Question

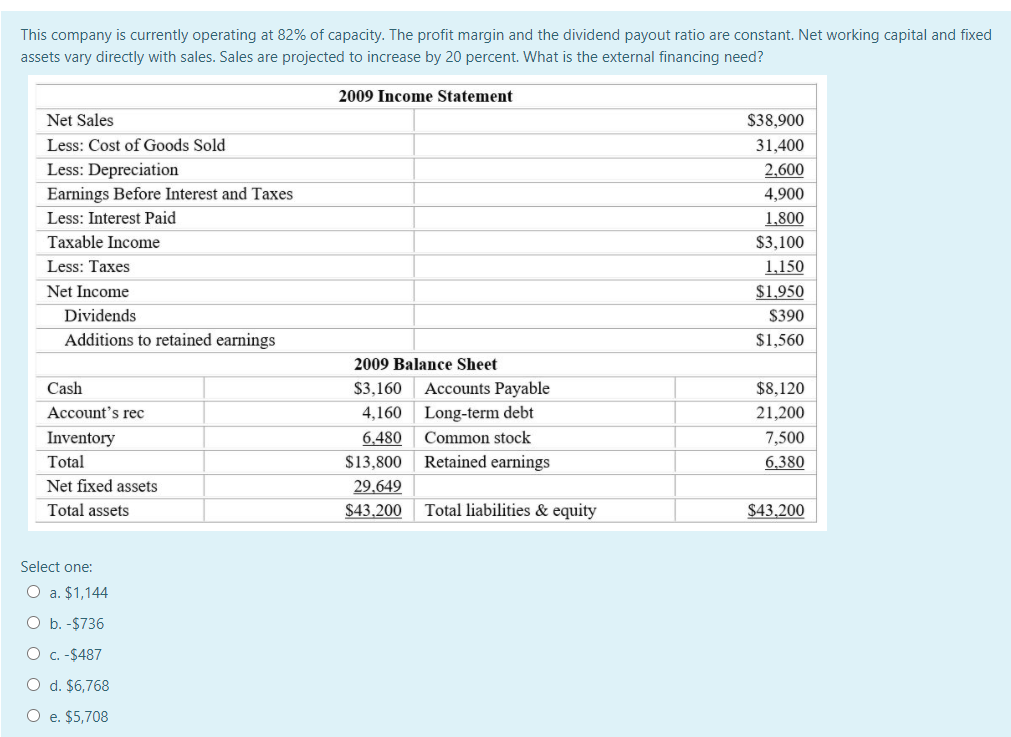

23)This company is currently operating at 82% of capacity. The profit margin and the dividend payout ratio are constant. Net working capital and fixed assets

23)This company is currently operating at 82% of capacity. The profit margin and the dividend payout ratio are constant. Net working capital and fixed assets vary directly with sales. Sales are projected to increase by 20 percent. What is the external financing need? (check the attached picture)

Select one:

a. $1,144

b. -$736

c. -$487

d. $6,768

e. $5,708

-Just answer if you're 100% sure about the Correct Letter for the question, please -Dont Explain at all please, Just the correct letter for the question without any explanation at all, and I'll put a like.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started