Answered step by step

Verified Expert Solution

Question

1 Approved Answer

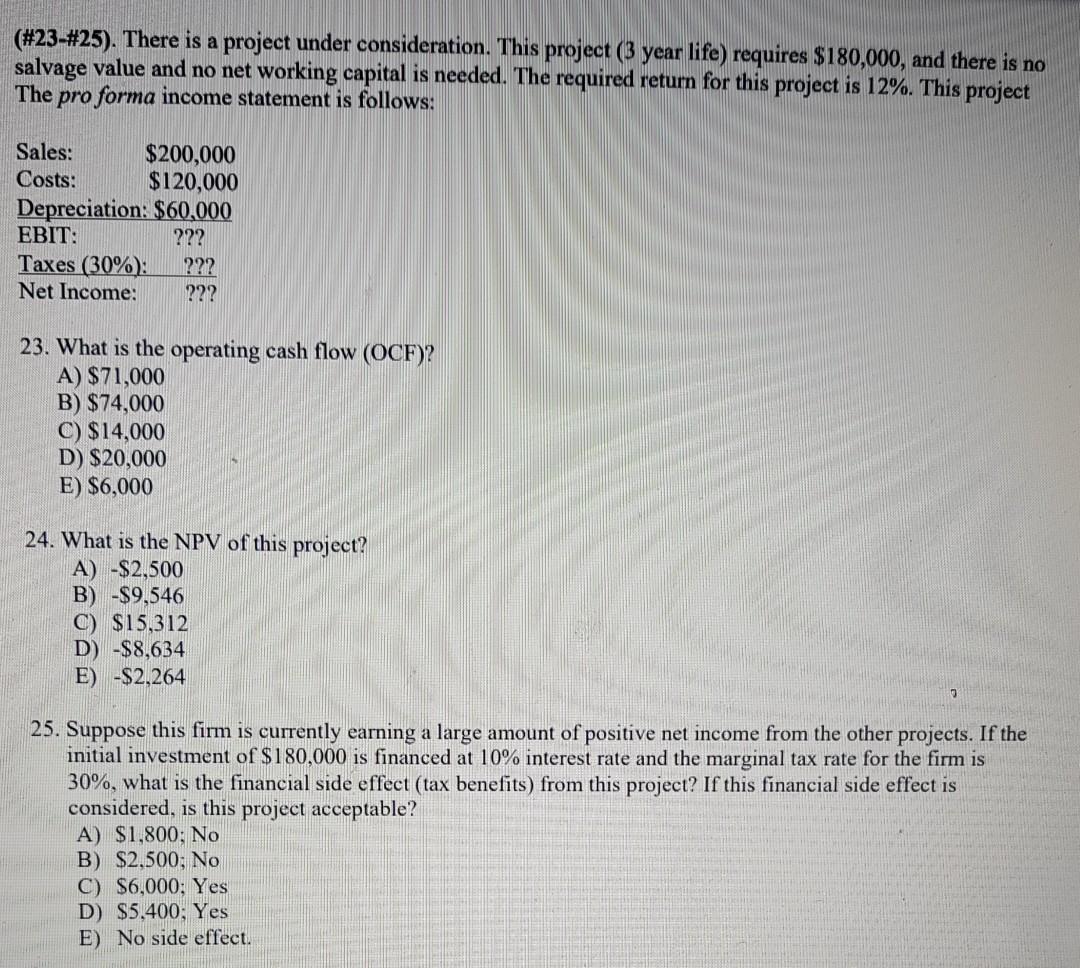

(#23-#25). There is a project under consideration. This project (3 year life) requires $180,000, and there is no salvage value and no net working capital

(#23-#25). There is a project under consideration. This project (3 year life) requires $180,000, and there is no salvage value and no net working capital is needed. The required return for this project is 12%. This project The pro forma income statement is follows: Sales: $200,000 Costs: $120,000 Depreciation: $60,000 EBIT: ??? Taxes (30%): ??? Net Income: ??? 23. What is the operating cash flow (OCF)? A) $71,000 B) $74,000 C) $14,000 D) $20,000 E) $6,000 24. What is the NPV of this project? A) -$2,500 B) -$9,546 C) $15,312 D) -$8,634 E) -$2,264 25. Suppose this firm is currently earning a large amount of positive net income from the other projects. If the initial investment of $180,000 is financed at 10% interest rate and the marginal tax rate for the firm is 30%, what is the financial side effect (tax benefits) from this project? If this financial side effect is considered, is this project acceptable? A) $1,800: No B) $2,500; No C) $6,000; Yes D) $5.400: Yes E) No side effect

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started