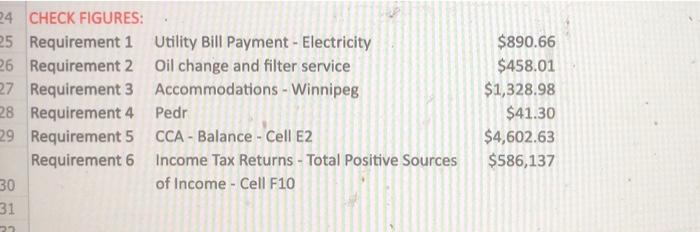

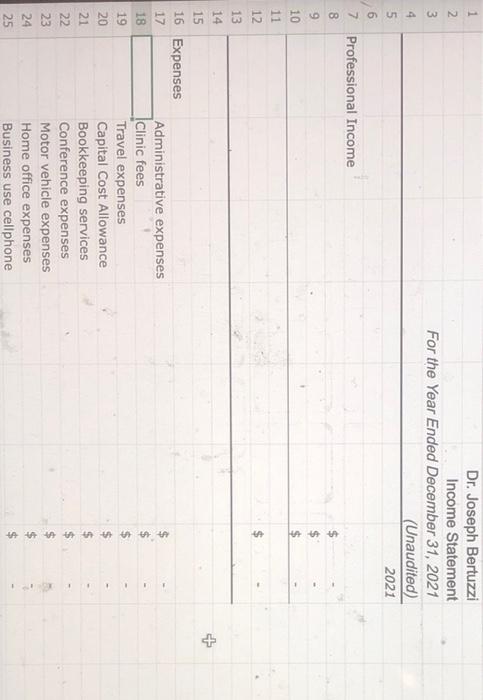

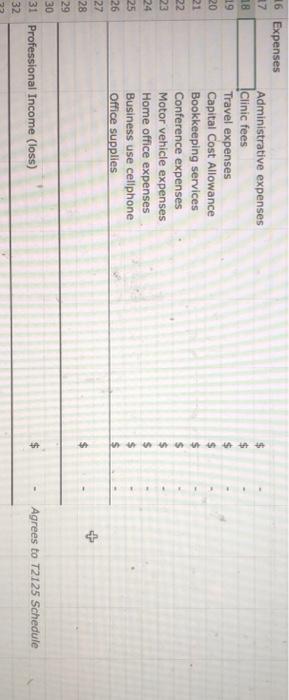

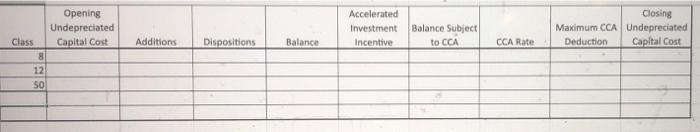

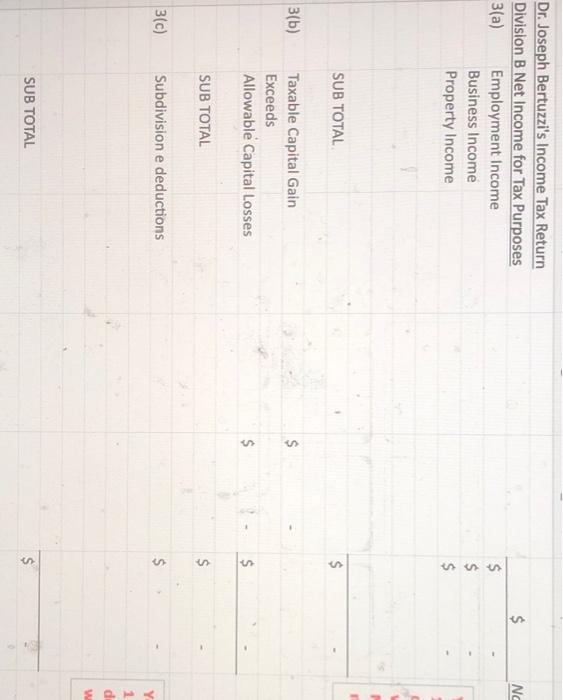

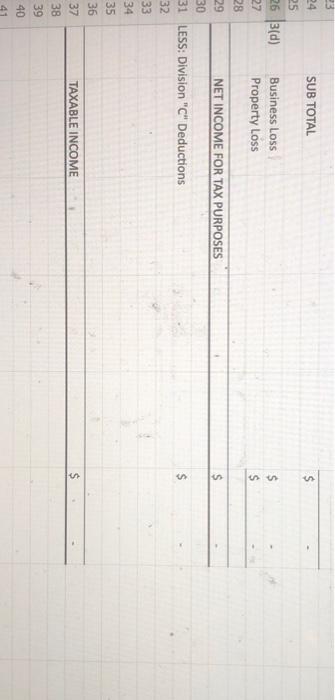

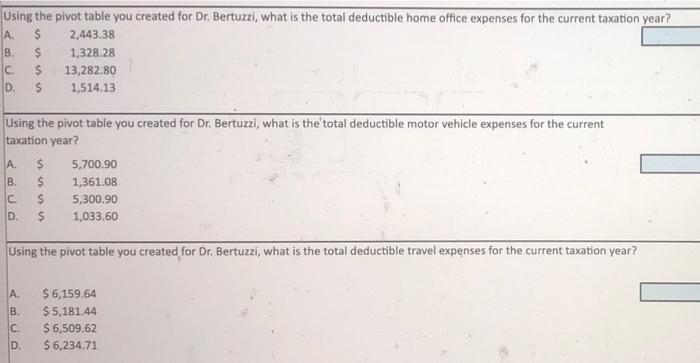

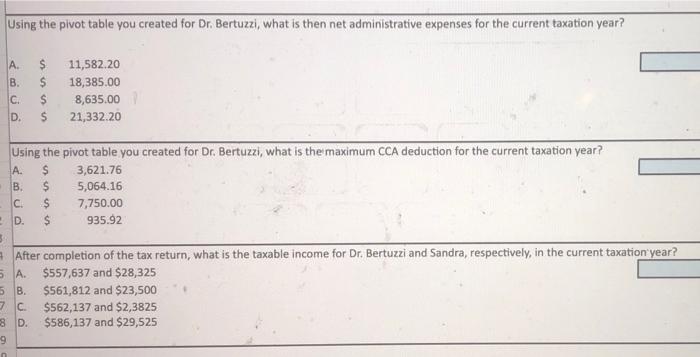

24 CHECK FIGURES: 25 Requirement i Utility Bill Payment - Electricity 26 Requirement 2 Oil change and filter service 27 Requirement 3 Accommodations - Winnipeg 28. Requirement 4 Pedr 29 Requirement 5 CCA- Balance - Cell E2 Requirement 6 Income Tax Returns - Total Positive Sources 30 of Income - Cell F10 31 $890.66 $458.01 $1,328.98 $41.30 $4,602.63 $586,137 27 No un a w NE Dr. Joseph Bertuzzi Income Statement For the Year Ended December 31, 2021 (Unaudited) 2021 5 6 7 Professional Income 8 9 10 $ + 11 12 13 14 15 16 Expenses 17 18 19 20 A to to 21 Administrative expenses Clinic fees Travel expenses Capital Cost Allowance Bookkeeping services Conference expenses Motor vehicle expenses Home office expenses Business use cellphone 22 23 24 25 $ $ $ $ 16 Expenses 17 Administrative expenses 18 clinic fees 19 Travel expenses 20 Capital Cost Allowance 21 Bookkeeping services 22 Conference expenses 23 Motor vehicle expenses 24 Home office expenses 25 Business use cellphone 26 Office supplies 27 28 29 30 31 Professional Income (loss) + $ - $ - Agrees to T2125 Schedule 32 Opening Undepreciated Capital Cost Accelerated Investment Incentive Balance Subject Closing Maximum CCA Undepreciated Deduction Capital Cost Additions Dispositions Balance to CCA CCA Rate Class 8 12 50 $ Nc Dr. Joseph Bertuzzi's Income Tax Return Division B Net Income for Tax Purposes 3(a) Employment Income Business Income Property Income $ $ $ SUB TOTAL $ 3(b) $ Taxable Capital Gain Exceeds Allowable Capital Losses $ $ SUB TOTAL $ 3(c) Subdivision e deductions $ w SUB TOTAL $ $ $ $ 24 SUB TOTAL 25 26 3(d) Business Loss 27 Property Loss 28 29 NET INCOME FOR TAX PURPOSES 30 31 LESS: Division "C" Deductions 32 33 34 35 