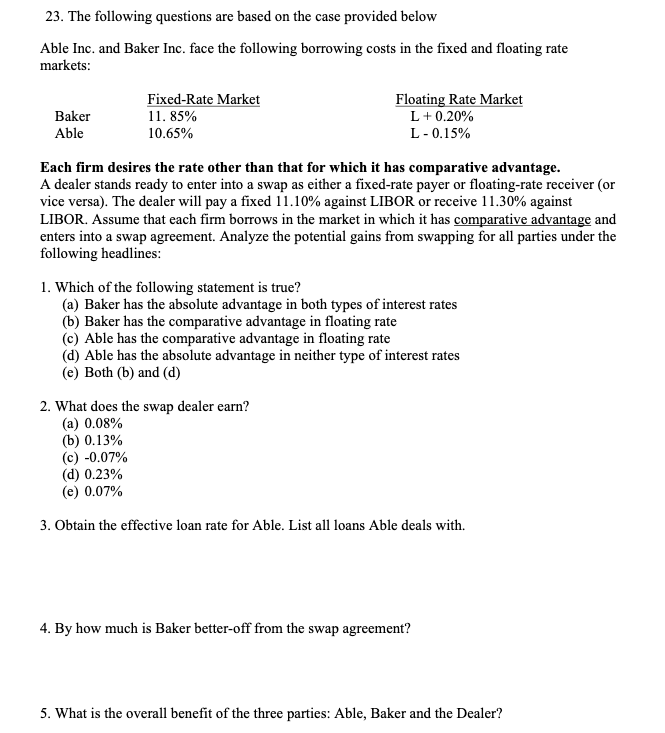

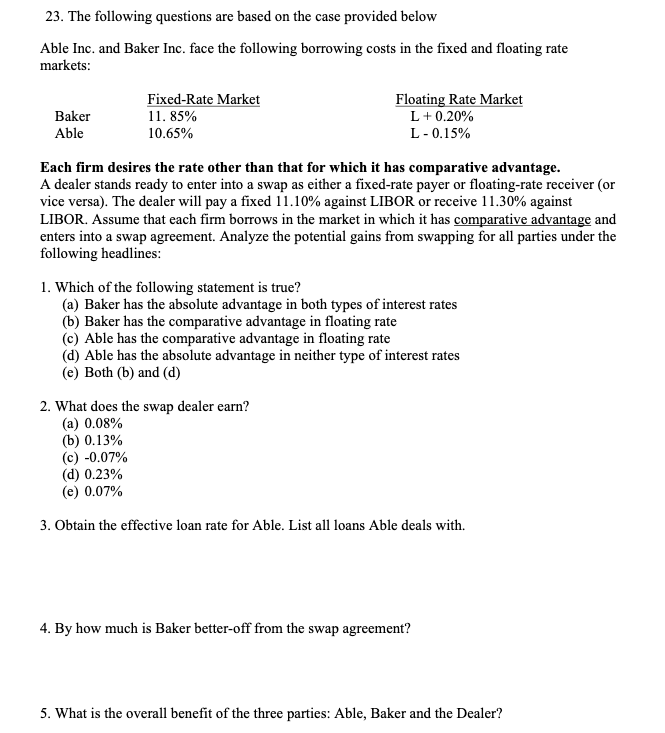

23. The following questions are based on the case provided below Able Inc. and Baker Inc. face the following borrowing costs in the fixed and floating rate markets: Baker Able Fixed-Rate Market 11. 85% 10.65% Floating Rate Market L+ 0.20% L -0.15% Each firm desires the rate other than that for which it has comparative advantage. A dealer stands ready to enter into a swap as either a fixed-rate payer or floating-rate receiver (or vice versa). The dealer will pay a fixed 11.10% against LIBOR or receive 11.30% against LIBOR. Assume that each firm borrows in the market in which it has comparative advantage and enters into a swap agreement. Analyze the potential gains from swapping for all parties under the following headlines: 1. Which of the following statement is true? (a) Baker has the absolute advantage in both types of interest rates (b) Baker has the comparative advantage in floating rate (c) Able has the comparative advantage in floating rate (d) Able has the absolute advantage in neither type of interest rates (e) Both (b) and (d) 2. What does the swap dealer earn? (a) 0.08% (b) 0.13% (c) -0.07% (d) 0.23% (e) 0.07% 3. Obtain the effective loan rate for Able. List all loans Able deals with 4. By how much is Baker better-off from the swap agreement? 5. What is the overall benefit of the three parties: Able, Baker and the Dealer? 23. The following questions are based on the case provided below Able Inc. and Baker Inc. face the following borrowing costs in the fixed and floating rate markets: Baker Able Fixed-Rate Market 11. 85% 10.65% Floating Rate Market L+ 0.20% L -0.15% Each firm desires the rate other than that for which it has comparative advantage. A dealer stands ready to enter into a swap as either a fixed-rate payer or floating-rate receiver (or vice versa). The dealer will pay a fixed 11.10% against LIBOR or receive 11.30% against LIBOR. Assume that each firm borrows in the market in which it has comparative advantage and enters into a swap agreement. Analyze the potential gains from swapping for all parties under the following headlines: 1. Which of the following statement is true? (a) Baker has the absolute advantage in both types of interest rates (b) Baker has the comparative advantage in floating rate (c) Able has the comparative advantage in floating rate (d) Able has the absolute advantage in neither type of interest rates (e) Both (b) and (d) 2. What does the swap dealer earn? (a) 0.08% (b) 0.13% (c) -0.07% (d) 0.23% (e) 0.07% 3. Obtain the effective loan rate for Able. List all loans Able deals with 4. By how much is Baker better-off from the swap agreement? 5. What is the overall benefit of the three parties: Able, Baker and the Dealer