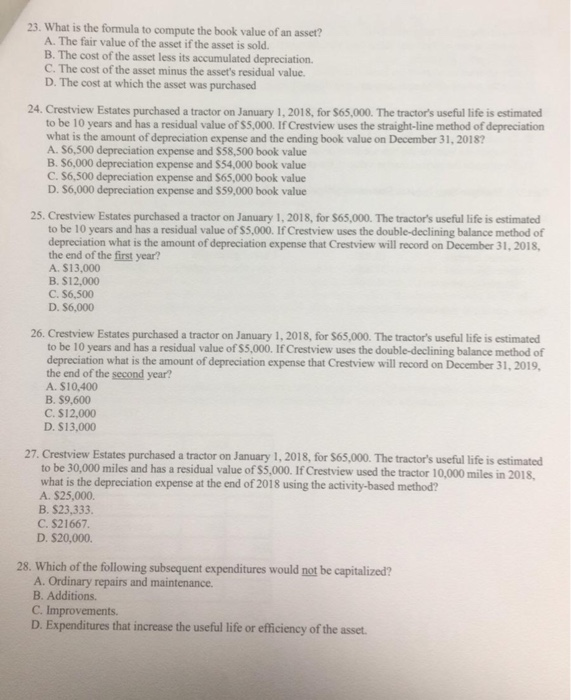

23. What is the formula to compute the book value of an asset? A. The fair value of the asset if the asset is sold. B. The cost of the asset less its accumulated depreciation C. The cost of the asset minus the asset's residual value. D. The cost at which the asset was purchased 24. Crestview Estates purchased a tractor on January 1, 2018, for $65,000. The tractor's useful life is estimated to be 10 years and has a residual value of $5,000. If Crestview uses the straight-line method of depreciation what is the amount of depreciation expense and the ending book value on December 31, 2018? A. S6,500 depreciation expense and $58,500 book value B. $6,000 depreciation expense and S54,000 book value C. S6,500 depreciation expense and $65.000 book value D. $6,000 depreciation expense and $59.000 book value 25. Crestview Estates purchased a tractor on January 1, 2018, for $65.000. The tractor's useful life is estimated to be 10 years and has a residual value of $5,000. If Crestview uses the double-declining balance method of depreciation what is the amount of depreciation expense that Crestview will record on December 31, 2018, the end of the first year? A. S13,000 B. $12.000 C. $6,500 D. $6,000 26. Crestview Estates purchased a tractor on January 1, 2018, for $65,000. The tractor's useful life is estimated to be 10 years and has a residual value of $5,000. If Crestview uses the double-declining balance method of depreciation what is the amount of depreciation expense that Crestview will record on December 31, 2019 the end of the second year? A. $10,400 B. $9,600 C. S12,000 D. $13,000 27. Crestview Estates purchased a tractor on January 1, 2018, for $65,000. The tractor's useful life is estimated to be 30,000 miles and has a residual value of $5,000. If Crestview used the tractor 10,000 miles in 2018, what is the depreciation expense at the end of 2018 using the activity-based method? A. $25,000 B. $23,333 C. $21667 D. $20,000 28. Which of the following subsequent expenditures would not be capitalized? A. Ordinary repairs and maintenance. B. Additions. C. Improvements D. Expenditures that increase the useful life or efficiency of the asset