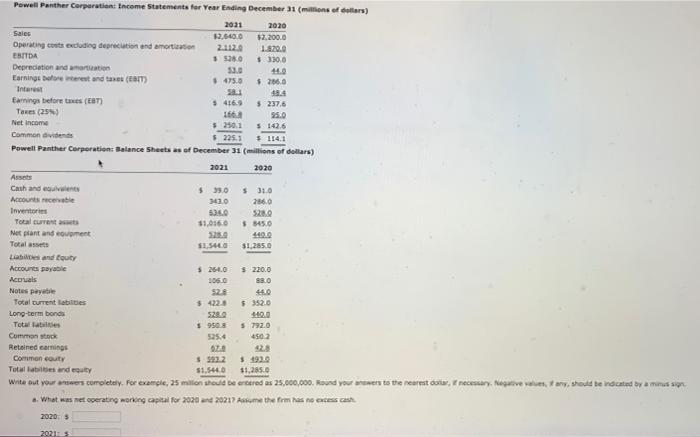

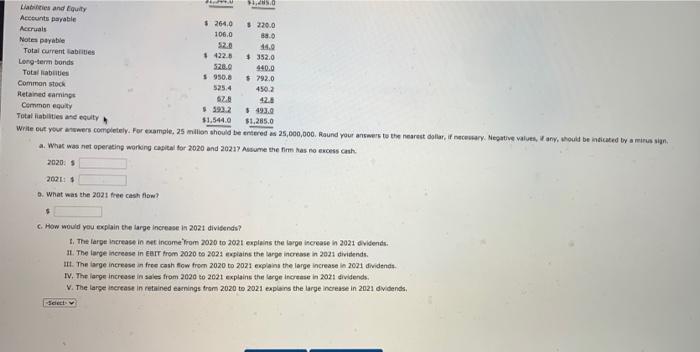

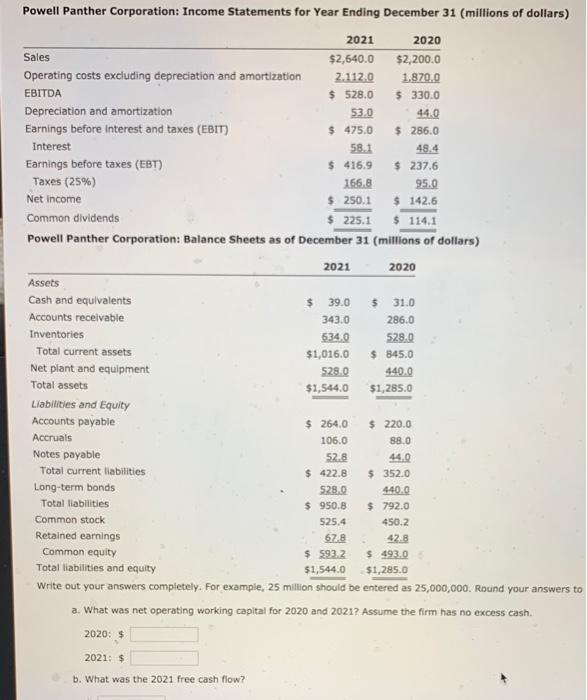

23 Powell Panther Corporation Income Statements for Year Ending December 31 (milions of dollars) 2031 2020 Sales 12.640.0 42.200.0 Operating costs excluding deprecation and more 2012 8200 EBITDA 55380 $330.0 Depreciation and more Earnings before west and taxes (ET) $475.0 $286.0 Interest 19.4 Earnings before taxes (ET) 54169 $ 237.6 Taxes (25) 186 35.0 Net Income 52501 $1426 Common dividends 225.1 $ 114.1 Powell Panther Corporation Balance Sheets as of December 31 (millions of dollars) 2021 2020 Assets Cath and events $ 10 $31.0 Accounts recevable 14.0 286,0 Inventaris 6360 5280 Total current 51.0560 $345.0 Net plant and comment 23.0 4400 Totale 51.285.0 Les and Equity Accounts payable $ 254.0 $ 220.0 Acorus 1060 880 Notes payable $20 440 Total current les 5 23 $352.0 Long-term bonds 10. Totales $9508 S 792.0 Commons 525.4 4502 Retained earnings ZA 423 Common couty $991.2 $ 1930 Total labies and outy $1.255.0 write out your neers completely. For example, 25 million should be entered as 25,000,000. Round your arms to the nearest cor necessary. Negative way should be indicated by a mission a. What was met operating world capital for 2020 and 20217 me the firm has no excessos 20205 20215 5.0 Labies and Equity Accounts payable $ 264.0 $ 220.0 Accruals 106.0 880 Notes payable $2.0 14.0 Total current abrities #4228 $352.0 Long-term bonds 520.0 440.0 Total abilities $ 950.8 $ 792.0 Common stock 525.4 4502 Retained caring 28 Cormon equity $493, Total liabilities and equity $1.544.0 51.285.0 write out your wwers completely. For example, 25 million should be entered 25,000,000. Round your answers to the nearest collar, if necessary. Negative values, Vany, should be indicated by mini a. What was net operating working capital for 2020 and 20217 Assume the firm has no excess cash 2020.5 423 2021: $ D. What was the 2021 free cash flow? 5 C. How would you explain the large increase in 2021 dividends? 1. The tarpe increase in net income from 2020 to 2021 explains the large increase in 2021 vidend. 11. The large increase in torr from 2020 to 2021 explains the large increase in 2021 dividende II. The large increase in free cash flow from 2020 to 2021 explains the large increase in 2021 dividende IV. The large increase in sales from 2020 to 2021 explains the large increase in 2021 dividends. V. The large increase in retained earnings from 2020 to 2021 explains the large increase in 2021 dividends. Select Powell Panther Corporation: Income Statements for Year Ending December 31 (millions of dollars) 2021 2020 Sales $2,640.0 $2,200.0 Operating costs excluding depreciation and amortization 2.112.0 1.870.0 EBITDA $ 528.0 $ 330.0 Depreciation and amortization 53.0 44.0 Earnings before interest and taxes (EBIT) $ 475.0 $286.0 Interest 58.1 48.4 Earnings before taxes (EBT) $ 416.9 $ 237.6 Taxes (25%) 166.8 95.0 Net income $ 250.1 $ 142.6 Common dividends $ 225.1 $ 114.1 Powell Panther Corporation: Balance Sheets as of December 31 (millions of dollars) 2021 2020 Assets Cash and equivalents $ 39.0 $ 31.0 Accounts receivable 343.0 286.0 Inventories 634.0 528,0 Total current assets $1,016.0 $ 845.0 Net plant and equipment 528.0 440.0 Total assets $1,544.0 $1,285.0 Liabilities and Equity Accounts payable $ 264.0 $ 220.0 Accruals 106.0 88.0 Notes payable 52.8 Total current liabilities $ 422.8 $ 352.0 Long-term bonds $28.0 440.0 Total liabilities $ 950.8 $ 792.0 Common stock 525.4 450.2 Retained earnings 678 42.8 Common equity $ 593.2 $493.0 Total liabilities and equity $1,544.0 $1,285.0 Write out your answers completely. For example, 25 million should be entered as 25,000,000. Round your answers to a. What was net operating working capital for 2020 and 2021? Assume the firm has no excess cash. 2020: $ 2021: $ b. What was the 2021 free cash flow