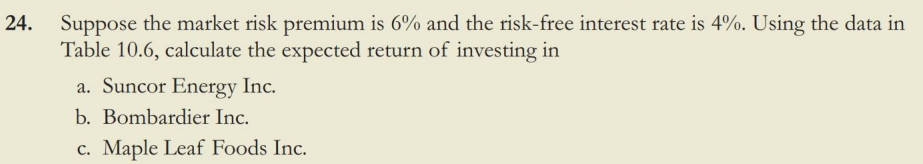

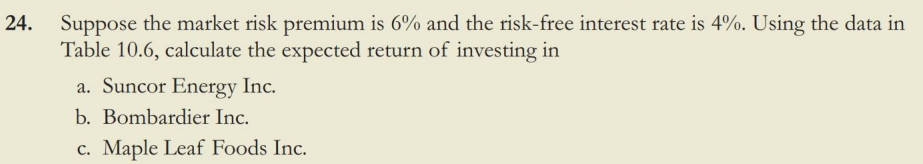

24. Suppose the market risk premium is 6% and the risk-free interest rate is 4%. Using the data in Table 10.6, calculate the expected return of investing in a. Suncor Energy Inc. b. Bombardier Inc. c. Maple Leaf Foods Inc. TABLE 10.6 Betas with Respect to the S&P/TSX Composite Index for Individual Stocks and Average Betas for Stocks in Their TSX Industry Sectors Energy L Industry Industry Ticker Market Cap Sector Beta* Symbol Company Name (Billions) Beta* SU Suncor Energy Inc. $69.1094 1.5458 1.3858 ENB Enbridge Inc. $91.1049 1.0488 AGU Agrium Inc. $17.6050 0.8545 Materials 1.3450 POT Potash Corp. of Saskatchewan $19.2233 1.0122 ABX Barrick Gold Corp. $29.7804 1.1697 EIF Exchange Income Corp. $1.2188 0.5152 WJA WestJet Airlines Ltd. $2.6839 0.5869 Industrials 0.8431 BBD.B Bombardier Inc. $4.7006 1.0777 WCN Waste Connections Inc. $20.4217 0.3700 CNR Canadian National Railway Co. $75.3214 0.8826 ZZZ Sleep Country Canada Holding $1.2232 0.4367 HBC Hudson's Bay Co. $1.8368 0.9792 Consumer Discretionary 0.7598 CGX Cineplex Inc. $3.1815 0.4060 CTC.A Canadian Tire Corp. $11.0774 0.6418 NWC The North West Company $1.5374 0.3362 BCB Cott Corporation $2.2583 0.5472 Consumer Staples 0.5399 MFI Maple Leaf Foods Inc. $4.2783 0.5705 Loblaw Companies Ltd. $29.1412 0.4700 PLI Prometic Life Sciences Inc. $1.4711 1.1624 Health Care 0.8962 VRX Valeant Pharmaceuticals $4.9882 1.2898 TMX Group Ltd. $3.6600 0.6651 ONEX Onex Corporation $9.7817 0.5393 Financials 0.8224 SLF Sun Life Financial Inc. $30.0470 1.0376 BAM.A Brookfield Asset Management $48.1471 0.8908 TD Toronto-Dominion Bank $122.4495 0.7843 BlackBerry Ltd. $4.9972 1.0750 Information Technology 0.6846 OTEX Open Text Corp. $11.9729 0.6272 TELUS Corp. $25.4771 0.5251 Telecommunication Services 0.4799 RCI.B Rogers Communications Inc. $30.1175 0.4898 BCE BCE Inc. $52.9275 0.4525 TA TransAlta Corp $2.2255 1.1329 Algonquin Power & Utilities $4.8111 0.6260 Utilities 0.5783 CU Canadian Utilities Ltd. $10.4038 0.7253 Hydro One Ltd. $14.3097 0.2282 AX.UN Artis Real Estate Investment $1.9848 0.6028 Real Estate 0.4546 CIGI Colliers International Group $2.4284 0.5329 BPY.UN Brookfield Property Partners $20.8741 0.4817 *Bet estimated with five years of monthly returns relative to the S&P/TSX Composite Index ending March 29, 2017. Sources: Based on Bloomberg, MSCI-Barra GICS Tables, and author's calculations. AQN