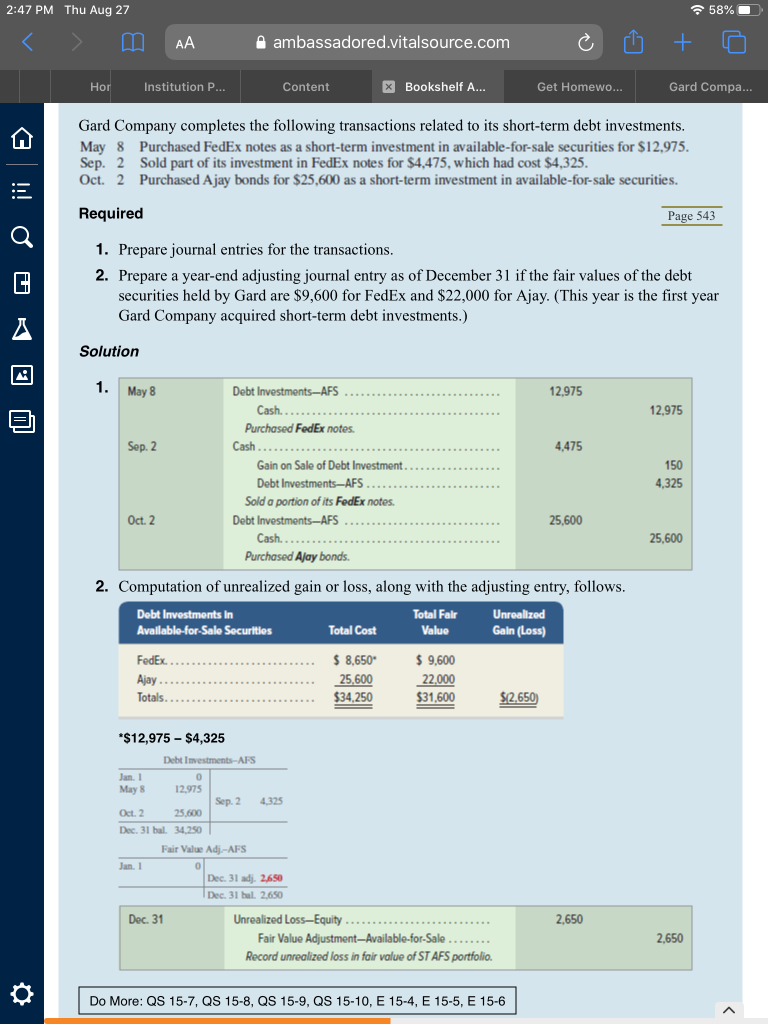

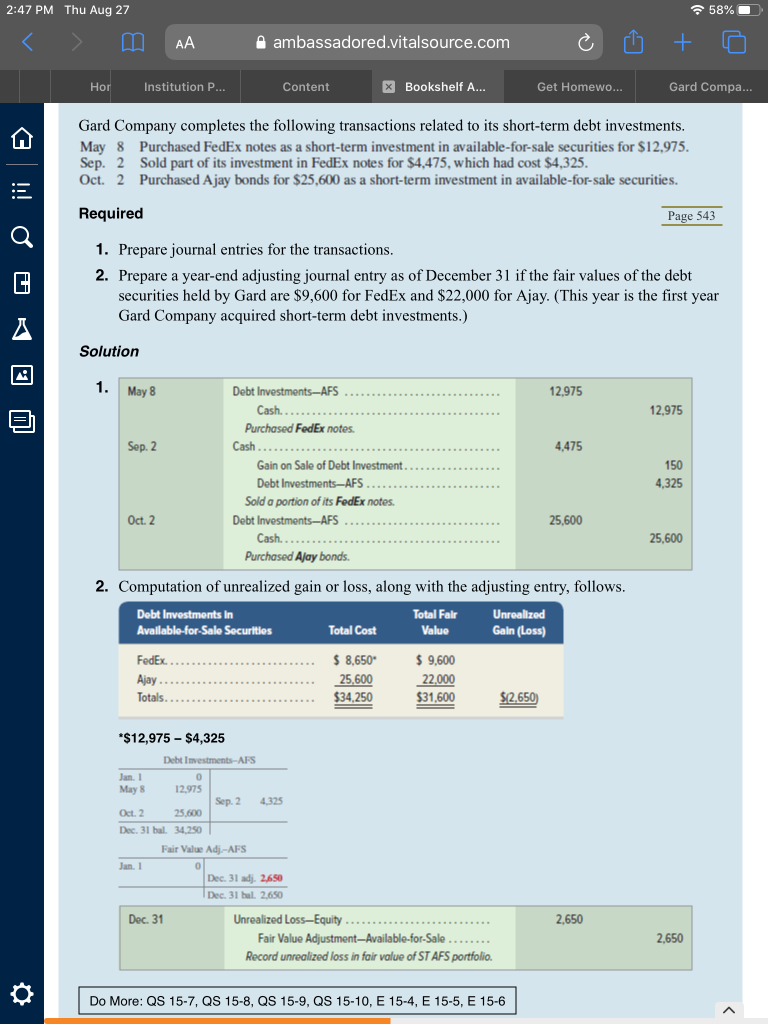

2:47 PM Thu Aug 27 58% AA ambassadored.vitalsource.com + Hor Institution P... Content x Bookshelf A... Get Homewo... Gard Compa... C Gard Company completes the following transactions related to its short-term debt investments. May 8 Purchased FedEx notes as a short-term investment in available-for-sale securities for $12.975. Sep. 2 Sold part of its investment in FedEx notes for $4,475, which had cost $4,325. Oct. 2 Purchased Ajay bonds for $25,600 as a short-term investment in available-for-sale securities. : Required Page 543 1. Prepare journal entries for the transactions. 2. Prepare a year-end adjusting journal entry as of December 31 if the fair values of the debt securities held by Gard are $9,600 for FedEx and $22,000 for Ajay. (This year is the first year Gard Company acquired short-term debt investments.) Solution 1. May 8 12.975 150 4,325 Debt Investments-AFS 12,975 Cash..... Purchased FedEx notes. Sep. 2 Cash ..... 4,475 Gain on Sale of Debt Investment. Debt InvestmentsAFS. .. Sold a portion of its FedEx notes. Oct. 2 Debt Investments-AFS 25,600 Cash........ Purchased Ajay bonds. 2. Computation of unrealized gain or loss, along with the adjusting entry, follows. Debt Investments in Total Falr Unrealized Available for Sale Securities Total Cost Value Gain (Loss) 25,600 FedEx. Ajay Totals. $ 8,650 25,600 $34.250 $ 9,600 22.000 $31,600 $12.650 *$12,975 - $4,325 - Debt Investments-AFS Jan. 1 0 May 8 12.975 Sep. 2 4,325 Oct. 2 25,600 Dec. 31 bal. 34.250 Fair Value Adj.-AFS Jan. 1 0 Dec. 31 adj. 2,650 Dec. 31 bal. 2,650 Dec. 31 Unrealized Loss-Equity ..... Fair Value Adjustment-Available-for-Sale ........ Record unrealized loss in fair value of ST AFS portfolio. 