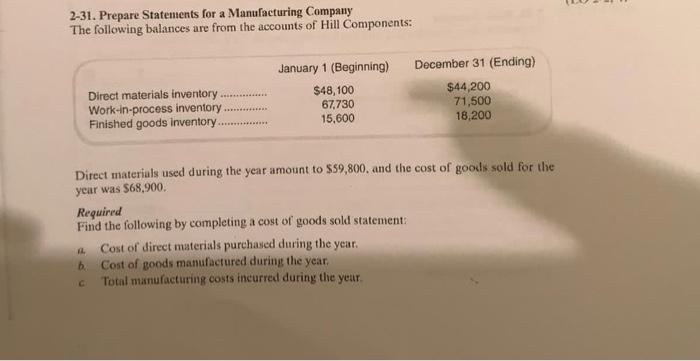

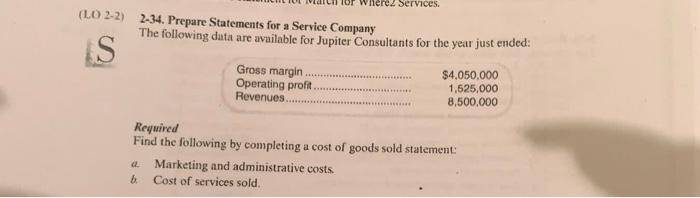

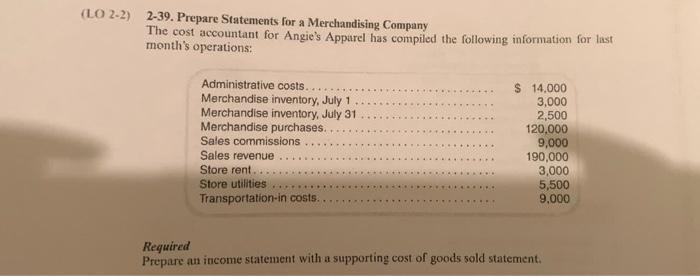

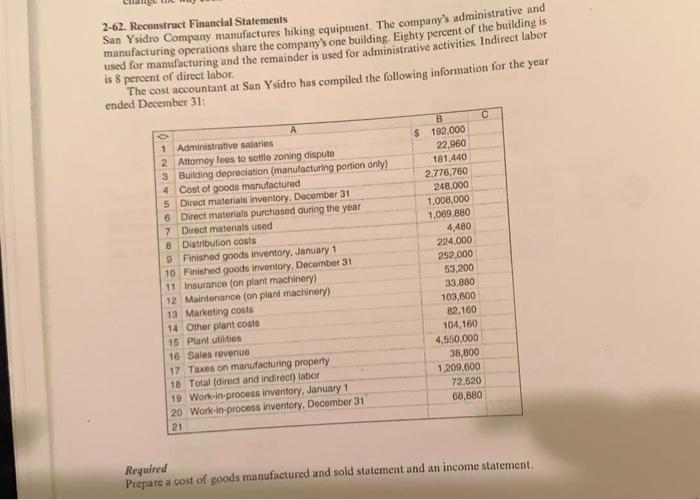

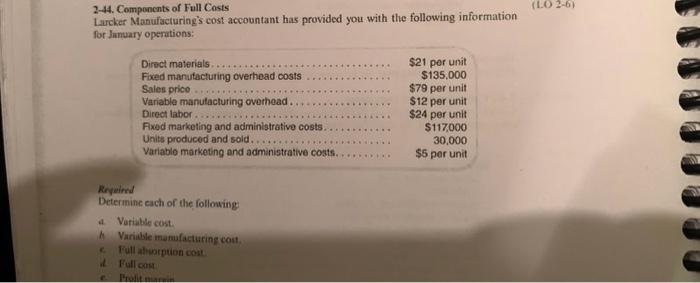

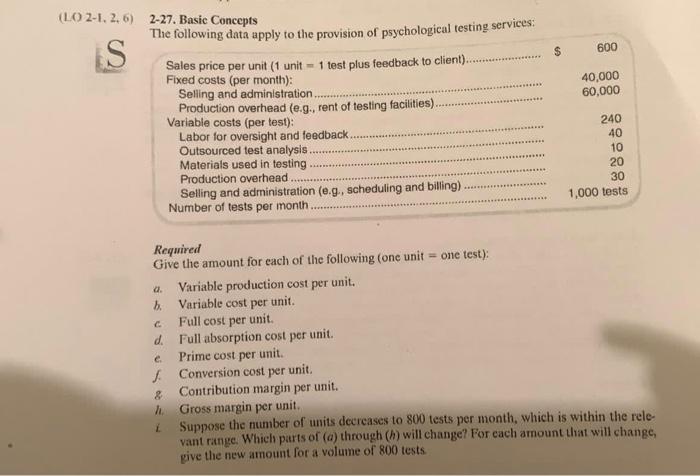

2-31. Prepare Statements for a Manufacturing Company The following balances are from the accounts of Hill Components: Direct materials used during the year amount to $59,800, and the cost of goots sold for the year was $68,900. Required Find the following by completing a cost of goods sold statement: a. Cost of direct materials purchased during the year. b. Cost of gonds manufactured during the year. c. Total manufacturing costs incurred during the year. 2-34. Prepare Statements for a Service Company The following data are available for Jupiter Consultants for the year just ended: Required Find the following by completing a cost of goods sold statement: a. Marketing and administrative costs b. Cost of services sold. -2) 2-39. Prepare Statements for a Merchandising Company The cost accountant for Angie's Apparel has compiled the following information for last month's operations: Required Prepare an income statement with a supporting cost of goods sold statement. 2-62. Reconstruct Financial Statements San Ysidro Company manufactures hiking equipment. The company's administrative and manufacturing operations share the company's one building. Eighty percent of the building is used for manufacturing and the remainder is used for administrative activities. Indirect labor is 8 percent of direct libot. The cost accountant at San Ysidro has compiled the following information for the year ended December 31: Required Prepare a cost of goods manufactured and sold statement and an income statement. 2-44. Components of Full Costs Larcker Manulacturing's cost accountant has provided you with the following information for January operations: Rryeirrd Determine each of the following: 4. Vuriable cost. A Varidble manufacturing cost. c. Full ahwarpion cost. 4. Full ons 2-27. Basic Concepts The following data apply to the provision of psychological testing services: Required Give the amount for each of the following (one unit = one test): a. Variable production cost per unit. b. Variable cost per unit. c. Full cost per unit. d. Full absorption cost per unit. e. Prime cost per unit. f. Conversion cost per unit. & Contribution margin per unit. h. Gross margin per unit. Luppose the number of units decreases to 800 tests per month, which is within the relevant range. Which parts of (a) through (h) will change? For each amount that will change, give the new amount for a volume of 800 tests