Answered step by step

Verified Expert Solution

Question

1 Approved Answer

24. The following report appeared in The Daily Gazette (Schenectady, NY, Sept. 25, 1993): OPEC's high oil output and falling prices have cost member

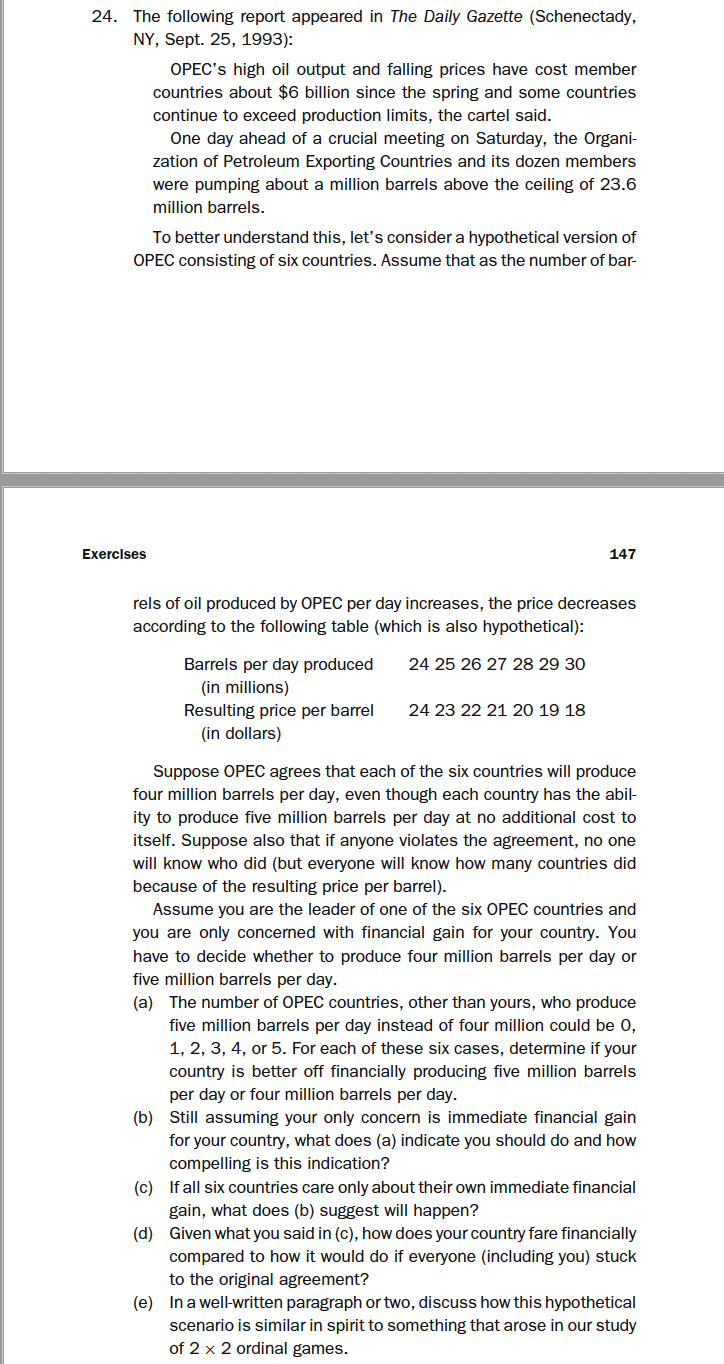

24. The following report appeared in The Daily Gazette (Schenectady, NY, Sept. 25, 1993): OPEC's high oil output and falling prices have cost member countries about $6 billion since the spring and some countries continue to exceed production limits, the cartel said. One day ahead of a crucial meeting on Saturday, the Organi- zation of Petroleum Exporting Countries and its dozen members were pumping about a million barrels above the ceiling of 23.6 million barrels. To better understand this, let's consider a hypothetical version of OPEC consisting of six countries. Assume that as the number of bar- Exercises 147 rels of oil produced by OPEC per day increases, the price decreases according to the following table (which is also hypothetical): Barrels per day produced (in millions) Resulting price per barrel (in dollars) 24 25 26 27 28 29 30 24 23 22 21 20 19 18 Suppose OPEC agrees that each of the six countries will produce four million barrels per day, even though each country has the abil ity to produce five million barrels per day at no additional cost to itself. Suppose also that if anyone violates the agreement, no one will know who did (but everyone will know how many countries did because of the resulting price per barrel). Assume you are the leader of one of the six OPEC countries and you are only concerned with financial gain for your country. You have to decide whether to produce four million barrels per day or five million barrels per day. (a) The number of OPEC countries, other than yours, who produce five million barrels per day instead of four million could be 0, 1, 2, 3, 4, or 5. For each of these six cases, determine if your country is better off financially producing five million barrels per day or four million barrels per day. (b) Still assuming your only concern is immediate financial gain for your country, what does (a) indicate you should do and how compelling is this indication? (c) If all six countries care only about their own immediate financial gain, what does (b) suggest will happen? (d) Given what you said in (c), how does your country fare financially compared to how it would do if everyone (including you) stuck to the original agreement? (e) In a well-written paragraph or two, discuss how this hypothetical scenario is similar in spirit to something that arose in our study of 2 x 2 ordinal games.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started