Answered step by step

Verified Expert Solution

Question

1 Approved Answer

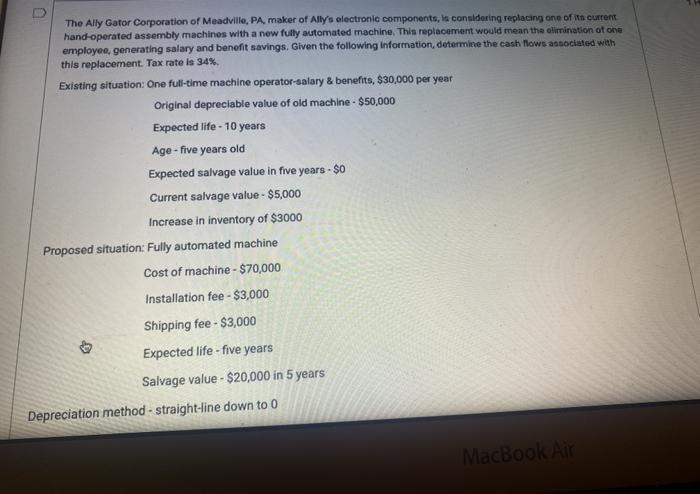

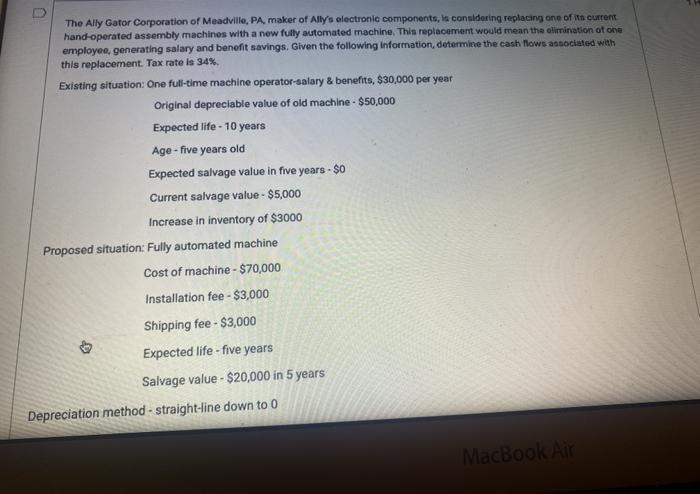

23 Please show work The Ally Gator Corporation of Meadville, PA, maker of Ally's electronic components, is considering replacing one of its current hand operated

23 Please show work

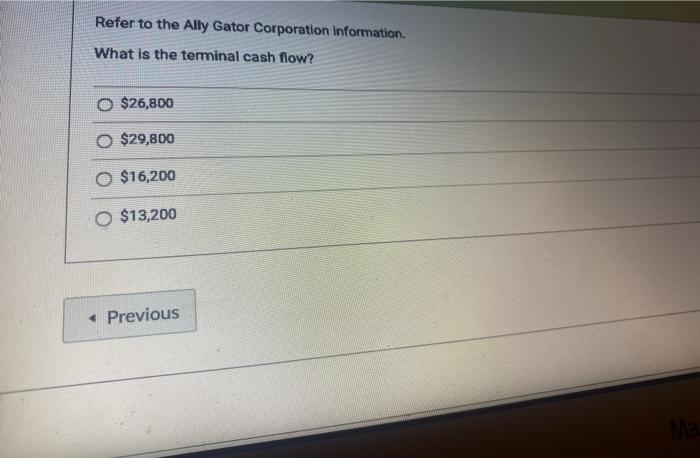

The Ally Gator Corporation of Meadville, PA, maker of Ally's electronic components, is considering replacing one of its current hand operated assembly machines with a new fully automated machine. This replacement would mean the elimination of one employee, generating salary and benefit savings. Given the following information, determine the cash flows associated with this replacement. Tax rate is 34% Existing situation: One full-time machine operator-salary & benefits, $30,000 per year Original depreciable value of old machine - $50,000 Expected life - 10 years Age - five years old Expected salvage value in five years - $0 Current salvage value - $5,000 Increase in inventory of $3000 Proposed situation: Fully automated machine Cost of machine - $70,000 Installation fee - $3,000 Shipping fee - $3,000 Expected life-five years Salvage value - $20,000 in 5 years be Depreciation method - straight-line down to o MacBook Air Refer to the Ally Gator Corporation Information. What is the terminal cash flow? O $26,800 $29,800 O $16,200 O $13,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started