Answered step by step

Verified Expert Solution

Question

1 Approved Answer

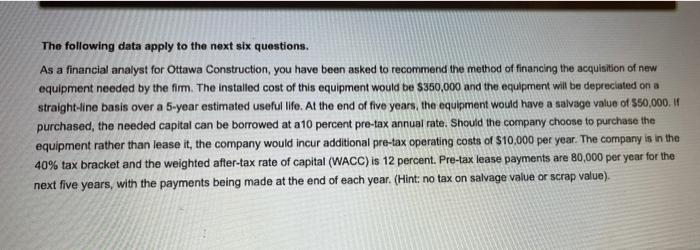

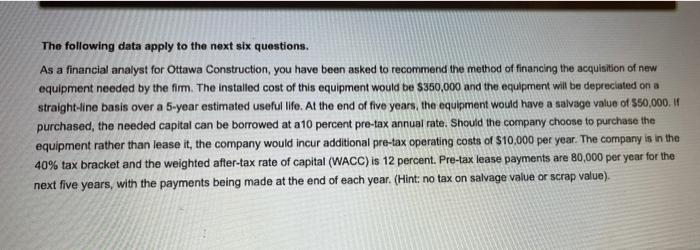

23 The following data apply to the next six questions. As a financial analyst for Ottawa Construction, you have been asked to recommend the method

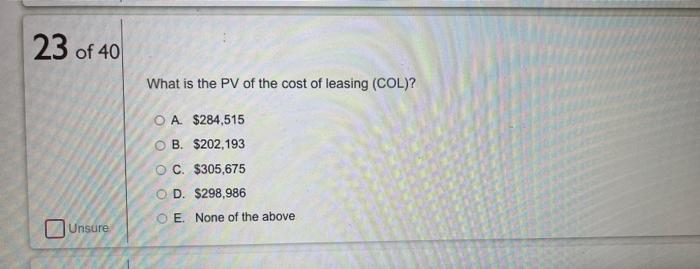

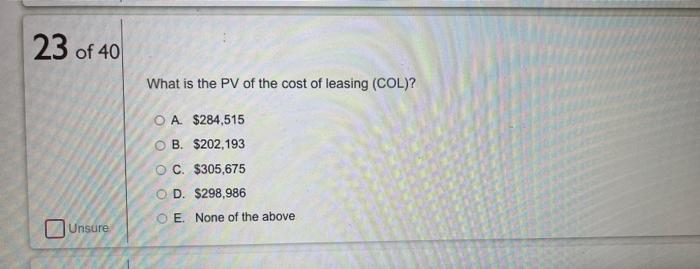

23

The following data apply to the next six questions. As a financial analyst for Ottawa Construction, you have been asked to recommend the method of financing the acquisition of new equipment needed by the firm. The installed cost of this equipment would be $360,000 and the equipment will be depreciated on a straight-line basis over a 5-year estimated useful life. At the end of five years, the equipment would have a salvage value of $50,000. If purchased, the needed capital can be borrowed at a 10 percent pre-tax annual rate. Should the company choose to purchase the equipment rather than lease it, the company would incur additional pre-tax operating costs of $10,000 per year. The company is in the 40% tax bracket and the weighted after-tax rate of capital (WACC) is 12 percent. Pre-tax lease payments are 80,000 per year for the next five years, with the payments being made at the end of each year. (Hint: no tax on salvage value or scrap value). 23 of 40 What is the PV of the cost of leasing (COL)? O A $284,515 OB. $202,193 OC. $305,675 OD. $298.986 E. None of the above Unsure

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started