36 $ TAXABLE INCOME $ 37 38 39 40 41 Using the pivot table you created for Dr. Bertuzzi, what is the total deductible home office expenses for the current taxation year? A $ 2,443.38 B. $ 1,328.28 C $ 13,282.80 D. S 1,514.13 Using the pivot table you created for Dr. Bertuzzi, what is the total deductible motor vehicle expenses for the current taxation year? A 5,700.90 B. $ 1,361.08 C. $ 5,300.90 D. $ 1,033.60 Using the pivot table you created for Dr. Bertuzzi, what is the total deductible travel expenses for the current taxation year? A B. C. D. $ 6,159.64 $ 5,181.44 $ 6,509.62 $ 6,234.71 Using the pivot table you created for Dr. Bertuzzi, what is then net administrative expenses for the current taxation year? A B. C. D. $ $ $ 11,582.20 18,385.00 8,635.00 21,332.20 UU C O Using the pivot table you created for Dr. Bertuzzi, what is the maximum CCA deduction for the current taxation year? A. 3,621.76 B. 5,064.16 $ 7,750.00 D. S 935.92 3 After completion of the tax return, what is the taxable income for Dr. Bertuzzi and Sandra, respectively, in the current taxation year? 5 A $557,637 and $28,325 6 B. $561,812 and $23,500 I c. $562,137 and $2,3825 8 D. $586,137 and $29,525 9 24 CHECK FIGURES: 25 Requirement i Utility Bill Payment - Electricity 26 Requirement 2 Oil change and filter service 27 Requirement 3 Accommodations - Winnipeg 28. Requirement 4 Pedr 29 Requirement 5 CCA- Balance - Cell E2 Requirement 6 Income Tax Returns - Total Positive Sources 30 of Income - Cell F10 31 $890.66 $458.01 $1,328.98 $41.30 $4,602.63 $586,137 27 No un a w NE Dr. Joseph Bertuzzi Income Statement For the Year Ended December 31, 2021 (Unaudited) 2021 5 6 7 Professional Income 8 9 10 $ + 11 12 13 14 15 16 Expenses 17 18 19 20 A to to 21 Administrative expenses Clinic fees Travel expenses Capital Cost Allowance Bookkeeping services Conference expenses Motor vehicle expenses Home office expenses Business use cellphone 22 23 24 25 $ $ $ $ 16 Expenses 17 Administrative expenses 18 clinic fees 19 Travel expenses 20 Capital Cost Allowance 