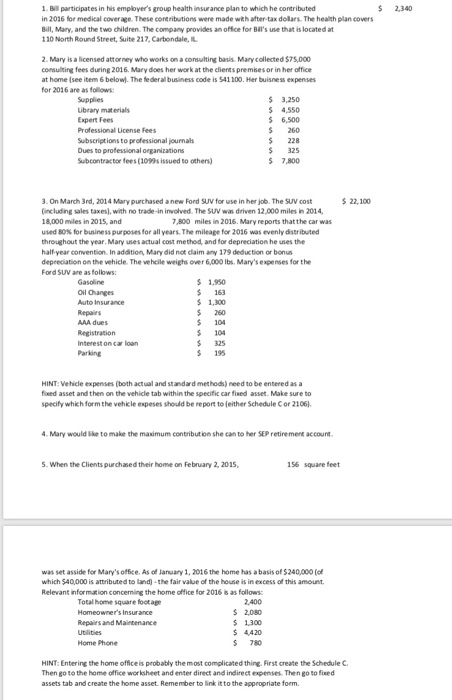

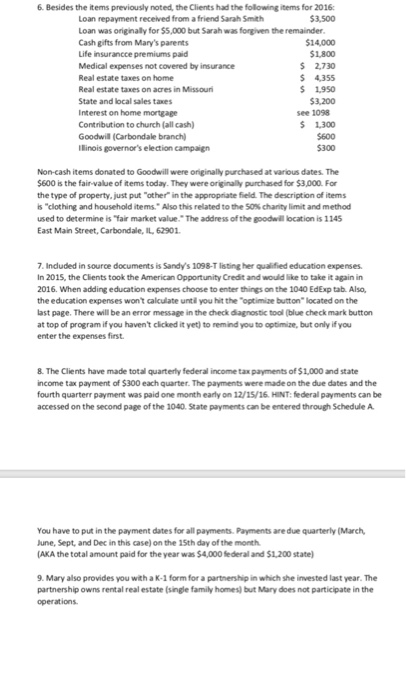

$2,340 Bill participates in his employer's group health insurance plan to which he contributed in 2016 for medical coverage. These contributions were made wth after-tax dolars. The health plan covers Bill, Mary, and the two children. The company provides an office for Bll's use that is located at 110 North Round Street, Suite 217-Carbondale, IL 2. Mary is a licensed attorney who works on a consulting basis. Mary collected $75,000 consulting fees during 2016. Mary does her work at the clients prembes or in her ofice at home (see item 6 belowl. The federal business code is 541100. Her buisness expenses for 2016 are as folows Ubrary materials Expert Fees Professional License Fees Subscriptions to professional journals Dues to professional organizations Subcontrac tor fees (109s issued to others) $ 3,250 4,550 $ 6,500 $ 260 $ 228 $325 $ 7,800 22,100 3. On March 3rd, 2014 Mary purchased anew Ford SUV for use in her job. The SUV cost including sales taxes), with no trade-in involved. The SUV was driven 12,000 miles in 2014 18,000 miles in 2015, and used 80% for business purposes for all years. The mileage for 2016 was evenly distributed throughout the year. Mary uses actual cost method, and for depreciation he uses the half-year convention In addition, Mary did not claim any 179 deduction or bonus depreciation on the vehicle. The vehcile weighi over 6,000 lbs. Mary's expenses for the Ford SUV are as follows: 7,800 miles in 2016. Mary re ports that the car was 1,950 Gasoline Oil Changes Auto Insur Repairs AAA dues 1,300 $260 Interest on car loan Parking $ 104 $325 $ 195 HINT: Vehicle expenses (both actual and standard methods) need to be entered as a foeed asset and then on the vehicle tab within the specific car fixed asset. Make sure to specify which form the vehicle expeses shoud be report to (either Schedule Cor 2106) 4. Mary would like to make the maximum contribut ion she can to her SEP retirement account 5. When the Clients purchased their home on February 2, 2015, 156 square feet was set asside for Mary's office. As of January 1, 2016 the home has a basis of $240,000 (o which $40,000 is attributed to land) the fair value of the house is in excess of this amount Relevant inform non concern?the home office for 2016 as follows: 2,400 2,080 1300 4420 5 780 Total home square foot age Homeowner's Insurance Repairs and Maintenance Home Phone HINT: Entering the home office is probably the most complicated thing. Frst create the Schedule C Then go to the home office worksheet and enter direct and indirect expenses Then go to fixed assets tab and create the home asset. Remember to link itto the appropriate form. $2,340 Bill participates in his employer's group health insurance plan to which he contributed in 2016 for medical coverage. These contributions were made wth after-tax dolars. The health plan covers Bill, Mary, and the two children. The company provides an office for Bll's use that is located at 110 North Round Street, Suite 217-Carbondale, IL 2. Mary is a licensed attorney who works on a consulting basis. Mary collected $75,000 consulting fees during 2016. Mary does her work at the clients prembes or in her ofice at home (see item 6 belowl. The federal business code is 541100. Her buisness expenses for 2016 are as folows Ubrary materials Expert Fees Professional License Fees Subscriptions to professional journals Dues to professional organizations Subcontrac tor fees (109s issued to others) $ 3,250 4,550 $ 6,500 $ 260 $ 228 $325 $ 7,800 22,100 3. On March 3rd, 2014 Mary purchased anew Ford SUV for use in her job. The SUV cost including sales taxes), with no trade-in involved. The SUV was driven 12,000 miles in 2014 18,000 miles in 2015, and used 80% for business purposes for all years. The mileage for 2016 was evenly distributed throughout the year. Mary uses actual cost method, and for depreciation he uses the half-year convention In addition, Mary did not claim any 179 deduction or bonus depreciation on the vehicle. The vehcile weighi over 6,000 lbs. Mary's expenses for the Ford SUV are as follows: 7,800 miles in 2016. Mary re ports that the car was 1,950 Gasoline Oil Changes Auto Insur Repairs AAA dues 1,300 $260 Interest on car loan Parking $ 104 $325 $ 195 HINT: Vehicle expenses (both actual and standard methods) need to be entered as a foeed asset and then on the vehicle tab within the specific car fixed asset. Make sure to specify which form the vehicle expeses shoud be report to (either Schedule Cor 2106) 4. Mary would like to make the maximum contribut ion she can to her SEP retirement account 5. When the Clients purchased their home on February 2, 2015, 156 square feet was set asside for Mary's office. As of January 1, 2016 the home has a basis of $240,000 (o which $40,000 is attributed to land) the fair value of the house is in excess of this amount Relevant inform non concern?the home office for 2016 as follows: 2,400 2,080 1300 4420 5 780 Total home square foot age Homeowner's Insurance Repairs and Maintenance Home Phone HINT: Entering the home office is probably the most complicated thing. Frst create the Schedule C Then go to the home office worksheet and enter direct and indirect expenses Then go to fixed assets tab and create the home asset. Remember to link itto the appropriate form