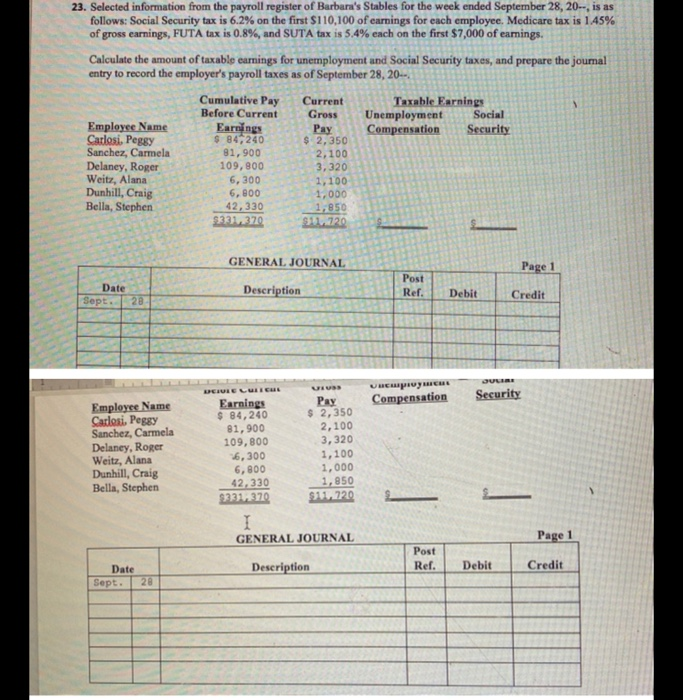

23. Selected information from the payroll register of Barbara's Stables for the week ended September 28, 20--, is as follows: Social Security tax is 6.2% on the first $110,100 of earnings for each employee. Medicare tax is 1.45% of gross earnings, FUTA tax is 0.8%, and SUTA tax is 5,4% each on the first $7,000 of earnings. Calculate the amount of taxable earnings for unemployment and Social Security taxes, and prepare the joumal entry to record the employer's payroll taxes as of September 28, 20... Cumulative Pay Current Taxable Earnings Before Current Gross Unemployment Social Employee Name Earrings Pay Compensation Security Carlosi. Peggy $ 84,240 $ 2,350 Sanchez, Carmela 81,900 2,100 Delaney, Roger 109,800 3,320 Weitz, Alana 6,300 1,100 Dunhill, Craig 6,800 1.000 Bella, Stephen 42,330 1,850 533370 $11.7220 GENERAL JOURNAL Page 1 Date Sept. 28 Description Post Ref. Debit Credit GUVERN ULUSS Compensation Security Employee Name Carlosi. Peggy Sanchez, Carmela Delaney, Roger Weitz, Alana Dunhill, Craig Bella, Stephen REURE LURIEL Earnings $ 84,240 81,900 109,800 16,300 6,800 42.330 $221.370 Pay $ 2,350 2,100 3,320 1,100 1.000 1,850 $11.720 I GENERAL JOURNAL Page 1 Post Ref. Description Debit Credit Date Sept. 28 23. Selected information from the payroll register of Barbara's Stables for the week ended September 28, 20--, is as follows: Social Security tax is 6.2% on the first $110,100 of earnings for each employee. Medicare tax is 1.45% of gross earnings, FUTA tax is 0.8%, and SUTA tax is 5,4% each on the first $7,000 of earnings. Calculate the amount of taxable earnings for unemployment and Social Security taxes, and prepare the joumal entry to record the employer's payroll taxes as of September 28, 20... Cumulative Pay Current Taxable Earnings Before Current Gross Unemployment Social Employee Name Earrings Pay Compensation Security Carlosi. Peggy $ 84,240 $ 2,350 Sanchez, Carmela 81,900 2,100 Delaney, Roger 109,800 3,320 Weitz, Alana 6,300 1,100 Dunhill, Craig 6,800 1.000 Bella, Stephen 42,330 1,850 533370 $11.7220 GENERAL JOURNAL Page 1 Date Sept. 28 Description Post Ref. Debit Credit GUVERN ULUSS Compensation Security Employee Name Carlosi. Peggy Sanchez, Carmela Delaney, Roger Weitz, Alana Dunhill, Craig Bella, Stephen REURE LURIEL Earnings $ 84,240 81,900 109,800 16,300 6,800 42.330 $221.370 Pay $ 2,350 2,100 3,320 1,100 1.000 1,850 $11.720 I GENERAL JOURNAL Page 1 Post Ref. Description Debit Credit Date Sept. 28