Answered step by step

Verified Expert Solution

Question

1 Approved Answer

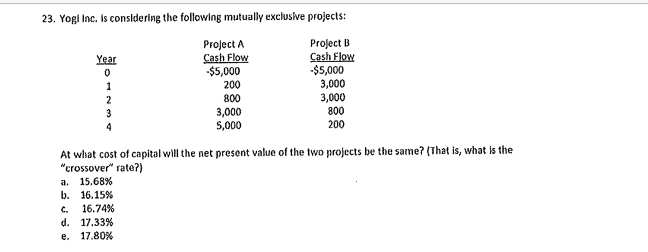

23. Yogil inc. is considering the following mutually exclusive projects: At what cost of capital will the net present value of the two projects be

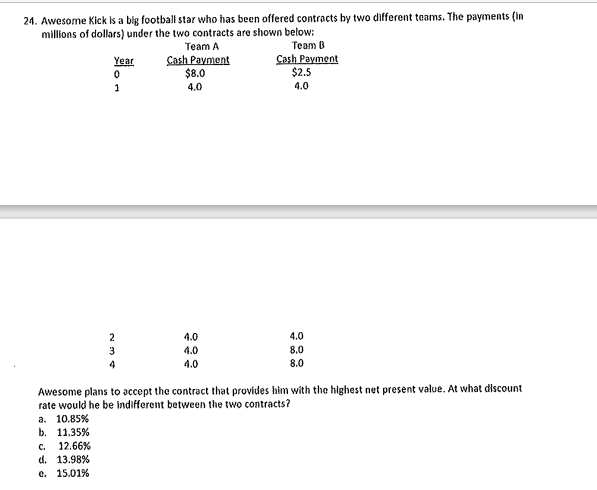

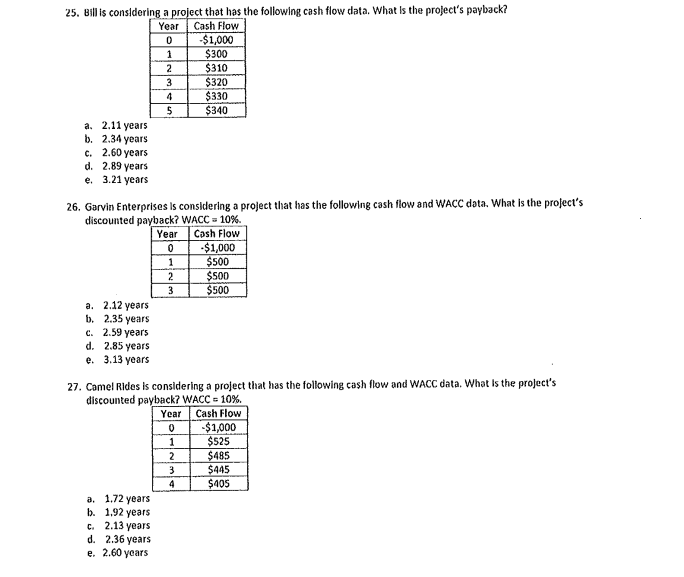

23. Yogil inc. is considering the following mutually exclusive projects: At what cost of capital will the net present value of the two projects be the same? (That is, what is the "crossover" rate?) a. 15.68% b. 16,15% c. 16.74% d. 17,33% e. 17.80% 4. Awesome Xick is a big football star who has been offered contracts by two different teams. The payments (in millions of dollars) under the two contracts are shown below: Awesome plans to accept the contract that provides him with the highest net present value. At what discount rate would he be indifferent between the two contracts? a. 10.85% b. 11.35% c. 12.66% d. 13.98% e. 15.01% 25. Bill is considering a project that has the following cash flow data. What is the project's payback? a. 2.11 years b. 2.34 years c. 2.60 years d. 2.89 years e. 3.21 years 26. Garvin Enterprises is considering a project that has the following cash flow and WACC dota. What is the project's discounted payback? WACC =10% a. 2.12 years b. 2.35 years c. 2.59 year's d. 2.85 years e. 3.13 years 27. Camel Rides is considering a project that has the following cash flow and WACC data. What Is the project's discounted pavback? WACC =10%. a. 1,72 years b. 1,92 years c. 2.13 years d. 2.36 years e. 2.60 years

23. Yogil inc. is considering the following mutually exclusive projects: At what cost of capital will the net present value of the two projects be the same? (That is, what is the "crossover" rate?) a. 15.68% b. 16,15% c. 16.74% d. 17,33% e. 17.80% 4. Awesome Xick is a big football star who has been offered contracts by two different teams. The payments (in millions of dollars) under the two contracts are shown below: Awesome plans to accept the contract that provides him with the highest net present value. At what discount rate would he be indifferent between the two contracts? a. 10.85% b. 11.35% c. 12.66% d. 13.98% e. 15.01% 25. Bill is considering a project that has the following cash flow data. What is the project's payback? a. 2.11 years b. 2.34 years c. 2.60 years d. 2.89 years e. 3.21 years 26. Garvin Enterprises is considering a project that has the following cash flow and WACC dota. What is the project's discounted payback? WACC =10% a. 2.12 years b. 2.35 years c. 2.59 year's d. 2.85 years e. 3.13 years 27. Camel Rides is considering a project that has the following cash flow and WACC data. What Is the project's discounted pavback? WACC =10%. a. 1,72 years b. 1,92 years c. 2.13 years d. 2.36 years e. 2.60 years Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started