Answered step by step

Verified Expert Solution

Question

1 Approved Answer

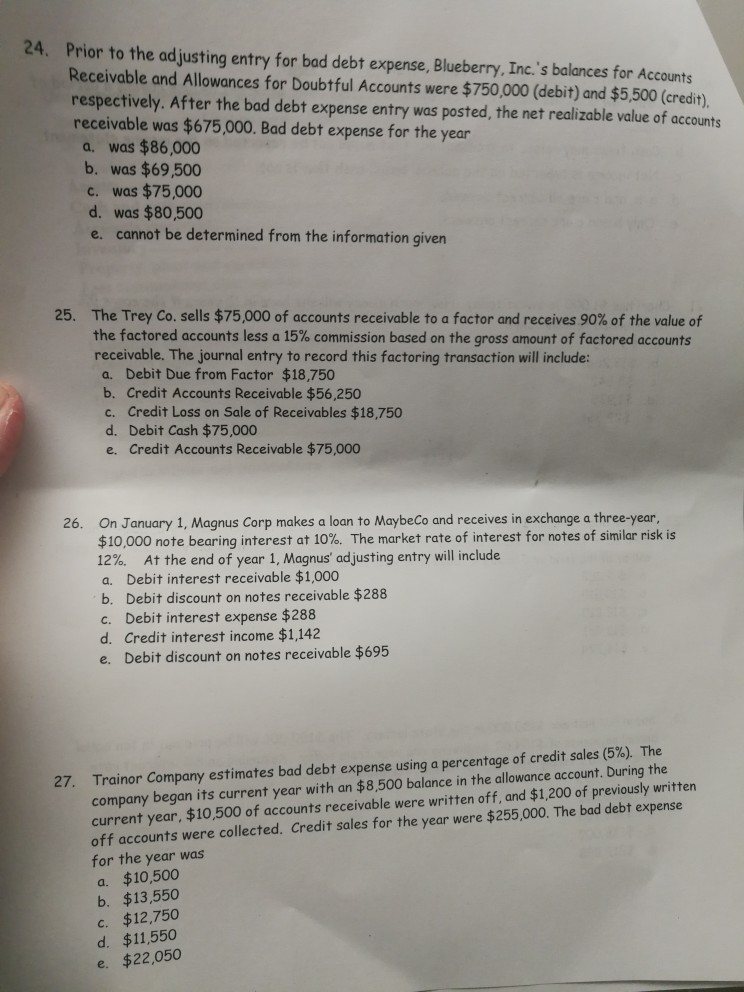

24. Prior to the adjusting entry for bad debt expense, Blueberry, Inc.'s balances for Accounts Receivable and Allowances for Doubtful Accounts were $750,000 (debit) and

24. Prior to the adjusting entry for bad debt expense, Blueberry, Inc.'s balances for Accounts Receivable and Allowances for Doubtful Accounts were $750,000 (debit) and $5,500 (credit), respectively. After the bad debt expense entry was posted, the net realizable value of accounts receivable was $675,000. Bad debt expense for the year a. was $86,000 b. was $69,500 c. was $75,000 d. was $80,500 e. cannot be determined from the information given The Trey Co. sells $75,000 of accounts receivable to a factor and receives 90% of the value of the factored accounts less a 15% commission based on the gross amount of factored accounts 25 receivable. The journal entry to record this factoring transaction will include: a. Debit Due from Factor $18,750 b. Credit Accounts Receivable $56,250 c. Credit Loss on Sale of Receivables $18,750 d. Debit Cash $75,000 e, Credit Accounts Receivable $75,000 26. On January 1, Magnus Corp makes a loan to MaybeCo and receives in exchange a three-year $10,000 note bearing interest at 10%. The market rate of interest for notes of similar risk is 12%. At the end of year 1, Magnus, adjusting entry will include a. Debit interest receivable $1,000 b. Debit discount on notes receivable $288 c. Debit interest expense $288 d. Credit interest income $1,142 e. Debit discount on notes receivable $695 Trainor Company estimates bad debt expense using a percentage of credit sales (5%). The company began its current year with an $8,500 balance in the allowance account. During the current year, $10,500 of accounts receivable were written off, and $1,200 of previously written off accounts were collected. Credit sales for the year were $255,000. The bad debt expense for the year was a. $10,500 b. $13,550 c. $12,750 d $11,550 e. $22,050 27

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started