Answered step by step

Verified Expert Solution

Question

1 Approved Answer

24,25 USE THE FOLLOWING INFORMATION FOR QUESTIONS 24-25: Carol Manufacturing produces a single product that sells for $300. Variable costs per unit equal $120. The

24,25

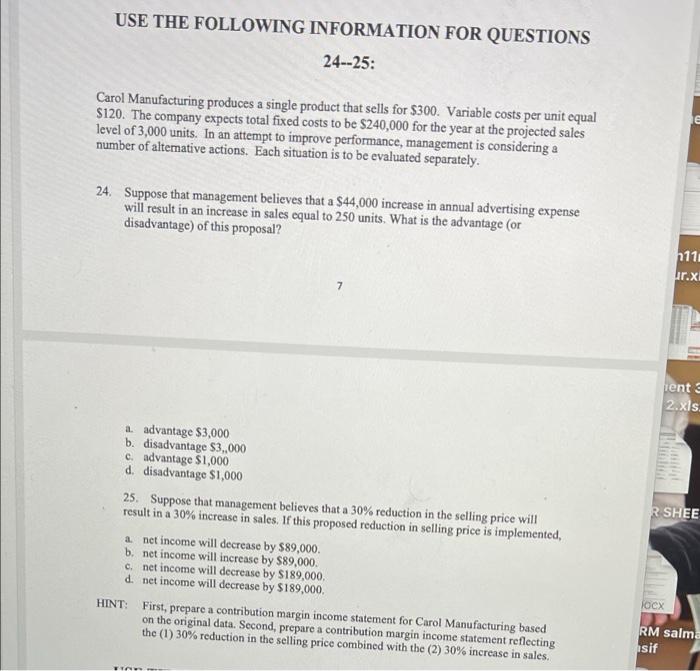

USE THE FOLLOWING INFORMATION FOR QUESTIONS 24-25: Carol Manufacturing produces a single product that sells for $300. Variable costs per unit equal $120. The company expects total fixed costs to be $240,000 for the year at the projected sales level of 3,000 units. In an attempt to improve performance, management is considering a number of altemative actions. Each situation is to be evaluated separately. 24. Suppose that management believes that a $44,000 increase in annual advertising expense will result in an increase in sales equal to 250 units. What is the advantage (or disadvantage) of this proposal? 7 a. advantage $3,000 b. disadvantage $3,000 c. advantage $1,000 d. disadvantage $1,000 25. Suppose that management believes that a 30% reduction in the selling price will result in a 30% increase in sales. If this proposed reduction in selling price is implemented, a. net income will decrease by $89,000. b. net income will increase by $89,000. c. net income will decrease by $189,000. d. net income will decrease by $189,000. HINT: First, prepare a contribution margin income statement for Carol Manufacturing based on the original data. Second, prepare a contribution margin income statement reflecting the (1) 30% reduction in the selling price combined with the (2) 30% increase in sales

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started