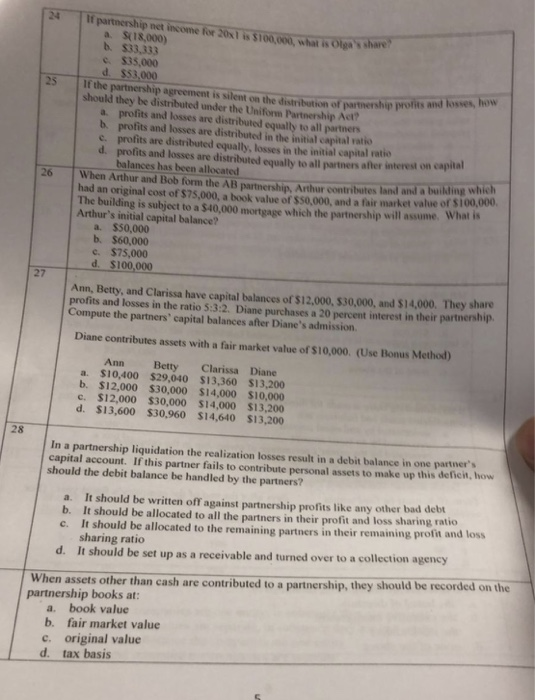

24 if partnership net income for 30N7 15 $100. 60 what is Olen 's share a $(18,000) b $33,333 c. $35,000 d. $53,000 25 If the partnership agreement is silent on the distribution of partnership should they be distributed under the Uniform Partnership Act? o ind ..d losses, how a. profits and losses are distributed equally to all partners b. profits and losses are distributed in the initial capital vatio c. profits are distributed equally, losses in the initial capital ratio d. profits and losses are distributed equally to all partners after interest on capital balances has been allocated 26 When Arthur and Bob form the AB partnershin Arthur contributes land and a building w had an original cost of $75,000, a book value of $50,000, and a fair market value of $10,000 The building is subject to a $40,000 mortgage which the partnership will assume. What is Arthur's initial capital balance? $50,000 b. $60,000 c. $75,000 d $100,000 a, Ann, Betty, and Clarissa have capital balances of $12,000, 530,000, and $14,000. They share profits and losses in the ratio 5:3:2. Diane purchases a 20 percent interest in their partnership Compute the partners' capital balances after Diane's admission Diane contributes assets with a fair market value of $10,000. (Use Bonus Method) Ann Betty Clarissa Diane a. $10,400 $29,040 s13,360 s13,200 b. $12,000 $30,000 $14,000 $10,000 c. $12,000 $30,000 $14,000 $13,200 d. $13,600 $30,960 $14,640 $13,200 28 In a partnership liquidation the realization losses result in a debit balance in one partner's capital account. If this partner fails to contribute personal assets to make up this deficit, how should the debit balance be handled by the partners? a. It should be written off against partnership profits like any other bad debt b. It should be allocated to all the partners in their profit and loss sharing ratio c. It should be allocated to the remaining partners in their remaining profit and loss sharing ratio It should be set up as a receivable and turned over to a collection agency d. When assets other than cash are contributed to a partnership, they should be recor partnership books at: ded on the a. book value b. fair market value c. original value d. tax basis