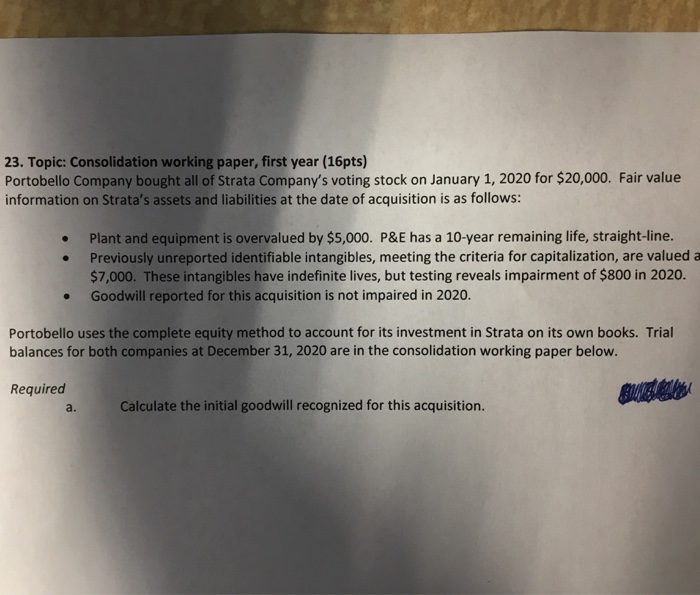

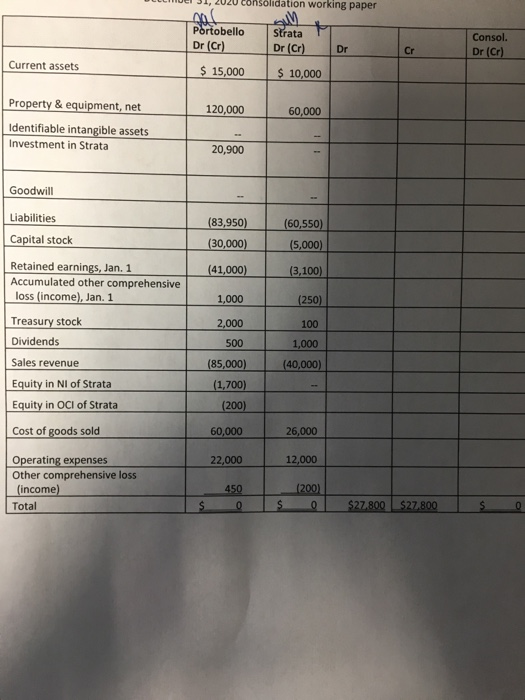

23. Topic: Consolidation working paper, first year (16pts) Portobello Company bought all of Strata Company's voting stock on January 1, 2020 for $20,000. Fair value information on Strata's assets and liabilities at the date of acquisition is as follows: Plant and equipment is overvalued by $5,000. P&E has a 10-year remaining life, straight-line. Previously unreported identifiable intangibles, meeting the criteria for capitalization, are valued a $7,000. These intangibles have indefinite lives, but testing reveals impairment of $800 in 2020. Goodwill reported for this acquisition is not impaired in 2020. Portobello uses the complete equity method to account for its investment in Strata on its own books. Trial balances for both companies at December 31, 2020 are in the consolidation working paper below. Required a. Calculate the initial goodwill recognized for this acquisition. D e l 31, 2020 consolidation working paper M M Portobello Strata 1 Dr (Cr) Dr (Cr) Dr $ 15,000 $ 10,000 Consol. Dr (Cr) Current assets Property & equipment, net 120,000 60,000 Identifiable intangible assets Investment in Strata 20,900 Goodwill Liabilities (83,950) Capital stock (30,000) (60,550) (5,000) (3,100) (41,000) Retained earnings, Jan. 1 Accumulated other comprehensive loss (income), Jan. 1 1,000 Treasury stock 2,000 500 (250) 100 1,000 (40,000) Dividends Sales revenue (85,000) Equity in Nl of Strata (1,700) (200) Equity in OCI of Strata Cost of goods sold 60,000 26,000 22,000 12,000 Operating expenses Other comprehensive loss (income) Total 450 0 1200) 0 $ $ $27,800 $27,800 $ 0 23. Topic: Consolidation working paper, first year (16pts) Portobello Company bought all of Strata Company's voting stock on January 1, 2020 for $20,000. Fair value information on Strata's assets and liabilities at the date of acquisition is as follows: Plant and equipment is overvalued by $5,000. P&E has a 10-year remaining life, straight-line. Previously unreported identifiable intangibles, meeting the criteria for capitalization, are valued a $7,000. These intangibles have indefinite lives, but testing reveals impairment of $800 in 2020. Goodwill reported for this acquisition is not impaired in 2020. Portobello uses the complete equity method to account for its investment in Strata on its own books. Trial balances for both companies at December 31, 2020 are in the consolidation working paper below. Required a. Calculate the initial goodwill recognized for this acquisition. D e l 31, 2020 consolidation working paper M M Portobello Strata 1 Dr (Cr) Dr (Cr) Dr $ 15,000 $ 10,000 Consol. Dr (Cr) Current assets Property & equipment, net 120,000 60,000 Identifiable intangible assets Investment in Strata 20,900 Goodwill Liabilities (83,950) Capital stock (30,000) (60,550) (5,000) (3,100) (41,000) Retained earnings, Jan. 1 Accumulated other comprehensive loss (income), Jan. 1 1,000 Treasury stock 2,000 500 (250) 100 1,000 (40,000) Dividends Sales revenue (85,000) Equity in Nl of Strata (1,700) (200) Equity in OCI of Strata Cost of goods sold 60,000 26,000 22,000 12,000 Operating expenses Other comprehensive loss (income) Total 450 0 1200) 0 $ $ $27,800 $27,800 $ 0