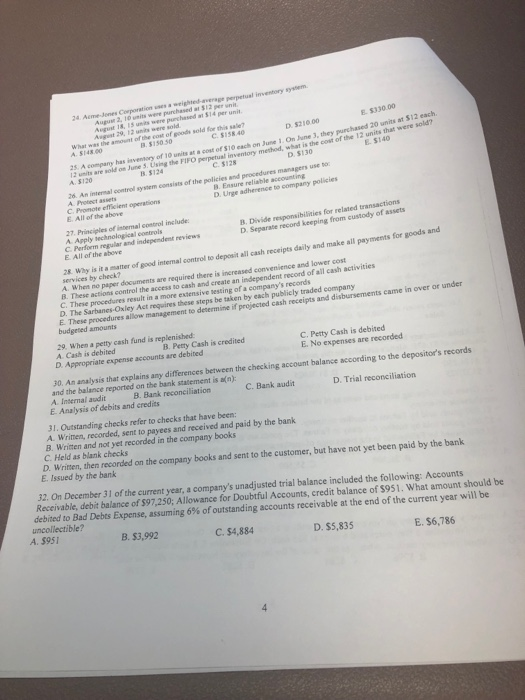

24 Aeme-Jenes Corporation were pur S330.00 of soldthis saet D. $210.00 C$158.40 B.5150 50 10 each on June 1. On June 3, they purchased 20 units at $12 each. A company has inventory of 10 units at a cost of 12 units are sold on June 5. Using the FIFO A. $120 inventory E $140 perpetual inventory method, what is the cost of the 12 units that were sold? D. $130 C 5128 B. $124 intermal control sysnem consists of the policies and procedures managers use B. Ensure reliable D. Urge adherence A. Protect assets C-Promote efficient operations E. All of the above to company policies Principles of internal control include: responsibilities for related transactions B. Divide A Apply technological eontrols C Perform regular and independent reviews E. All of the above record keeping from custody of assets 28. Wiy is it a mater of good intemal control to deposit all cash receipts daily and make all payment services by check? make all payments for goods and A. When no paper documents are required there is increased convenience and lower cost nese actions control the access to cash and create an independent record ofall cash activities C. These procedures result in a more extensive sesting of a company's records D. The Sarbanes-Oxley Act requires these steps be taken by each publicly traded company E These procedures allorw management to determine if projected cash receipts and disbursements came in over or under budgeted amounts 29. When a petty cash fund is replenished A Cash is debited B. Petty Cash is credited C. Petty Cash is debited E. No expenses are recorded D. Appropriate expense accounts are debited 30. An analysis that explains any differences between the checking account balance according to the depositor's records and the balance reported on the bank statement is a(n) A. Internal audit 8. Bank reconciliation C. Bank audit D. Trial reconciliation E. Analysis of debits and credits 31. Outstanding checks refer to checks that have been B. written and not yet recorded in the company books A. Wrimen, recorded, sent to payees and received and paid by the bank C. Held as blank checks D. Writen, then recorded company i ed on the company books and sent to the customer, but have not yet been paid by the bank E. Issued by the bank 32. On December 31 of the current year, a company's unadjusted trial balance included the following: Accounts Receivable, debit balance of $97,250; Allowance for Doubtful Accounts, credit balance of $951. What amount should be debited to Bad Debts Expense, assuming 6% of utstanding accounts receivable at the end of the current year will be uncollectible? A. $951 B. $3,992 C.$4,884 D. $5,835 E. $6,786