21 Bookkeeping services 22 Conference expenses 23 Motor vehicle expenses 24 Home office expenses 25 Business use cellphone 26 Office supplies 27 28 29 30 31 Professional Income (loss) + $ - $ - Agrees to T2125 Schedule 32 Opening Undepreciated Capital Cost Accelerated Investment Incentive Balance Subject Closing Maximum CCA Undepreciated Deduction Capital Cost Additions Dispositions Balance to CCA CCA Rate Class 8 12 50 $ Nc Dr. Joseph Bertuzzi's Income Tax Return Division B Net Income for Tax Purposes 3(a) Employment Income Business Income Property Income $ $ $ SUB TOTAL $ 3(b) $ Taxable Capital Gain Exceeds Allowable Capital Losses $ $ SUB TOTAL $ 3(c) Subdivision e deductions $ w SUB TOTAL $ $ $ $ 24 SUB TOTAL 25 26 3(d) Business Loss 27 Property Loss 28 29 NET INCOME FOR TAX PURPOSES 30 31 LESS: Division "C" Deductions 32 33 34 35 36 $ TAXABLE INCOME $ 37 38 39 40 41 Using the pivot table you created for Dr. Bertuzzi, what is the total deductible home office expenses for the current taxation year? A $ 2,443.38 B. $ 1,328.28 C $ 13,282.80 D. S 1,514.13 Using the pivot table you created for Dr. Bertuzzi, what is the total deductible motor vehicle expenses for the current taxation year? A 5,700.90 B. $ 1,361.08 C. $ 5,300.90 D. $ 1,033.60 Using the pivot table you created for Dr. Bertuzzi, what is the total deductible travel expenses for the current taxation year? A B. C. D. $ 6,159.64 $ 5,181.44 $ 6,509.62 $ 6,234.71 Using the pivot table you created for Dr. Bertuzzi, what is then net administrative expenses for the current taxation year? A B. C. D. $ $ $ 11,582.20 18,385.00 8,635.00 21,332.20 UU C O Using the pivot table you created for Dr. Bertuzzi, what is the maximum CCA deduction for the current taxation year? A. 3,621.76 B. 5,064.16 $ 7,750.00 D. S 935.92 3 After completion of the tax return, what is the taxable income for Dr. Bertuzzi and Sandra, respectively, in the current taxation year? 5 A $557,637 and $28,325 6 B. $561,812 and $23,500 I c. $562,137 and $2,3825 8 D. $586,137 and $29,525 9