2,650 2,650 Do More: QS 15-7, QS 15-8, QS 15-9, QS 15-10, E 15-4, E 15-5, E 15-6 2:47 PM Thu Aug 27 58% AA ambassadored.vitalsource.com + Hor Institution P... Content x Bookshelf A... Get Homewo... Gard Compa... C Gard Company completes the following transactions related to its short-term debt investments. May 8 Purchased FedEx notes as a short-term investment in available-for-sale securities for $12.975. Sep. 2 Sold part of its investment in FedEx notes for $4,475, which had cost $4,325. Oct. 2 Purchased Ajay bonds for $25,600 as a short-term investment in available-for-sale securities. : Required Page 543 1. Prepare journal entries for the transactions. 2. Prepare a year-end adjusting journal entry as of December 31 if the fair values of the debt securities held by Gard are $9,600 for FedEx and $22,000 for Ajay. (This year is the first year Gard Company acquired short-term debt investments.) Solution 1. May 8 12.975 150 4,325 Debt Investments-AFS 12,975 Cash..... Purchased FedEx notes. Sep. 2 Cash ..... 4,475 Gain on Sale of Debt Investment. Debt InvestmentsAFS. .. Sold a portion of its FedEx notes. Oct. 2 Debt Investments-AFS 25,600 Cash........ Purchased Ajay bonds. 2. Computation of unrealized gain or loss, along with the adjusting entry, follows. Debt Investments in Total Falr Unrealized Available for Sale Securities Total Cost Value Gain (Loss) 25,600 FedEx. Ajay Totals. $ 8,650 25,600 $34.250 $ 9,600 22.000 $31,600 $12.650 *$12,975 - $4,325 - Debt Investments-AFS Jan. 1 0 May 8 12.975 Sep. 2 4,325 Oct. 2 25,600 Dec. 31 bal. 34.250 Fair Value Adj.-AFS Jan. 1 0 Dec. 31 adj. 2,650 Dec. 31 bal. 2,650 Dec. 31 Unrealized Loss-Equity ..... Fair Value Adjustment-Available-for-Sale ........ Record unrealized loss in fair value of ST AFS portfolio. 2,650 2,650 Do More: QS 15-7, QS 15-8, QS 15-9, QS 15-10, E 15-4, E 15-5, E 15-6