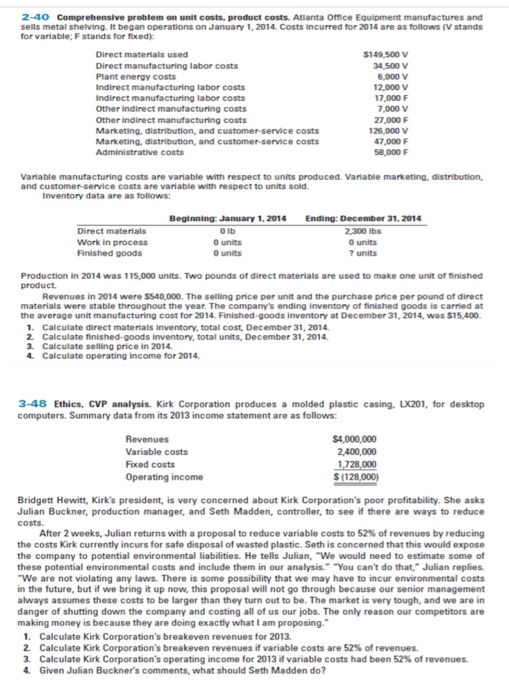

2-40 Comprehensive problem on unit costs. product costs. Atlanta Office Equipment manufactures and sells metal shelving. It began operations on January 1, 2014. Costs incurred for 2014 are as follows [V stands for variable; F stands for fixed Direct materials used $149,500 V Direct manufacturing labor costs 34,500 V Plant energy costs 6,000 V Indirect manufacturing labor costs 12,000 V Indirect manufacturing labor costs 17,000 F Other indirect manufacturing costs 7,000 V Other indirect manufacturing costs 27,000 F Marketing, distribution, and customer service costs 125,000 V Marketing, distribution, and customer service costs 47,000 F Administrative costs 58,000 F Variable manufacturing costs are variable with respect to units produced. Variable marketing, distribution, and customer service costs are variable with respect to units sold. Inventory data are as follows: Beginning: January 1, 2014 Ending: December 31, 2014 Direct materials Olb 2,300 lbs Work in process O units O units Finished goods O units ? units Production in 2014 was 115,000 units. Two pounds of direct materials are used to make one unit of finished product Revenues in 2014 were $540,000. The selling price per unit and the purchase price per pound of direct materials were stable throughout the year. The company's ending inventory of finished goods is carried at the average unit manufacturing cost for 2014. Finished-goods inventory at December 31, 2014, was S15,400 1. Calculate direct materials inventory, total cost, December 31, 2014 2 Calculate finished-goods inventory, total units, December 31, 2014 3. Calculate selling price in 2014. 4. Calculate operating income for 2014 3-48 Ethics. CVP analysis. Kirk Corporation produces a molded plastic casing. LX201, for desktop computers. Summary data from its 2013 income statement are as follows: Revenues $4,000,000 Variable costs 2,400,000 Fixed costs 1,728.000 Operating income S (128,000) Bridgett Hewitt, Kirk's president, is very concerned about Kirk Corporation's poor profitability. She asks Julian Buckner, production manager, and Seth Madden, controller, to see if there are ways to reduce costs. After 2 weeks, Julian returns with a proposal to reduce variable costs to 52% of revenues by reducing the costs Kirk currently incurs for safe disposal of wasted plastic. Seth is concerned that this would expose the company to potential environmental liabilities. He tells Julian, "We would need to estimate some of these potential environmental costs and include them in our analysis." "You can't do that," Julian replies. "We are not violating any laws. There is some possibility that we may have to incur environmental costs in the future, but if we bring it up now, this proposal will not go through because our senior management always assumes these costs to be larger than they turn out to be. The market is very tough, and we are in danger of shutting down the company and costing all of us our jobs. The only reason our competitors are making money is because they are doing exactly what I am proposing." 1. Calculate Kirk Corporation's breakeven revenues for 2013. 2. Calculate Kirk Corporation's breakeven revenues if variable costs are 52% of revenues. 3. Calculate Kirk Corporation's operating income for 2013 if variable costs had been 52% of revenues. 4. Given Julian Buckner's comments, what should Seth Madden do