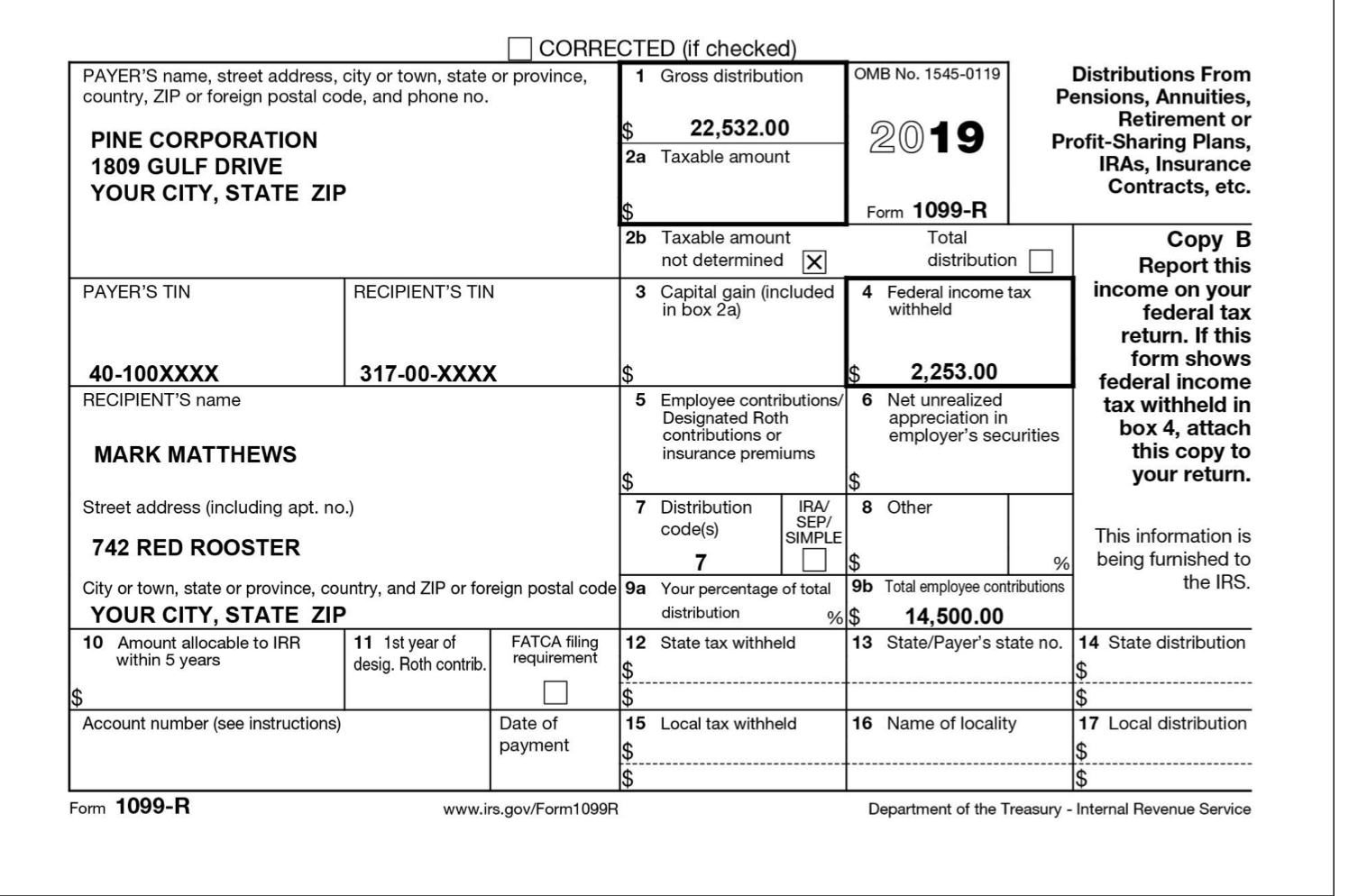

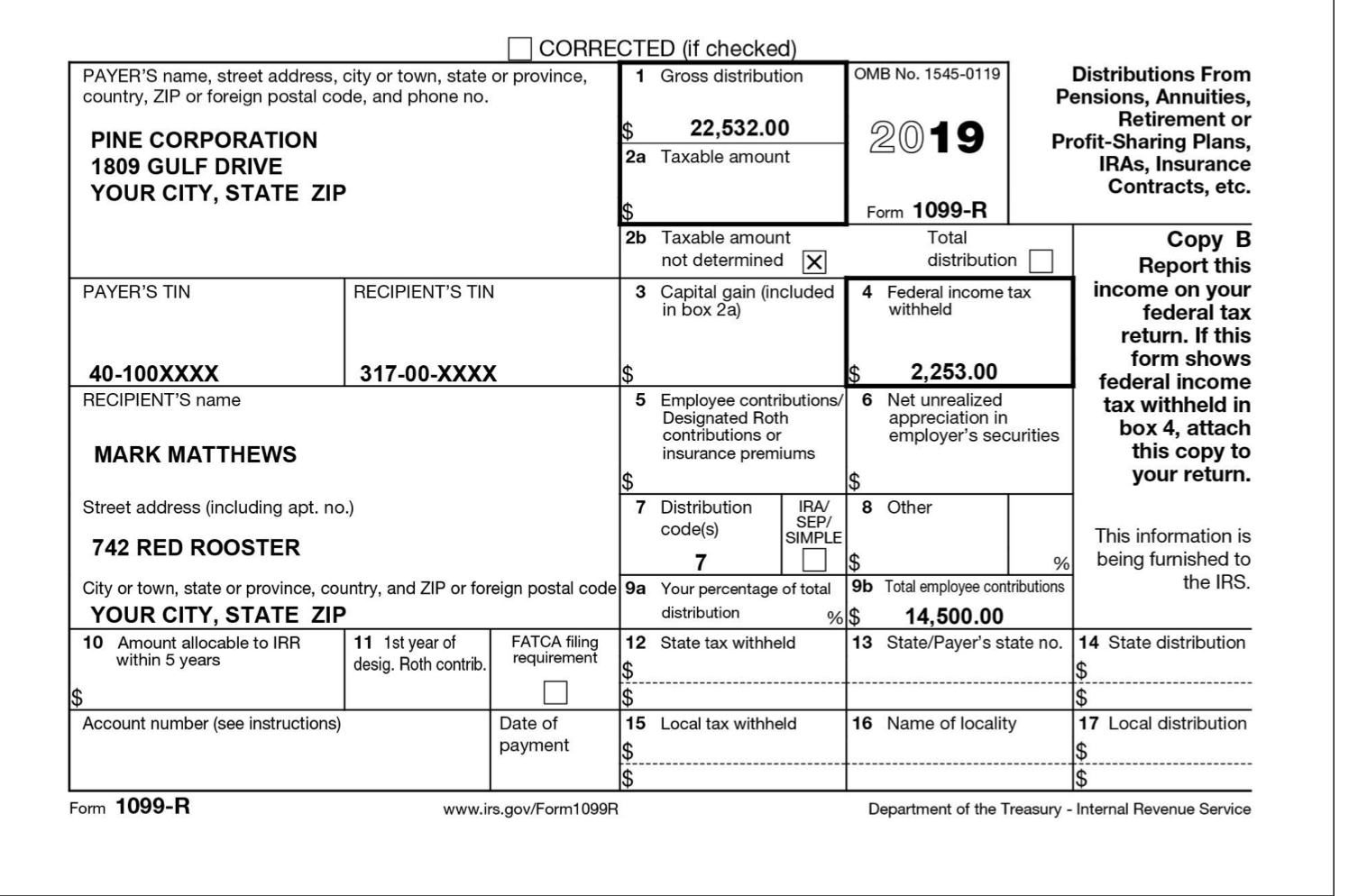

24. What is the taxable portion of Marks pension from Pine Corporation using the simplified method? $________.

NOTE: Mark retired and began receiving retirement income on March 1, 2017 . No distributions were received prior to his retirement . Mark selected a joint survivor annuity for these payments . The plan cost at annuity start date was $14,500 . Mark has already recovered $1,029 of his cost in the plan .

2019 O CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, 1 Gross distribution OMB No. 1545-0119 Distributions From country, ZIP or foreign postal code, and phone no. Pensions, Annuities, $ 22,532.00 Retirement or PINE CORPORATION Profit-Sharing Plans, 1809 GULF DRIVE 2a Taxable amount IRAs, Insurance YOUR CITY, STATE ZIP Contracts, etc. Form 1099-R 2b Taxable amount Total Copy B not determined X distribution Report this PAYER'S TIN RECIPIENT'S TIN 3 Capital gain (included 4 Federal income tax income on your in box 2a) withheld federal tax return. If this form shows 40-100XXXX 317-00-XXXX 2.253.00 federal income RECIPIENT'S name 5 Employee contributions/ 6 Net unrealized tax withheld in Designated Roth appreciation in contributions or employer's securities box 4, attach MARK MATTHEWS insurance premiums this copy to your return. Street address (including apt. no.) 7 Distribution IRA 8 Other | SEPI code(s) SIMPLE This information is 742 RED ROOSTER 7 O % being furnished to City or town, state or province, country, and ZIP or foreign postal code 9a Your percentage of total 9b Total employee contributions the IRS. YOUR CITY, STATE ZIP distribution % $ 14,500.00 10 Amount allocable to IRR 11 1st year of FATCA filing 12 State tax withheld 13 State/Payer's state no. 14 State distribution within 