Answered step by step

Verified Expert Solution

Question

1 Approved Answer

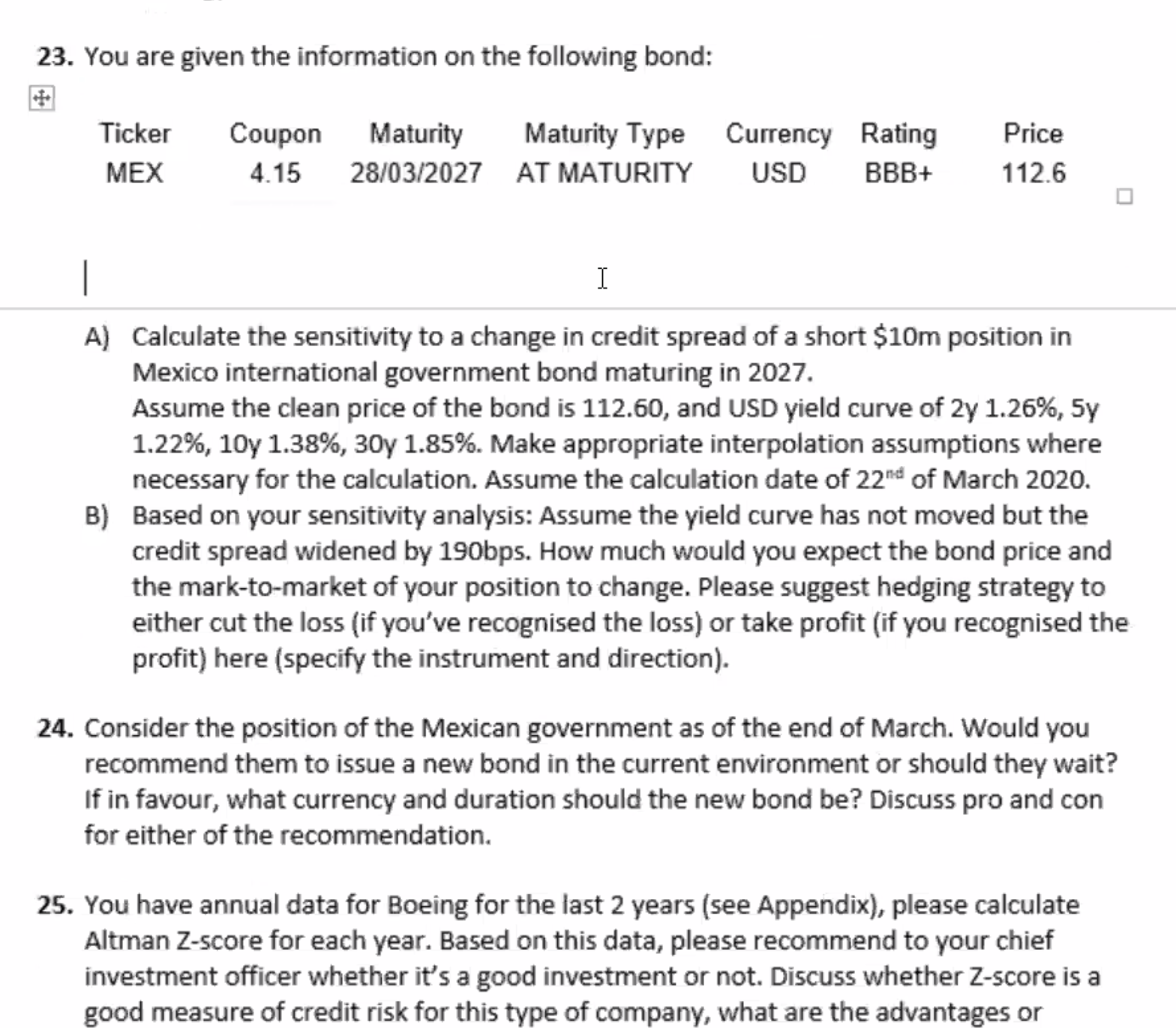

23. You are given the information on the following bond: Ticker MEX Coupon Maturity 4.15 28/03/2027 Maturity Type Currency Rating AT MATURITY Price USD

23. You are given the information on the following bond: Ticker MEX Coupon Maturity 4.15 28/03/2027 Maturity Type Currency Rating AT MATURITY Price USD BBB+ 112.6 I A) Calculate the sensitivity to a change in credit spread of a short $10m position in Mexico international government bond maturing in 2027. Assume the clean price of the bond is 112.60, and USD yield curve of 2y 1.26%, 5y 1.22%, 10y 1.38%, 30y 1.85%. Make appropriate interpolation assumptions where necessary for the calculation. Assume the calculation date of 22nd of March 2020. B) Based on your sensitivity analysis: Assume the yield curve has not moved but the credit spread widened by 190bps. How much would you expect the bond price and the mark-to-market of your position to change. Please suggest hedging strategy to either cut the loss (if you've recognised the loss) or take profit (if you recognised the profit) here (specify the instrument and direction). 24. Consider the position of the Mexican government as of the end of March. Would you recommend them to issue a new bond in the current environment or should they wait? If in favour, what currency and duration should the new bond be? Discuss pro and con for either of the recommendation. 25. You have annual data for Boeing for the last 2 years (see Appendix), please calculate Altman Z-score for each year. Based on this data, please recommend to your chief investment officer whether it's a good investment or not. Discuss whether Z-score is a good measure of credit risk for this type of company, what are the advantages or

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Question 23 A To calculate the sensitivity to a change in credit spread of a short 10 million position in the Mexico international government b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started