost new Remaining net book value Major repair needed now Annual cash operating costs Salvage value now Trade-in value in seven years Present Bus New Bus $32,000 $40,000 $ 21,000 $ 9,000 $ 12,000 $ 8,000 $ 10,000 $ 2,000 $ 5,000 Click here to view Exhibit 138-1 and Exhibit 138-2, to determine the appropriate discount factor(s) using the tables provided. The University could continue to use the present bus for the next seven years. Whether the present bus is used or a new bus is purchased. the bus would be traded in for another bus at the end of seven years. The University uses a discount rate of 12% and the total cost approach to net present value analysis. If the present bus is repaired, the present value of the salvage received on sale of the bus seven years from now is closest to: 23 Multiple Choice $(2,260) $2,260 $904 $(904) The following transactions occurred last year at Jolly Corporation: 27 Issuance of shares of the company's own common stock Dividends paid to the company's own shareholders Sale of long-term investment Interest paid to lenders Retirement of the company's own bonds payable Proceeds from sale of the company's used equipment Purchase of property $120,000 $ 1.000 $ 7,000 $ 13,000 $ 60,000 $ 8,000 $170,000 Based solely on the above information, the net cash provided by (used in) financing activities for the year on the statement of cash flows would be 27 Multiple Choice $179,000 $59.000 $(109,000) $46.000 28 Kaze Corporation's cash and cash equivalents consist of cash and marketable securities. Last year the company's cash account increased by $25,000 and its marketable securities account decreased by $15,000. Net cash provided by (used in) operating activities was $38,000. Net cash provided by (used in) investing activities was $9,000. Based on this information, the net cash provided by (used in) financing activities on the statement of cash flows was 28 Multiple Choice $(37,000). $37,000. $(47,000). $47.000