Answered step by step

Verified Expert Solution

Question

1 Approved Answer

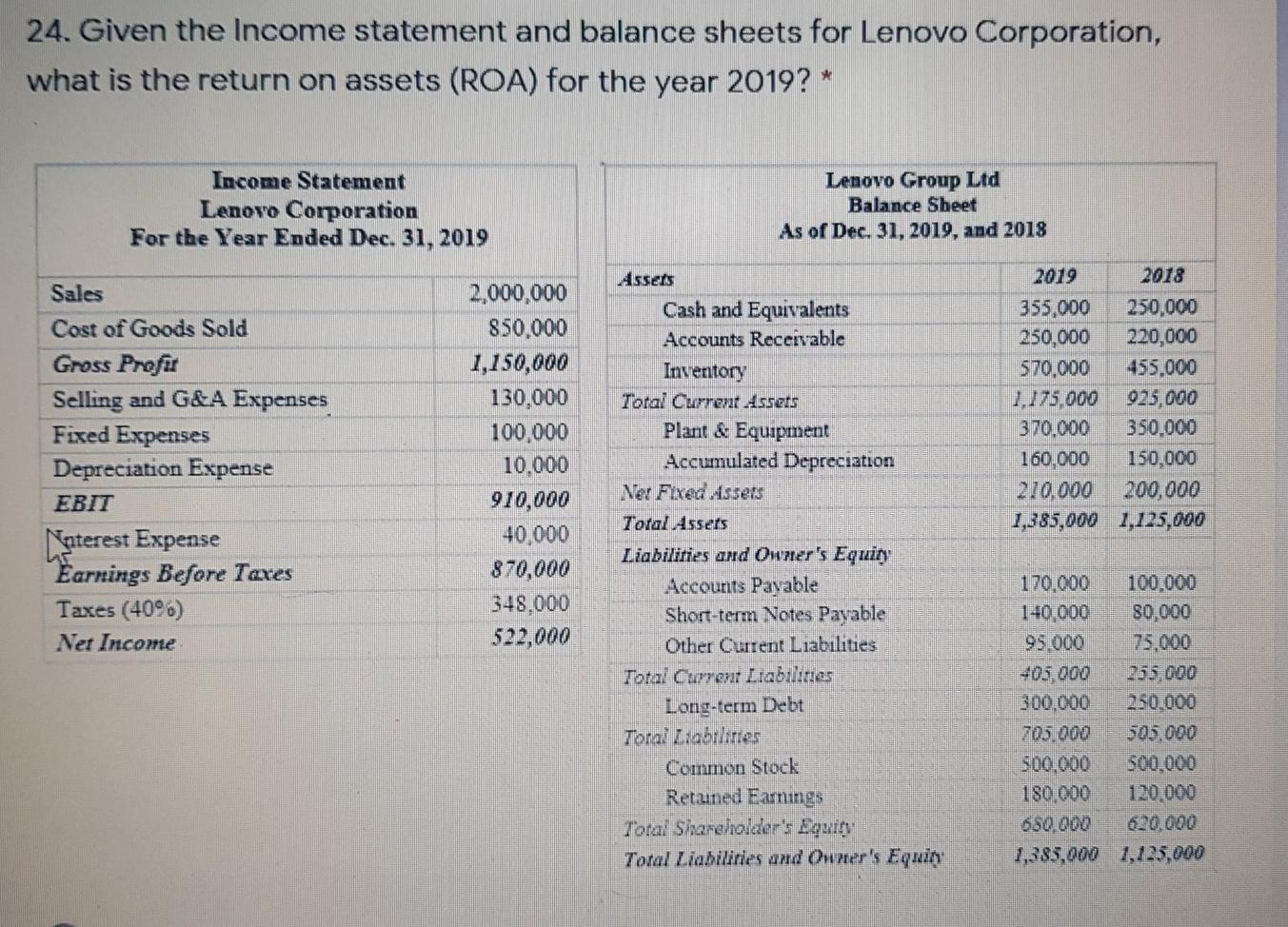

24. Given the income statement and balance sheets for Lenovo Corporation, what is the return on assets (ROA) for the year 2019? * Income Statement

24. Given the income statement and balance sheets for Lenovo Corporation, what is the return on assets (ROA) for the year 2019? * Income Statement Lenovo Corporation For the Year Ended Dec. 31, 2019 Lenovo Group Ltd Balance Sheet As of Dec. 31, 2019, and 2018 Sales Cost of Goods Sold Gross Profir Selling and G&A Expenses Fixed Expenses Depreciation Expense EBIT Naterest Expense Earnings Before Taxes Taxes (409) Net Income 2,000,000 850.000 1,150,000 130,000 100,000 10.000 910,000 40,000 870,000 348.000 522,000 2019 2018 355,000 250,000 250,000 220,000 570.000 455.000 1,175.000 925,000 370.000 350.000 160,000 150,000 210.000 200,000 1,385,000 1,125,000 Assets Cash and Equivalents Accounts Receivable Inventory Total Current Assets Plant & Equipment Accumulated Depreciation Ner Fixed Assets Total Assets Liabilities and Owner's Equity Accounts Payable Short-term Notes Payable Other Curent Liabilities Total Current Liabilines Long-term Debt Tora? Liabilities Common Stock Retained Earnings Total Shareholder's Equiq Total Liabilities and Owner's Equin 170,000 100.000 140,000 80,000 95.000 75.000 405.000 255,000 300.000 250.000 705.000 505.000 500.000 180.000 650.000 620.000 1,385,000 1,225,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started