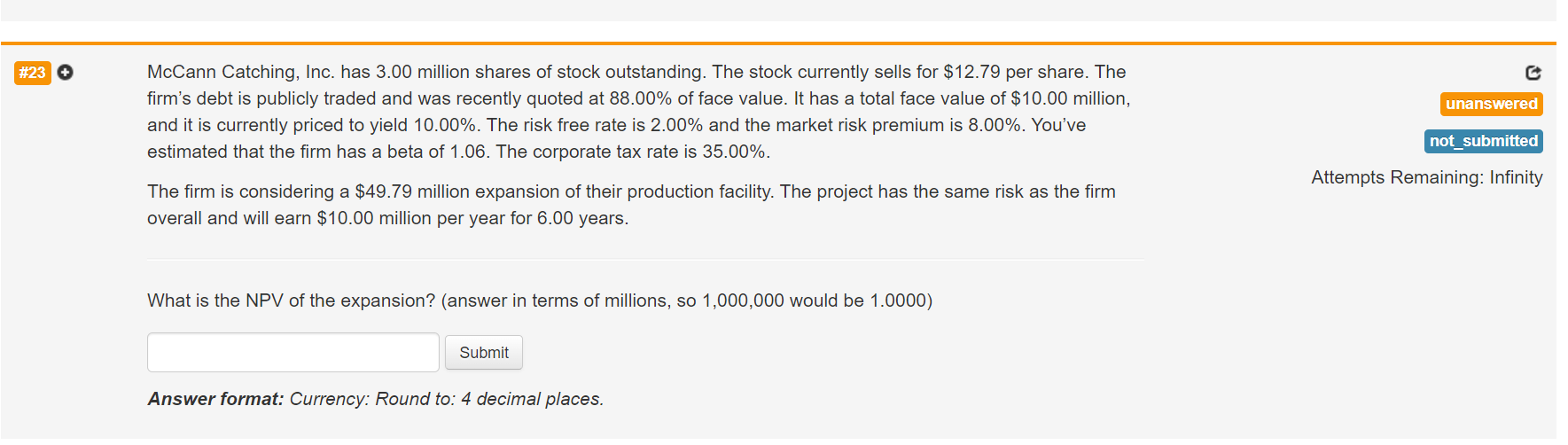

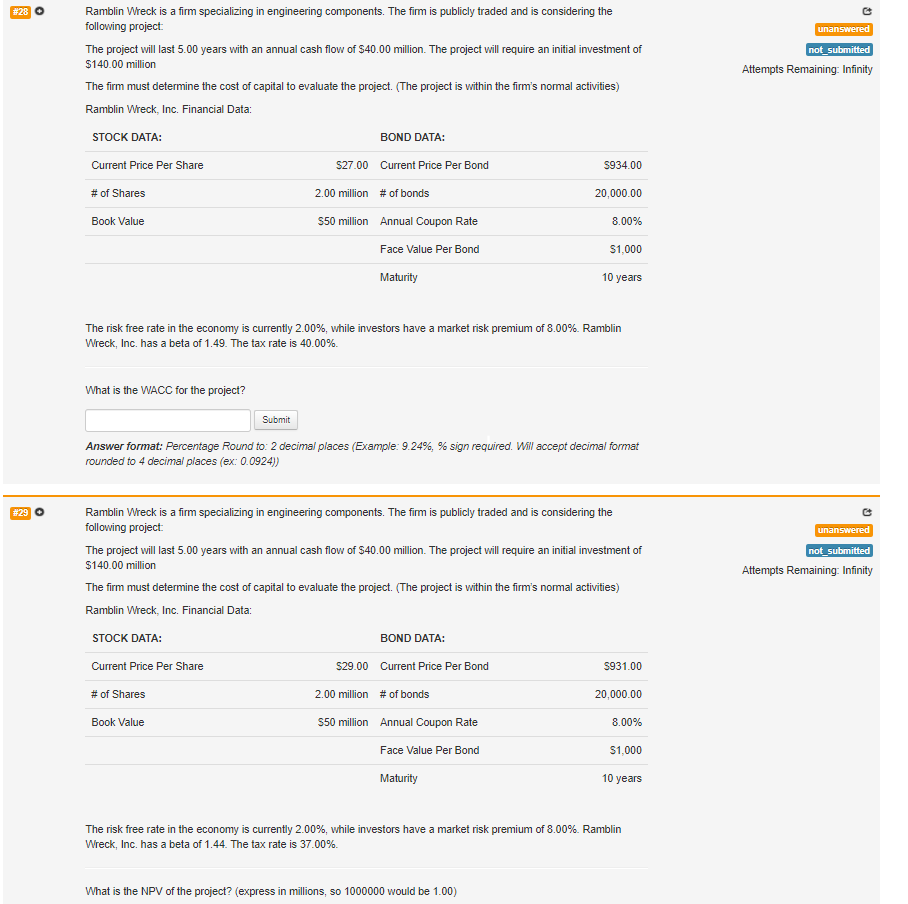

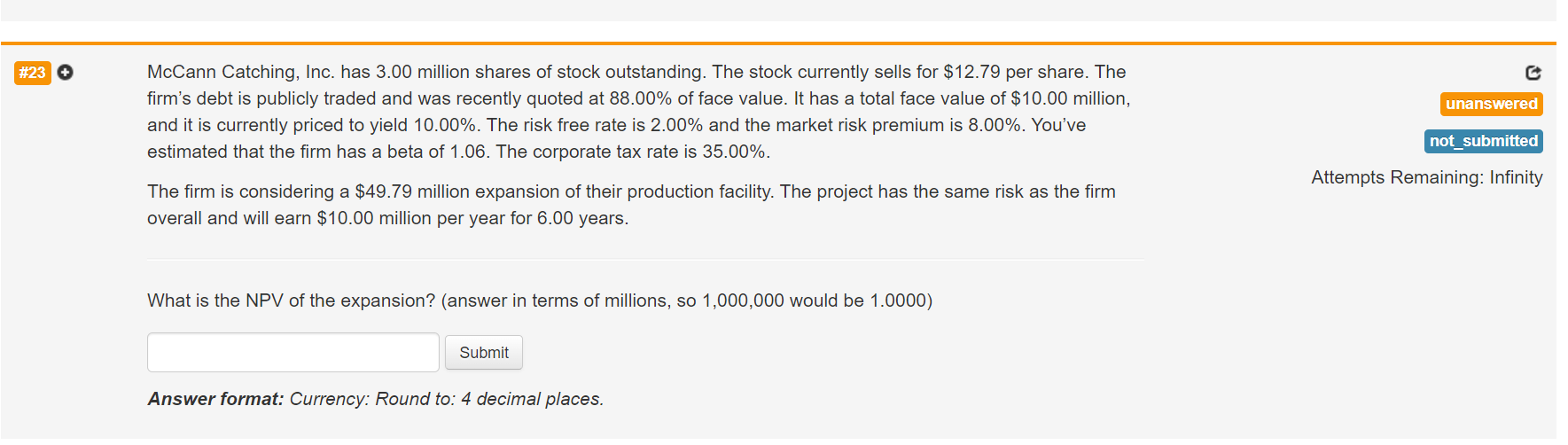

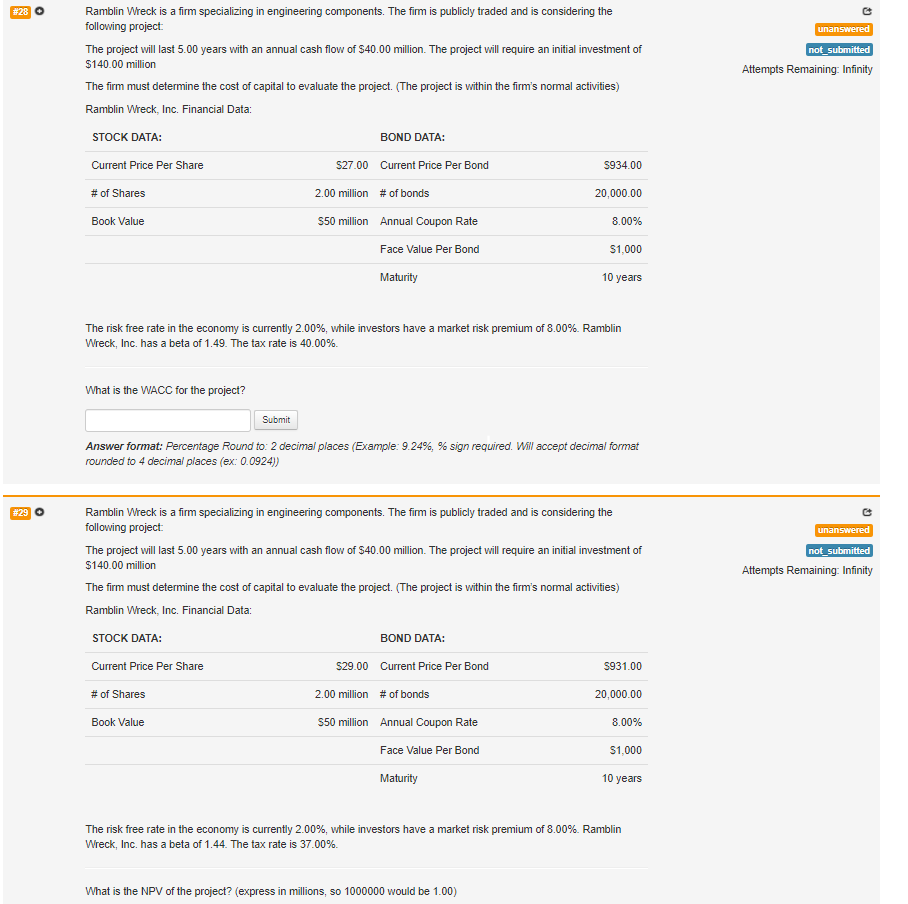

#23 unanswered McCann Catching, Inc. has 3.00 million shares of stock outstanding. The stock currently sells for $12.79 per share. The firm's debt is publicly traded and was recently quoted at 88.00% of face value. It has a total face value of $10.00 million, and it is currently priced to yield 10.00%. The risk free rate is 2.00% and the market risk premium is 8.00%. You've estimated that the firm has a beta of 1.06. The corporate tax rate is 35.00%. The firm is considering a $49.79 million expansion of their production facility. The project has the same risk as the firm overall and will earn $10.00 million per year for 6.00 years. not submitted Attempts Remaining: Infinity What is the NPV of the expansion? (answer in terms of millions, so 1,000,000 would be 1.0000) Submit Answer format: Currency: Round