5 years desig. Roth contrib.) requirement $ $ Account number (see instructions) 15 Local tax withheld 16 Name of locality 17 Local distribution Date of payment Form 1099-R www.irs.gov/Form 1099R Department of the Treasury - Internal Revenue Service 2019 O CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, 1 Gross distribution OMB No. 1545-0119 Distributions From country, ZIP or foreign postal code, and phone no. Pensions, Annuities, $ 22,532.00 Retirement or PINE CORPORATION Profit-Sharing Plans, 1809 GULF DRIVE 2a Taxable amount IRAs, Insurance YOUR CITY, STATE ZIP Contracts, etc. Form 1099-R 2b Taxable amount Total Copy B not determined X distribution Report this PAYER'S TIN RECIPIENT'S TIN 3 Capital gain (included 4 Federal income tax income on your in box 2a) withheld federal tax return. If this form shows 40-100XXXX 317-00-XXXX 2.253.00 federal income RECIPIENT'S name 5 Employee contributions/ 6 Net unrealized tax withheld in Designated Roth appreciation in contributions or employer's securities box 4, attach MARK MATTHEWS insurance premiums this copy to your return. Street address (including apt. no.) 7 Distribution IRA 8 Other | SEPI code(s) SIMPLE This information is 742 RED ROOSTER 7 O % being furnished to City or town, state or province, country, and ZIP or foreign postal code 9a Your percentage of total 9b Total employee contributions the IRS. YOUR CITY, STATE ZIP distribution % $ 14,500.00 10 Amount allocable to IRR 11 1st year of FATCA filing 12 State tax withheld 13 State/Payer's state no. 14 State distribution within 5 years desig. Roth contrib.) requirement $ $ Account number (see instructions) 15 Local tax withheld 16 Name of locality 17 Local distribution Date of payment Form 1099-R www.irs.gov/Form 1099R Department of the Treasury - Internal Revenue Service