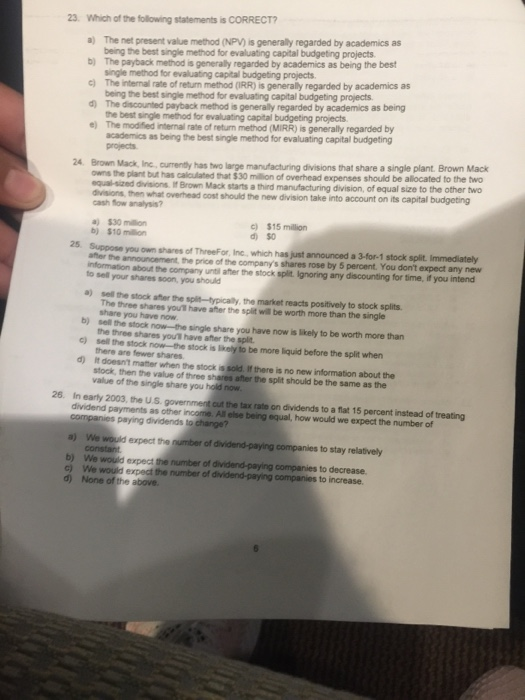

23. Which of the following statements is CORRECT? The net present value method (NPV) is generally regarded by academics as a) being the best single method for evaluating capital budgeting projects single method for evaluating capital budgeting projects being the best single method for evaluating capital budgeting projects the best single method for evaluating capital budgeting projects b) The payback method is generally regarded by academics as being the best c) The internal rate of return method (IRR) is generally regarded by academics as d) The discounted payback method is generally regarded by academics as being e) The modified internal rate of return method (MIRR) is generally regarded by academics as being the best single method for evalatingcapital budgeting projects 24 Brown Mack, Inc, curmently has two large manufacturing divisions that share a single plant. Brown Mack starts a third manufacturing division, of equal size to the other two owns the plant but has calculated that $30 million of overhead expenses should be allocated to the two equal-sized divisions. If Brown Mack cash fow analysis? )$30 million then what overhead cost should the new division take into account on its capital budgeting c)$15 million di so 25 Suppose you own shares of ThreeFor, Inc, which has just announced a 3-for-1 stock split. Immediately after the announcement, the price of the company's shares rose by 5 percent. You don't expect any new nformation about the company untl ather the stock spilit. Ignoring any discounting for time, if you intend to sell your shares soon, you should a) sell the stock after the spit-typically, the market reacts positively to stock splits The three shares youl have afher the split will be worth more than the single share you have now the three shares youl have after the split there are fewer shares b) sell the stock now-the single share you have now is likely to be worth more than c) sell the stock now the stock is likely to be more liquid before the split when d) it doesn't mater when the stock is sold. If there is no new information about the stock, then the value of three shares after the split should be the same as the value of the single share you hold now 26. In early 2003, the U.S. government cut the tax rate on dividends to a flat 15 percent instead of treating dividend payments as other income. All eise being equal, how would we expect the number of paying dividends to change? a) We would expect the number of dividend-paying companies to stay relatively c) We would expect the number of dividend-paying companies to increase. d) None of the above