to: 4 decimal places. #28 unanswered not_submitted Attempts Remaining: Infinity Ramblin Wreck is a firm specializing in engineering components. The firm is publicly traded and is considering the following project The project will last 5.00 years with an annual cash flow of $40.00 million. The project will require an initial investment of $140.00 million The firm must determine the cost of capital to evaluate the project. The project is within the firm's normal activities) Ramblin Wreck, Inc. Financial Data: STOCK DATA: BOND DATA: Current Price Per Share $27.00 Current Price Per Bond 5934.00 # of Shares 2.00 million # of bonds 20,000.00 Book Value $50 million Annual Coupon Rate 8.00% Face Value Per Bond $1,000 Maturity 10 years The risk free rate in the economy is currently 2.00%, while investors have a market risk premium of 8.00%. Ramblin Wreck, Inc. has a beta of 1.49. The tax rate is 40.00%. What is the WACC for the project? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) #29 unanswered not_submitted Attempts Remaining: Infinity Ramblin Wreck is a firm specializing in engineering components. The firm is publicly traded and is considering the following project: The project will last 5.00 years with an annual cash flow of $40.00 million. The project will require an initial investment of $140.00 million The firm must determine the cost of capital to evaluate the project. (The project is within the firm's normal activities) Ramblin Wreck, Inc. Financial Data: STOCK DATA: BOND DATA: Current Price Per Share $29.00 Current Price Per Bond 5931.00 # of Shares 2.00 million # of bonds 20,000.00 Book Value $50 million Annual Coupon Rate 8.00% Face Value Per Bond $1,000 Maturity 10 years The risk free rate in the economy is currently 2.00%, while investors have a market risk premium of 8.00%. Ramblin Wreck, Inc. has a beta of 1.44. The tax rate is 37.00%. What is the NPV of the project? (express in millions, so 1000000 would be 1.00)