Answered step by step

Verified Expert Solution

Question

1 Approved Answer

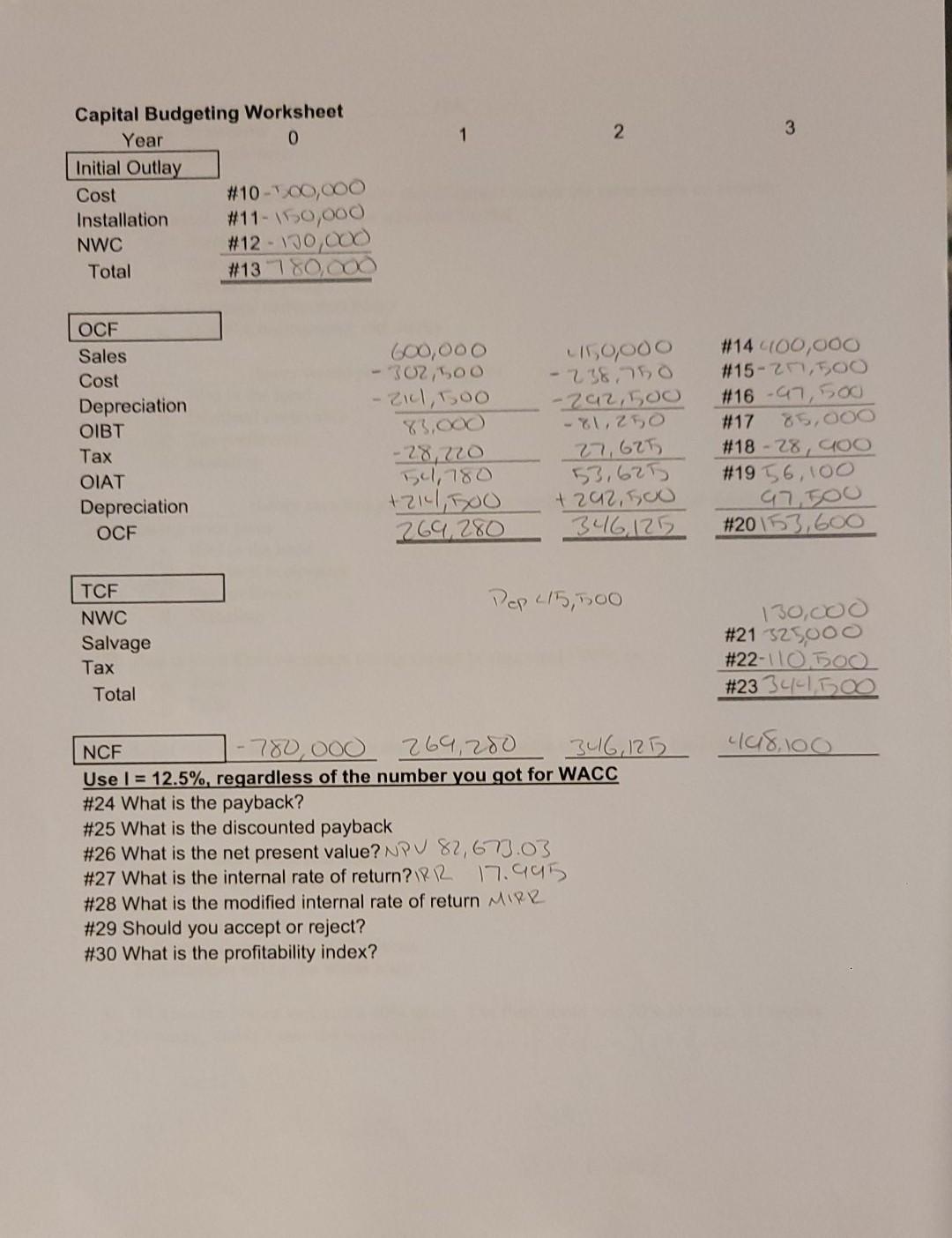

#24 #25 #28 thank you, 1 2 3 Capital Budgeting Worksheet Year 0 Initial Outlay Cost #10 -100,000 Installation #11 - 150,000 NWC #12 -

#24 #25 #28

thank you,

1 2 3 Capital Budgeting Worksheet Year 0 Initial Outlay Cost #10 -100,000 Installation #11 - 150,000 NWC #12 - 130,00 Total #13 780,000 OCF Sales Cost Depreciation OIBT Tax OIAT Depreciation OCF 600,000 - 302,500 - 211, Boo 83,000 -28,220 501, 780 +214, Boo 269,80 110,000 - 238.750 -292,500 - 81,250 27,625 ) 53,625 +242, 500 346,125 #14400,000 #15- 2,500 #16 -97,500 #17 85,000 #18 - 28,900 #19 56,100 97,500 #20153,600 Dep 115,oo TCF NWC Salvage Tax Total 130,000 #21 525000 #22-110.500 #2334450 198,100 NCF -780,000 269,200 346,125 Use l = 12.5%, regardless of the number you got for WACC #24 What is the payback? #25 What is the discounted payback #26 What is the net present value? NPV 82,673.03 #27 What is the internal rate of return?R2 17.995 #28 What is the modified internal rate of return Mire #29 Should you accept or reject? #30 What is the profitability indexStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started